Myanmar: Access to credit and skills gaps major concerns, survey reveals

Business executives remain concerned with the lack of affordable access to credit and insufficient human capital, according to the Myanmar business barometer survey published by Oxford Business Group (OBG).

Access to credit In a survey involving dozens of high-level executives across industries, more than half (58pc) of participants said they believed that less than 20pc of business in their sector came from public spending.

The survey also highlighted the challenges that businesses face when looking to borrow, with three-quarters of respondents describing access to credit as difficult or very difficult. The results shared sentiments expressed in the previous survey in 2016. In the 2016 survey, a considerable number of interviewees cited credit terms offered by local banks as onerous and restrictive.

Skills gap

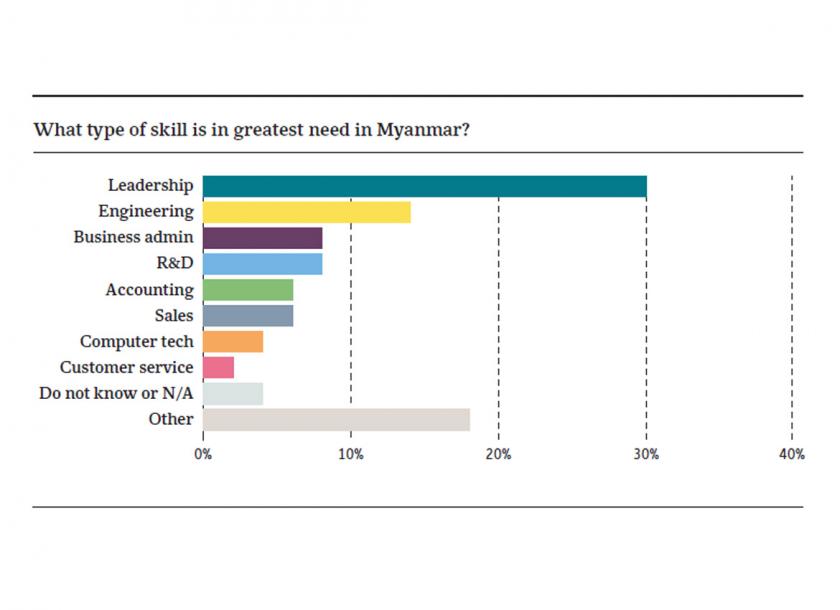

Asked which skills they felt were most in need within the workplace, 30pc of participants surveyed in 2017 cited leadership, followed by engineering (14pc), business administration (8pc), and research and development (8pc). Respondents noted a link between the lack of leadership skills among employees and the overall education system. They also described the education system as underfunded and failing to prioritise critical thinking.

The OBG asked respondents which externality they felt would have the greatest impact on the country’s short-to-medium-term growth. Around 40pc felt that a multiple Fed rate hike would have the biggest effect on economic

development, largely because of fluctuations this could cause in the value of the local currency. Executives were upbeat about Myanmar’s growth prospects, with 63pc saying they expected GDP growth for the next 12 months to fall somewhere between 5pc and 7pc. However, while noting the country’s advantages and potential, they also highlighted the need for improvements to be made to its business climate.

Respondents note a link between the lack of leadership skills among employees and the overall education system. Photo – OBG

Lack of transparency

“While investors undoubtedly recognise the innate potential of a 54m-person market with significant natural resources strategically situated between China and India, some are delaying investment decisions until there is more regulatory clarity,” Patrick Cooke, OBG’s regional editor for Asia, commented.

“The need for further improvements to be made to the business climate is backed up by the fact that 59pc of respondents characterised transparency for conducting business as low or very low in comparison to the wider region,” he added.

Mr Cooke explained that concerns raised among executives in the preceding survey one year ago about access to affordable credit and skilled labour remained to the fore, despite the passing of a new Financial Institutions Law in 2016 and the launch of a National Education Strategic Plan.

He added, however, that the country’s “significant inherent advantages” in geographic terms meant it was still on track to be the fastest-growing economy within the ASEAN in the coming years.

“The keys to success lie in the creation of a clear and transparent regulatory environment for attracting investment and financing the real economy, while also ensuring the country capitalises on its position between the emerging superpowers of China and India without becoming beholden to either,” he said.

Source: https://www.mmtimes.com/news/access-credit-and-skills-gaps-major-concerns-survey-reveals.html

Thailand

Thailand