Myanmar: Garment industry must raise value proposition to stay sustainable

2017 was a strong year for the garment export sector. During the seven months between April and November, some $1.5 billion worth of garment products were shipped out of Myanmar, bound for warehouses owned by the likes of Uniqlo and Primark in Japan and Europe, according to the Ministry of Commerce (MOC).

The pace of growth has been gaining momentum with labour costs picking up in former low-cost manufacturing hubs like China, and as demand from global clothes, lingerie and sportswear brands rises on the back of growing affluence in many parts of the world.

Now, the garment sector represents Myanmar’s second largest export sector, and it is expanding fast. During the 2016-17 fiscal year, the industry exported a garments worth some $2.2 billion, which is up from $1.8 billion the year before, according to the Myanmar Garment Manufacturers Association (MGMA). During 2013-14 and 2014-15, garment exports totalled $1.2 billion and $1.5 billion, respectively.

International markets

Looking ahead into 2018 and beyond though, insiders said more has to be done for growth to remain sustainable. “The garment sector has grown significantly over the past three years. But to continue expanding, we are planning to reach more customers in international markets and raise demand,” said Daw Yin Yin Moe, secretary of the Myanmar Textile Manufacturers’ Association.

Currently, about a third of locally produced garments are exported to Japan, while a quarter each is shipped to Europe and South Korea, respectively, according to the MOC. The remaining merchandise is shipped in smaller quantities to China and the US.

To serve a wider range of markets, the industry will cooperate with the government to host the Myanmar Gar-Tex Expo in Yangon next March. The exhibition will promote Myanmar-made garment products and expose local manufacturers to international competitors and customers, U Kyaw Win, vice-president of MGMA, said.

The exhibition, which will showcase more than 80 garment exhibitors and host up to 3,500 trade visitors worldwide, will be organised by the Ministry of Industry in cooperation with MGMA, the Myanmar Textile Manufacturer Association, Textile Engineer Association, and Vietnam Textile & Apparel Association.

Long term growth

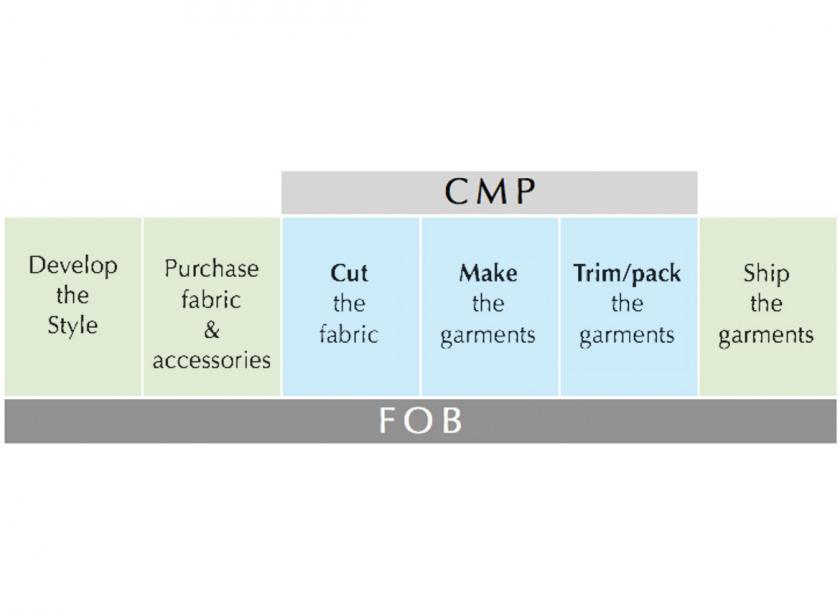

But the industry must also take steps to ensure growth is sustainable over the longer term. This involves Myanmar taking charge of the entire garment manufacturing and distribution process, from producing the garments in their entirety to arranging for shipments to retailers. In other words, adopting a freight-on-board (FOB) system instead (see chart).

Currently, the vast majority of garment factories operate under the Cut-Make-Pack (CMP) system, under which foreign buyers pay contracting fees to a garment factory in Myanmar to carry out labour-intensive tasks at a low cost. These include cutting fabric, sewing garments together and then packing the finished garments for export.

In addition, most factories in Myanmar work under CMP contracts of just six months, The Myanmar Timesunderstands. The country’s garment workers are also among the lowest paid compared with key garment hubs like China, Thailand, Cambodia, Vietnam and India, making it among the most competitive manufacturers in the world, according to MGMA.

Nevertheless, the industry should raise the quality of locally made products and negotiate for better contract terms to improve margins and employee wellbeing. Things are moving forward on this front. On December 29, the Ministry of Labour, Immigration and Population at the 4th National Minimum Wage Committee meeting in Nay Pyi Taw decided to raise the minimum wage by 33 percent to K4,800 per day from K3,600 per day currently.

The move comes after rounds of negotiations over the last year. The decision is now open for public comment or objection for a period of 60 days before taking effect. In Myanmar, employers with 10 workers of more are responsible for paying the minimum wage.

Meanwhile, recent research by MGMA and Boston-based Tufts University has also showed that better employee welfare in the sector enhances the productivity and performance of garment factories. “The government, employers and employees have to work together in a fair manner so that we can enjoy a sustainable and growing garment industry,” said U Kyaw Win.

If all goes well, the Myanmar garment sector could be worth as much as $8 billion – $10 billion in ten years’ time, according to MGMA. So far, some 500 garment local and foreign manufacturing companies have already opened factories in the country. These are mostly situated in Yangon, but quickly spreading to industrial zones in neighbouring townships like Bago, Hmawbi, Hlegu, Thanlyin, Thilawa Special Economic Zone as well as to other regions like Pathein and Mandalay.

Source: https://www.mmtimes.com/news/garment-industry-must-raise-value-proposition-stay-sustainable.html

Thailand

Thailand