Indonesia: Small businesses get subsidies, loan relief

The government will subsidize and ease loan interest payments for micro, small and medium enterprises (MSMEs), the backbone of the Indonesian economy, as they struggle to stay afloat amid the COVID-19 pandemic.

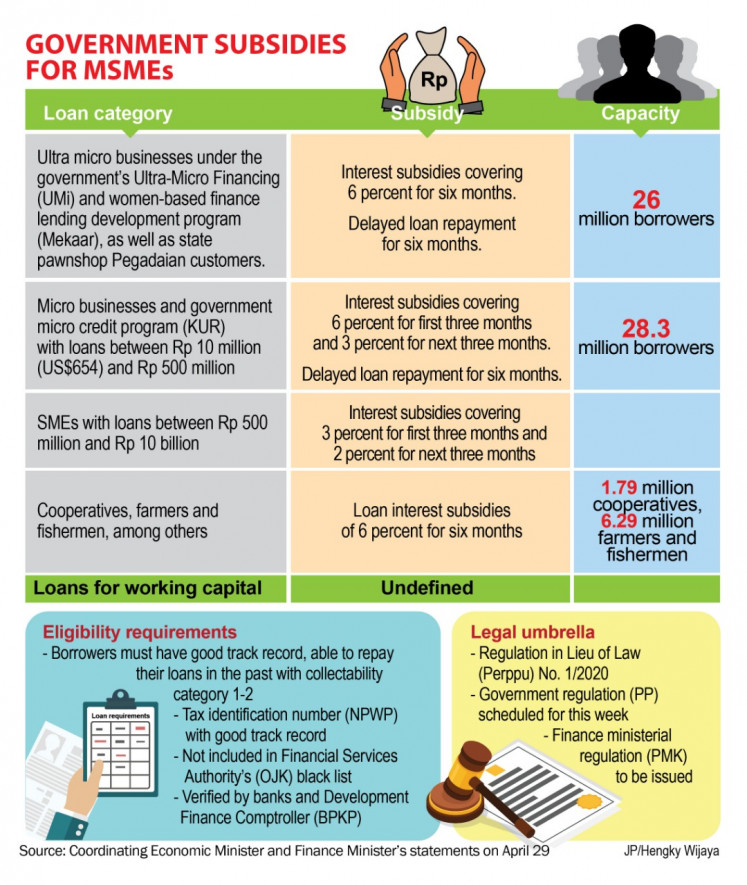

The subsidies will cover loan interest ranging from 2 to 6 percent for up to six months for millions of borrowers in the MSME category. The government will also roll out working capital credit for MSMEs, President Joko “Jokowi” Widodo announced on Wednesday.

“The emergency working capital assistance will need to be carefully designed so MSMEs can really access this emergency capital assistance scheme,” Jokowi told an online briefing after a Cabinet meeting. Around 41 million MSMEs have access to credit from financial institutions while 23 million are not bankable.

Indonesia’s more than 60 million MSMEs, which account for 60 percent of the gross domestic product (GDP) of Southeast Asia’s largest economy, are struggling to stay afloat with travel and social restrictions to contain the coronavirus severely affecting their income. Their operations are either closed or limited and many workers have been laid off or furloughed.

Finance Minister Sri Mulyani Indrawati said the government would cover 6 percent of the interest and suspend loan repayments, for six months, for ultra-micro businesses under the government’s UMi and Mekaar programs, as well as state pawnshop Pegadaian customers.

Micro businesses and government microloan program (KUR) borrowers with loans between Rp 10 million and Rp 500 million will also get interest subsidies covering 6 percent for the first three months and 3 percent for the next three months.

SMEs with loans between Rp 500 million and Rp 10 billion will get interest subsidies covering 3 percent for the first three months and 2 percent for the next three months. Both categories will also be able to delay their loan repayments for six months.

Government subsidies for MSMEs. (JP/Hengky Wijaya). Usage: 0 (JP/Hengky Wijaya)

Government subsidies for MSMEs. (JP/Hengky Wijaya). Usage: 0 (JP/Hengky Wijaya)

“This program is part of the government’s efforts to defend MSMEs’ financial capabilities,” Sri Mulyani said after the Cabinet meeting. “If this can work, then the COVID-19 economic impact on society can be minimized.”

The government will help micro businesses to pay their loan interest for businesses borrowing up to Rp 500 million from rural banks and for those borrowing Rp 500 million to RP 10 billion from conventional banks. It will also relieve interest payments for MSMEs that borrowed from the KUR program, Sri Mulyani said.

The government has allocated Rp 150 trillion for business recovery programs within its Rp 405.1 trillion extra spending for COVID-19 efforts, focusing on health and social spending as well as economic stimulus packages. The earlier stimulus packages covered tax waivers and deferrals for almost all business sectors and individual taxpayers.

“The government will push for transparency, accountability and professionalism to avoid moral hazard,” Coordinating Economic Minister Airlangga Hartarto told reporters during the same press briefing. “This stimulus is prioritized for those affected by the coronavirus pandemic.”

There are several prerequisites for MSMEs to be eligible for the new stimulus package, including a good track record on loan repayments and tax payments. They must be verified by banks and not included in the Financial Services Authority’s (OJK) black list.

The Association of Young Indonesian Businesspeople (Hipmi) head for micro, small and medium businesses Rano Wiharta said that the government must oversee the regulation tightly, calling for banks to be “more serious” in helping MSMEs.

“We appreciate the government’s stimulus measures but the most important thing is that the implementation process needs to be in line with this policy,” Rano told The Jakarta Post, adding that MSMEs often found difficulties in restructuring their loans.

“We are bleeding right now especially entering the Ramadan month,” Rano said, referring to the Islamic fasting period between April 24 and May 22. “We are hoping that this policy will be followed by better implementation, especially in banks.”

Rano said that many MSMEs could not get new loans from banks during the virus crisis, adding that the government must examine the issue to help save local companies.

The Indonesian Travel Agents Association (Astindo) secretary-general Pauline Suharno voiced a similar view, saying that previous government’s credit incentives were not effective because of botched implementation, calling for the government to ensure that businesses could receive the incentives.

“We think that this could be good, but only if the government and private lenders can implement it,” Pauline, who works in the badly hit tourist sector, told the Post.

Contacted separately, Perbanas Institute economist Piter Abdullah welcomed the government’s decision to roll out such incentives for MSMEs but said that “it would not be enough” to help businesses’ cashflow.

“This will help them to survive, but the government still needs to formulate stronger incentives to really boost their negative cashflow.”

Source: https://www.thejakartapost.com/news/2020/04/30/small-businesses-get-subsidies-loan-relief.html

Thailand

Thailand