Future of Indonesia’s education tech lies in untapped categories, experts say

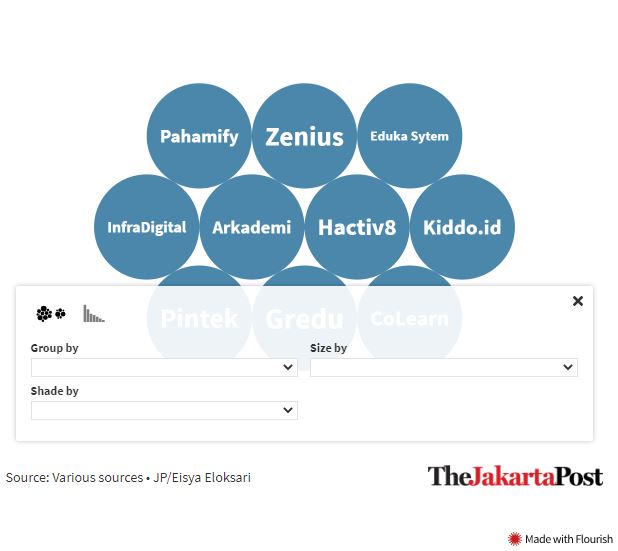

Indonesian education technology (EdTech) companies have the potential to expand to a wider market, including vocational training and the digitization of schools, as the COVID-19 outbreak has increased the need for such services, experts have said.

“EdTech is still an uncharted territory with a few players and plenty of potential. It is also very segmented, as each level of education needs a different approach; that is what makes it interesting,” Institute for Development of Economics and Finance (Indef) researcher Bhima Yudhistira said in a phone interview with The Jakarta Post on Sept. 28.

In the future, EdTech platforms could offer learning management systems (LMS) through business-to-business (B2B) partnerships with education institutions, he said, adding that there was also an opportunity to create tailor-made digital solutions, such IT system development.

As the country still struggled with the rising number of COVID-19 cases, Indonesia’s 60 million students are forced to adapt to remote learning, which accelerates the use of EdTech.

Currently, EdTech services in Indonesia are mainly consumer-centric, including Zenius, which offers free access to its library of more than 80,000 videos on various subjects for grades 1 to 12 students, as well as Ruangguru, an interactive online learning platform for students.

However, some are more institution-focused, like Scola, an LMS service that digitizes classroom monitoring, which has a feature to track students’ scores.

Bhima went on to say that, apart from merely expansion, B2B EdTech platforms had a stronger consumer base and user loyalty than business-to-consumer (B2C) platforms, as institutional customers were less likely to switch to other platforms even when discounts are discontinued.

According to a World Bank report published in May titled EdTech in Indonesia: ready for take-off?, fewer than 5 percent of EdTech platform users in Indonesia are willing to pay once a platform’s free trial period is over.

Consequently, the report also showed that 90 percent of EdTech firms have changed their business model, mostly from only B2C to also tapping into B2B in an effort to increase revenue and improve customer acquisition, among other reasons.

“EdTech companies have a greater focus on social impact. Therefore, their market is not inherently a high profit-generating sector. This poses a challenge for EdTech firms in terms of attracting potential investors,” the report reads, adding that only 8 of 35 EdTech firms participating in the survey considered themselves profitable.

Management consulting company Redseer noted that Indonesia’s EdTech startups only received US$200 million funding last year, with a large chunk of $150 million going to Ruangguru in December 2019. The number is significantly lower than the funding for the sector in India at around $2.5 billion and the US at around $7.5 billion over the same period.

Indonesia saw at least eight cases of EdTech funding this year totaling more than $23 million, including Zenius’s $20 million series-A funding and learning platform Pahamify’s $150,000 seed funding.

“We do think that this is the beginning of what is going to be a mega market. Indonesian EdTech will be very large and profitable, and we are very bullish about it,” Sequoia Capital India managing director Rajan Anandan told the Post in an interview on Sep. 30.

Sequoia’s recent accelerator program Surge 03 included an Indonesian EdTech startup called CoLearn. Anandan claimed that CoLearn had been used by 200,000 students since its launch in September.

He went on to say that Indonesia was likely to see some big players in EdTech for kindergarten to grade 12 students, while new players would emerge in university supplementary education and vocational training, filling in the current whitespace.

Anandan added that there were opportunities to build businesses in LMS or a similar products to help offline schools and universities move to digital platforms, but consumer-focused EdTech companies were expected to be larger than the B2B companies.

“Globally, we see it is much easier to scale and monetize a B2C business in EdTech than a B2B business,” he said.

Ruangguru, for example, has tapped into the LMS sector by launching ruangkelas in July. The new platform is available for free to help teachers during the pandemic. More than 17,000 teachers in more than 10,000 schools have used the service, according to the company’s founder Iman Usman.

“I do think in the future we will see more EdTech start-ups for upskilling workers, language learning and early childhood education, especially since millennial parents put priority on quality education,” Pahamify cofounder Mohammad Ikhsan said in an interview with the Post on Thursday.

So far, the company has seen a tenfold increase in users from July to September compared to all of last year’s total users. It currently grants discounts of up to 90 percent during school closure amid the pandemic.

Source: https://www.thejakartapost.com/news/2020/10/05/future-of-indonesias-education-tech-lies-in-untapped-categories-experts-say.html

Thailand

Thailand