Cambodia: Senior law and tax expert explains legal complexities of sales

Selling and buying goods is not straightforward, particularly if it involves an overseas company, a Singapore-based expert told members of the Phnom Penh business community.

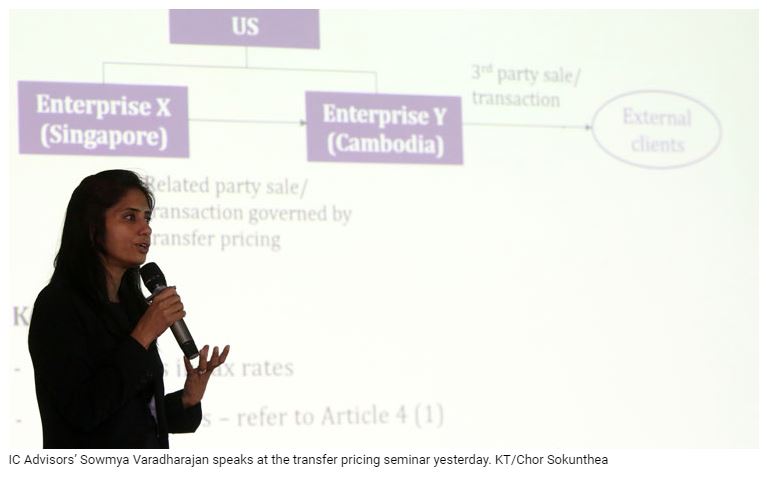

Speaking at a transfer pricing seminar organised by Cambodia’s tax and law experts VDB Loi, Sowmya Varadharajan, international transfer pricing director at Singapore’s IC Advisors, highlighted that a transaction between two related parties – be it the sale of goods, purchase of goods or even royalties – has to be consistent with transactions done with a third party.

“In Cambodia, transactions between related parties can be considered between parties with a familial relationship or when one company has at least a 20 percent stake in another,” Ms Varadharajan said.

However, most parties think market conditions are not applicable to such transactions because they believe the bargaining concept is not involved, she said.

This form of transaction is common between companies in different countries but difficulties can arise.

For instance, in Cambodia, the appropriate tax is 20 percent while in Singapore it is 17 percent. The 3 percent difference can help companies save money.

Ms Varadharajan said parties involved in transfer pricing should be aware of the correct price and other considerations such as the cost of manufacturing in order to come up with the right price strategy.

“Parties should also pay close attention to the right documentation in case an audit requires them,” said Ms Varadharajan.

There are several transfer pricing methods involved. They are divided into two groups, the ‘traditional transaction methods’ and the ‘transactional profit methods’. Each group has its own set of methods.

Ms Varadharajan said there is no best method for a company because each has its own strengths and weaknesses.

Companies applying the appropriate method would have to use it according to the terms and conditions that are set between parties.

“Commonly used in Cambodia are the ‘resale price method’ and the ‘transactional net margin method’, with 99 percent of transfer pricing reports utilising the latter method,” Ms Varadharajan said.

The Prakas (directive) 986 which oversees the transfer pricing transactions between related parties has been in effect since January 2018. Penalties for failure to comply with the necessary requirements lead to pricing adjustments that result in additional tax.

Source: https://www.khmertimeskh.com/50667513/senior-law-and-tax-expert-explains-legal-complexities-of-sales/

Thailand

Thailand