Thailand: An ageing conundrum

The Finance Ministry is growing concerned about slow economic growth prospects and higher inflationary pressure in the long term as Thailand transitions to an “aged” society.

A ministry source who requested anonymity said the country’s demographics are rapidly ageing, resulting from falling fertility rates and rising life expectancy. Having a larger proportion of the population made up of the elderly means fewer people in the workforce.

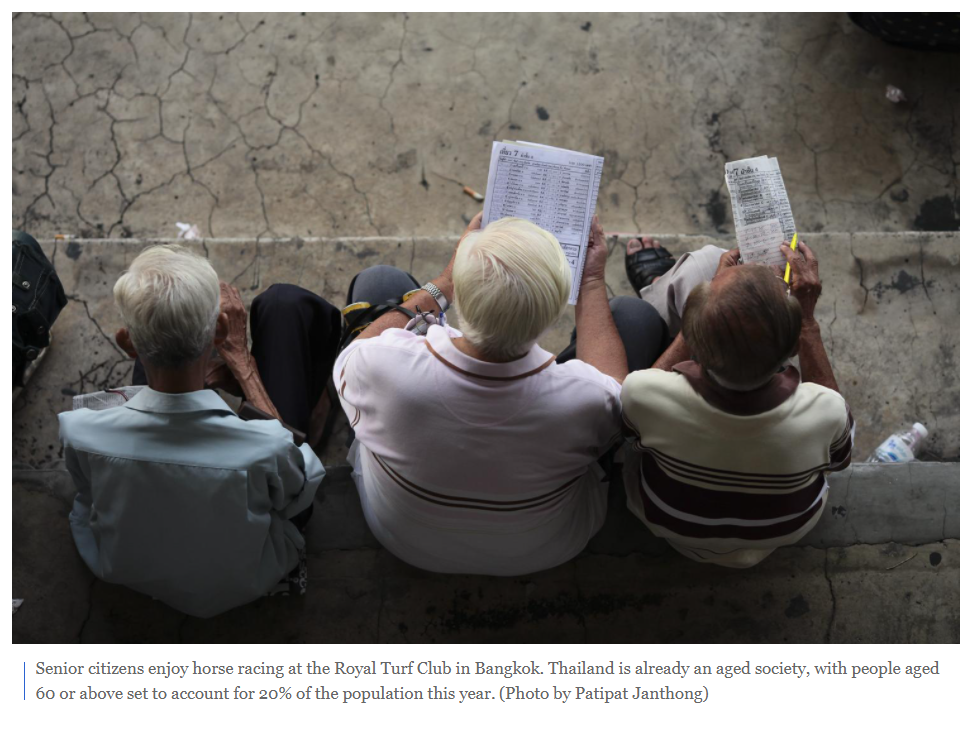

The country has been what is termed an “aged” society since 2005, meaning 10% of the population is already 60 or older.

The proportion of the population aged 60 or older is expected to reach 20% this year.

Thailand’s trajectory has it becoming a “super-aged” society in 2031, meaning 28% of the population will be 60 or older.

“The workforce is instrumental for economic growth,” the source said.

“A smaller workforce may result in a sharp rise in wages, which will put pressure on domestic inflation.”

According to the Finance Ministry, 42 million people are in the workforce as of 2021 out of a total population of 69.3 million.

In 2017, this number was projected to drop to 36 million by 2037.

In addition to mounting pressure on economic growth, the source said an older population will affect the government’s fiscal burden, as can be seen by the rising fiscal budget set aside over the past several years.

Between 2013-2016, the welfare budget stood at 18% of the government’s annual expenditure. This figure surged to 22% between 2020 and 2021.

The source admitted the welfare budget is difficult to cut and it is mostly a long-term tied-over budget.

According to the source, in the short and medium term, the Finance Ministry needs to find ways to raise income for the government.

The tax structures are likely to be revamped, with technology applied to increase the efficacy of tax revenue collection, said the source.

In its best attempt to cope with the rise of an ageing population, the government has developed a multi-pillar pension system to cover all groups, aiming to provide a minimum level of protection such as social welfare or assistance through monthly stipends for the elderly.

Another scheme sees the government contribute payments to the Social Security Fund, Government Pension Fund, or voluntary funded plans such as the National Savings Fund for self-employed workers.

Despite such funds, many informal workers have insufficient retirement savings to cover their expenses, said the source.

There are 20.4 million informal workers in the country and only 5.82 million have their own savings, according to ministry figures.

“Sufficient income for basic expenses after retirement should stand at about 50-60% of income prior to retirement,” said the source.

“But people in the social security system mostly have no additional savings and their pension represents only 20% of their income before retirement. Only civil servants, who are members of the Government Pension Fund, have a post-retirement income that meets the 50-60% requirement.”

KKP Research, a research house under Kiatnakin Phatra Financial Group, recently issued a report that found Thailand’s rapidly changing demographic structure has hurt the country’s economic growth over the past several years and will only create more economic pressure in the future.

“Thailand is approaching full-fledged aged society status while still being stuck in the middle-income trap. In 2020, the average age of Thais was 40.1 years, ranking as the oldest among Asia’s emerging economies,” the report stated.

“Given this scenario, the impact on structural problems will deepen, especially for domestic consumption and investment. The government will definitely face a higher fiscal burden due to rising welfare spending.”

Thailand’s old-age dependency ratio is projected to increase from 18% in 2020 to 30% in 2030.

The old-age dependency ratio reflects the number of elderly people at an age when they are generally economically inactive compared with the number of people of working age.

“Given the changing demographic structure, the greying population trend is expected to affect economic growth in all dimensions,” said KKP.

“Future potential growth rates could possibly drop to 2.6-2.8% from 3.2-3.5% now.”

As a result, Thailand needs structural economic reforms to sustain its growth in the long run, stated the report.

Innovative technologies are necessary to replace human labour.

Moreover, improving productivity and competitiveness via the creative economy and high value-added products are key solutions, the report recommended.

The government should also support legal amendments to promote cross-border labour movement and evolve from labour-intensive industries to technology and automation, said KKP.

Last but not least, the government should make doing business easier by encouraging productivity and competitiveness in the private sector, the report found.

Source: https://www.bangkokpost.com/business/2100451/an-ageing-conundrum

Thailand

Thailand