Thailand: BoT tells banks to rein in mortgages

The Bank of Thailand has sounded an alarm to banks in light of the growing appetite for mortgages, urging them to retain their risk management practices when considering housing loans.

Some financial institutions are offering a higher loan-to-value (LTV) ratio to homebuyers amid intense competition for mortgage products, said Bank of Thailand governor Veerathai Santiprabhob.

“We urged some banks to keep good risk management for both housing loan approvals and debt collection,” he said. “The risk appetite of some banks has increased as they wanted to grab a larger market share in the loan segment.”

All banks are still extending mortgages based on the central bank’s requirements, Mr Veerathai said.

The central bank’s warning came as it found higher LTV, but it has yet to monitor other factors such as debt-servicing ratio, he said.

LTV is a lending risk assessment that indicates the ratio of a loan to the value of an asset purchased. Typically, a loan with a lower LTV ratio bears lower risk for both lender and borrower, since less capital is being borrowed.

Even though new innovations, especially big data analytics, allows banks a higher risk appetite, good risk management in line with central bank regulations are still needed, Mr Veerathai said.

Even though new innovations, especially big data analytics, allows banks a higher risk appetite, good risk management in line with central bank regulations are still needed, Mr Veerathai said.

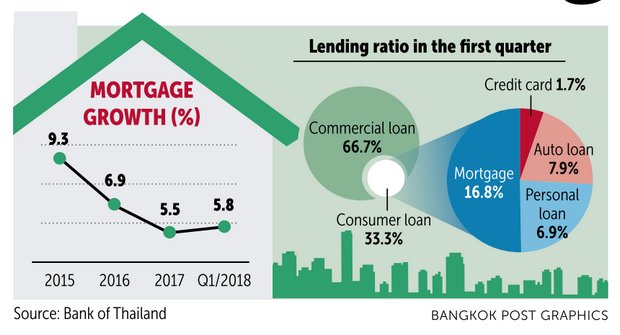

According to central bank data, housing loans grew 5.8% year-on-year during the January-March quarter, compared with 5.5% in 2017 and 6.9% in the preceding year. Mortgage accounted for 16.8% of total lending extended by commercial banks in the first quarter of this year.

In another development, Mr Veerathai said the central bank would revise regulations related to loan approval processes for small and medium-sized enterprises (SMEs) to be more flexible in response to technological and business innovations.

The regulatory revision will allow the adoption of digital and information-based lending, he said.

The newer technology would improve risk control and help banks cut down operating costs. At the same time, it would open more opportunities for SMEs to access funding with lower financial costs. The regulatory revision would cover all areas, including Know Your Customer, loan collateral, and non-performing loan and non-performing asset management.

Starting from Friday, the central bank will be collaborating with financial institutions to revise SME loan approval regulations, which will take about four months to complete.

Separately, the Bank of Thailand on Thursday granted Qualified Company status to five companies and one treasury centre under its foreign exchange regulation reform. Those are Thai Airways International Plc, NMB-Minebea Thai, Covestro Thailand, LG Electronics Thailand, Star Petroleum Refining Plc and Mitr Phol Treasury Center.

Companies or entities that have Qualified Company status are able to conduct foreign exchange transactions with commercial banks without having to submit any underlying supporting documents such as invoices, loan guarantees or other liability evidence.

To allow more time for eligible companies to join the scheme, the central bank has decided to extended the application deadline for another six months to Nov 16.

To become a Qualified Company, the minimum volume of cross-border foreign exchange transactions over the past three years has been halved to UScopy.5 billion (48 billion baht) from $3 billion in the past.

Source: https://www.bangkokpost.com/business/finance/1476561/bot-tells-banks-to-rein-in-mortgages

Thailand

Thailand