Malaysia: Better outlook for banking sector

PETALING JAYA: The economic recovery is expected to bode well for the banking sector with loan growth forecast to pick up pace to 3.8% in 2021 versus 3.4% last year, according to Maybank IB Research.

It attributed the growth to stable household loan growth and a pick-up in corporate lending.

The research house said loan growth could be stronger if not for the blanket loan moratorium from April to September 2020, which resulted in lower loan repayments during the period and which have since resumed.

Maybank IB’s economics team projects a gross domestic product (GDP) growth of 5.1% for the year.

At the same time, it forecast aggregate core net profit to accelerate 19% year-on-year (y-o-y) this year and return on equity (ROE) to average a higher 8.6% versus 7.6% in 2020, improving to 9.2% in 2022.

It noted that fixed deposits had gradually repriced since the last rate cut in 2020 and should fully reprice this year.

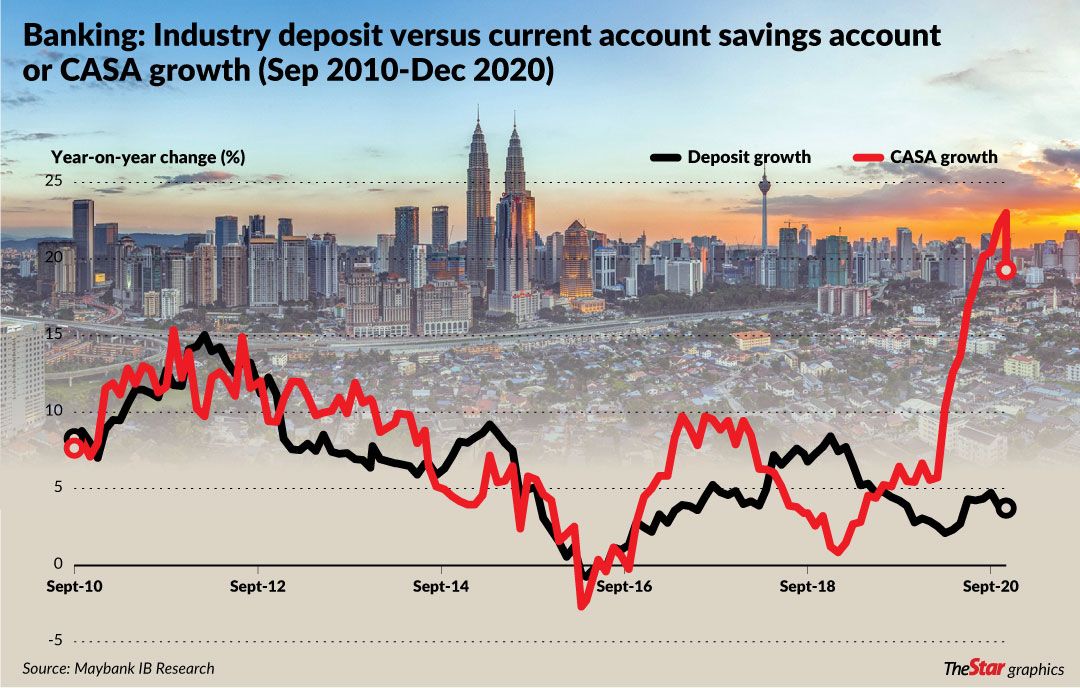

Moreover, current account savings account (CASA) growth was spectacular in 2020, allowing banks to lower their overall funding cost.

“As such, we expect the average net interest margin (NIM) for banks in our coverage, to improve 4 basis points (bps) on average in 2021, after having contracted by an estimated 10bps in 2020, ” it said in its banking sector report.

Last year saw a cumulative 125bps cut in the Overnight Policy Rate (OPR) to a low of 1.75%.

This, Maybank IB said coupled with modification losses in the second quarter of last year (2Q20), contributed to a sharp NIM compression of about 38bps on average for the banks in its coverage, from 2.22% in 4Q19 to a low of 1.84% in 2Q20, before recovering to 2.08% in 3Q20.

NIM is a measure of the difference between the interest income generated by banks and the amount of interest paid out for deposits.

The research house said as a result of declining bond yields, banks’ earnings also saw much support from investment gains in 2020.

As a result of the prevailing payment relief plans (PRP), it said the industry’s impaired loans ratio is unlikely to peak until the second half of the year.

Bank Negara’s stress test in 2020 had projected a rise in the banking system’s gross impaired loans (GIL) ratio to 3.1% end-2020 and 4.1% end-2021.

As at end-2020, the banking industry’s GIL ratio was just 1.57%, distorted in part by exemptions from having to classify PRP loans as impaired.

“What is more critical nevertheless, is that banks continue to provide prudently for risk. Credit cost jumped in 2020 as banks pre-emptively provided for economic risks through macro-economic variable adjustments as well as potential bad debt through higher management overlay provisions.

“We expect the credit cost for the banks in our coverage to remain high at 51bps in 2021, as compared to 22-30bps in 2018-2019, though marginally lower than 77bps in financial year (FY) 2020, ” it said.

“Our dividend per share (DPS) projections for FY20 are lower y-o-y across the board, mainly because of the lower earnings that we have projected for FY20, coupled with conservatively lower payout ratios for all banks, except Public Bank Bhd , for which we deem earnings risks to be low, given its superior loan loss coverage of 362%, including regulatory reserves.

, for which we deem earnings risks to be low, given its superior loan loss coverage of 362%, including regulatory reserves.

“Nevertheless, with their strong capital positions, it is possible that banks’ payout ratios could surprise positively, ” Maybank IB said.

Source: https://www.thestar.com.my/business/business-news/2021/02/17/better-outlook-for-banking-sector

Thailand

Thailand