Covid-19 challenges Vietnam’s fundamental weaknesses

The Hanoitimes – In 2020, raising public investment disbursement is the only way to lessen the pain of economic growth.

Although Vietnam has maintained macroeconomic stability amid the Covid-19 pandemic, the current crisis is posing challenges to the country’s fundamental weaknesses, mainly a high dependence on foreign investment and exports, weak supporting industries, and high debt ratio, according to Viet Dragon Securities Company (VDSC)’s latest report.

The Covid-19 pandemic started disrupting the global supply chain and in Vietnam around the post-Tet holiday. Quarantine and social distancing across Asia, especially China, forebode the possible shortage of intermediate goods coming into Vietnam. Nevertheless, international trade figures showed a quick response, with increases in imports from Japan, South Korea, and US partially offsetting the drop from China.

The adverse impact of this supply shock to Vietnam is diminishing because China’s economic production has restarted and Vietnam’s low dependence on the supply of intermediate goods of G7 countries which are on national lockdowns.

Moreover, China’s activity resumption ratio could soon reach 85% of 2019’s capacity, the report added.

Demand shock starts materializing

Although the supply shock is no longer the biggest threat to Vietnam’s economy, the demand shock starts materializing. Markets in developed countries of Europe and North America, account for over 40% of Vietnam’s total export revenue, are on lockdown.

A survey by McKinsey to gauge how people’s expectations, perceptions and behavior change through the crisis across the world expected the crisis to stick around for a long period. Over 50% of respondents are unsure about whether the economy will be affected for 6-12 months or longer and will stagnate or lead to slow growth thereafter. However, they expected a negative impact on their income and will be very careful on how to spend money.

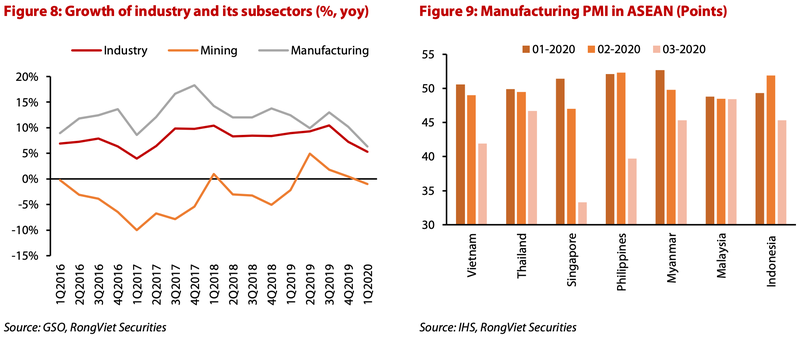

Meanwhile, Vietnam and other regional countries are starting to suffer from external economic changes globally. In March, most countries recorded a contraction of manufacturing Purchasing Managers’ Index (PMI). Excluding Singapore, Vietnam and the Philippines have been hurt the most as the manufacturing PMI dropped to 41.9 and 39.7 points, respectively. It is the lowest level of Vietnam’s PMI in the last decade.

The pandemic led to the sharpest declines in new orders and production in the survey’s history. Business sentiment dropped to the lowest since this series was added to the survey in April 2012. The industrial production, released by the General Statistics Office, also grew at an annual pace of 5.3% year-on-year. The mining sector decreased by 1% year-on-year because of the tumble in crude oil prices. The manufacturing sector advanced at 7.2% year-on-year, the lowest level since 2016.

Vietnam’s exports to the US and EU began dropping significantly in March. The most affected sectors are textiles, plastics, rubbers, chemicals, steels, and agriculture goods (except rice). All of them saw an annual drop of 10% in the first quarter 2020, on average.

Exports of agriculture goods to China are also stuck at customs borders. More and more processing factories stopped operating since the beginning of April and workers are going on furlough. That is because export orders are being delayed or canceled massively.

Export turnover is expected to drop over 20% year-on-year in the second quarter. The Covid-19 crisis also led to decrease in foreign direct investment (FDI). The disbursed FDI was only US$3.9 billion, down 6.6% year-on-year. Last year’s newly registered projects were mainly small- and midscale ones that can be done within 12 months.

In terms of domestic consumption, social distancing order is hurting producers and service providers. The normal growth of retail sale was only at 4.7% year-on-year in the first quarter, the lowest level in the last decade. Excluding the inflation factor, the real growth dropped to 1.6% year-on-year, significantly lower against the growth rate of 9.3% in the same period last year.

|

Notably, total sales of goods and services contracted in March narrowed. The entry ban policy has resulted in a sharp drop in the number of international tourists. In March, there were only 450 thousands foreign visitors coming to Vietnam, compared with over 1.4 million in the similar period in 2019. The number will shrink toward zero in April. As a result, more and more accommodation and catering services providers, in downtown centers and tourist attractions, have temporarily closed. Their revenue dropped 27% year-on-year in March. In general, it is certain that consumption, accounting for nearly three-quarters of Vietnam’s economy, will keep going down in the second quarter.

Public investment disbursement to boost economic recovery

In the context of all economic segments’ contraction, Vietnam’s GDP growth is estimated at 5.3% year-on-year in 2020, deeply below 2019’s 7%, given that the pandemic is contained and the restrictions in developed countries are lifted in the middle of the second quarter, plus a healthy public investment disbursement, the report predicted.

|

In 2020, raising public investment disbursement is the only way to lessen the economic growth’s pain, stressed the report.

More and more projects, which completed their legal procedures but are delayed due to insufficient capital funding, will restart thanks to the government’s advance payments and banks’ loans. Meanwhile, the government will allow to convert PPP projects of the North-South expressway into public investment ones. That will definitely push up the process and the projects’ construction will start in the third quarter. As a result, total state investment increased 16.4% year-on-year in the first quarter, focusing on transportation with an increase of 29.3% year-on-year and healthcare, up 30.7%. In case of completing 100% of the yearly disbursement plan in 2020, the additional investment will add 0.4% to the general GDP growth.

Source: http://hanoitimes.vn/covid-19-challenges-vietnam-fundamental-weaknesses-311647.html

Thailand

Thailand