Thailand: Covid insurance continues surge in April

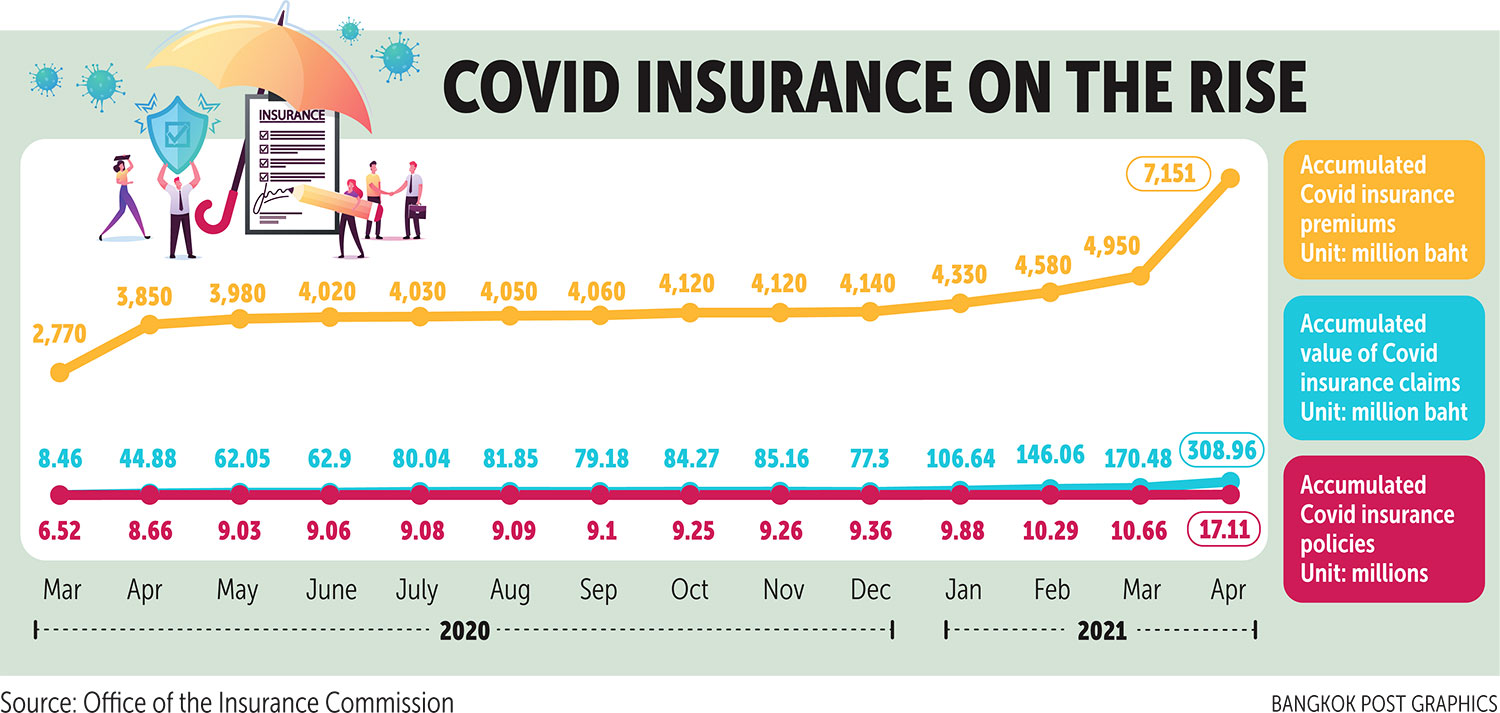

Accumulated Covid insurance premiums spiked by 2.2 billion baht from 6.45 million policies in April, driving the total premiums received to 7.15 billion baht over 14 months since the beginning of the pandemic.

The accumulated value of claims received from Covid insurance in April also rose to 138 million baht, spurred by surging new infections, said Suthiphon Thaveechaiyagarn, secretary-general of the Office of the Insurance Commission (OIC).

The accumulated value of claims does not include coverage for hospital and medical expenses claimed through life insurance policies.

Mr Suthiphon expects the accumulated number of claims to increase in line with surges in infections.

Daily new cases in Thailand hit an all-time high of 4,887 yesterday, a spike from last week’s daily average of about 2,000 cases per day, raising the total to 93,794 cases nationwide.

From March 2020 to the end of April 2021, Covid insurance products generated total premiums received of 7.51 billion baht from 17.1 million policies.

The accumulated value of claims stood at 309 million baht.

In addition to Covid insurance, Covid vaccine allergy insurance garnered interest as many people are concerned about side effects from vaccines.

Covid vaccine allergy insurance generated total premiums written worth 201 million baht from 529,865 policies since launching earlier this year.

The accumulated value of claims for vaccine allergy insurance has not yet been reported.

He said vaccine allergy insurance has high potential for growth as many insurers are now combining vaccine allergy protection with the main Covid insurance policies.

If the vaccine allergy insurance is extended to cover side effects from jabs imported by the private sector, in addition to the Sinovac and AstraZeneca doses provided by the government, this could support its growth, said Mr Suthiphon.

However, vaccine allergy insurance remains a supplementary protection, secondary to Covid insurance, he said.

Mr Suthiphon said the rapid increase in claims for Covid insurance has not yet affected non-life insurers, with stress tests suggesting insurers are still able to handle losses from claims.

“The industry’s capital adequacy ratio [CAR] is still high,” he said.

At the end of 2020, the average CAR for the non-life insurance industry was 348%, while the life insurance industry was 306%.

According to the OIC, health insurance protection continues to grow from last year thanks to rising health concerns amid the outbreak.

Last year health insurance products provided by non-life insurers recorded growth of 44%, with total direct premiums worth 15.9 billion baht.

Total health insurance premiums from life insurance companies also grew by 20.9% last year to 85.6 billion baht, up from 80.5 billion baht in 2019.

Health insurance is also a factor driving gross underwriting profit for non-life insurance companies.

The non-life insurance business reported underwriting profit worth 12.5 billion baht last year, up by 499% from 2019.

Source: https://www.bangkokpost.com/business/2115439/covid-insurance-continues-surge-in-april

Thailand

Thailand