Cambodia: Large private sector debt to cause high credit risk in economy

Sizable private sector debt, concentrated economic activities, relaxed underwriting standards and a very weak payment culture could result in the credit risk in the economy to remain extremely high, S&P Global Ratings said in a report yesterday.

It found the economic risk in Cambodia’s banking system is to stay high by global standards with an average creditworthiness of ‘b+’, reflecting the country’s low-income level, underdeveloped economy, and constrained monetary and fiscal flexibility.

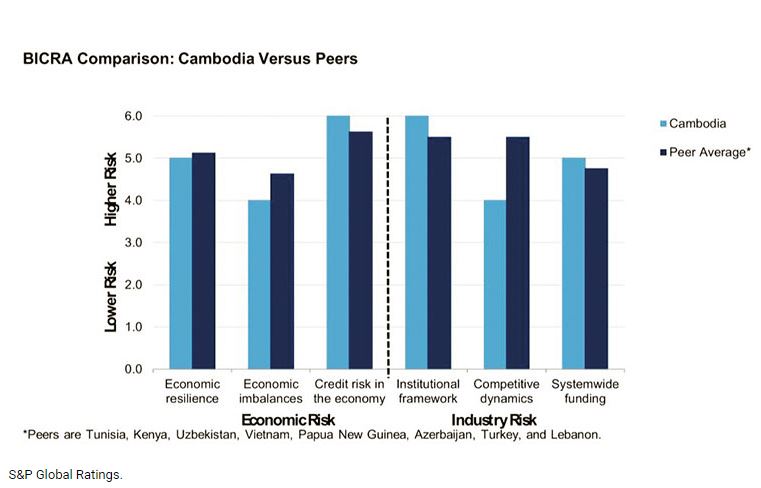

S&P Global Ratings assessed the Cambodian banking system as relatively high risk, placing it in ‘group nine’ on a scale of one to 10 based on its Banking Industry Country Risk Assessment.

It shares the spot with Turkey, Tunisia, Kenya, Uzbekistan, Vietnam, Papua New Guinea, Azerbaijan, and Lebanon.

“In our opinion, risks are high given strong credit growth, elevated property prices, and declining asset quality but Cambodia’s stable gross domestic product (GDP) growth and pre-election credit slowdown temper economic risks for the banking system,” it added.

Credit growth has been rapidly rising since 2012, fueling the risk of a credit-driven asset bubble, it said, adding that private sector credit growth, concentrated in real estate and construction, has averaged 30 percent a year from 2012 to 2017, far exceeding nominal GDP growth.

It said banks total loans and advances rose some nine percent in the first six months of 2018, believing there are inherent risks beyond high property prices but these might ease on the significant supply of condominiums, retail and office space.

The report said real estate and construction sectors accounted for 25 percent of bank credit and 40 percent of new credit as of June this year, which the agency viewed as sensitive to investor confidence and a key source of bank stress.

“Although credit growth started to slow in 2017, in part due to regulatory measures, we expect it to remain elevated in the near term,” it added.

In the medium term, it said growth prospects are favourable for Cambodia’s status as a low to middle income country, factoring in the growth of the garment industry and tourism into its real GDP per capita growth projection of 5.2 percent and real GDP growth of 6.7 percent over the 2018-2021 period.

However, it expects Cambodia’s fiscal and monetary policy flexibility to remain weak, with a fiscal deficit to temperately widen to an average of 3.7 percent of GDP from 2018 to 2021.

“The continued engagement of international donors would continue to underpin the country’s fiscal profile. This support conditions policy formulation and provides substantial fiscal and balance of payments assistance through concessional loans and grants.

“The absence of an independent monetary policy framework, owing to extensive use of the US dollar, severely hampers monetary policy flexibility. Foreign currency deposits account for more than 80 percent of broad money, leaving the central bank with setting bank reserve requirements as the main (and perhaps only) policy tool,” it added.

On the banking regulatory framework, S&P Global Ratings said its assessment showed that it was weak and that supervision was passive, adding that it was subject to financial and political constraints.

It said regulatory initiatives in the country yield only incremental improvements over time and do not keep pace with the rapid expansion of the banking system.

“An oversupply of banks and financial institutions constrains the industry’s risk-adjusted returns. We feel that bank failures have undermined depositor confidence and the stability of deposits. For example, local banks witnessed significant deposit withdrawals in 2013 following a dispute on the general elections,” it added.

Meanwhile, the global ratings agency said the economic risk trend for Cambodia is expected to remain stable, while credit growth will stay strong at around 2.5 times real GDP, particularly with the re-election of the federal government.

The significant increases in the supply of condominiums, retail, and office space will keep property price appreciation subdued over the next 12 months.

“Overall, our base case is for credit growth to remain robust but slower than in prior years,” it added.

The banking sector is expected to maintain a simple business mix and manageable risk appetite that counter risks from high loan growth.

Customer deposits are expected to be the major funding source for Cambodian banks although some lenders will increase external funding.

S&P Global Ratings opined that raising capital requirements for financial institutions and new credit risk grading and impairment provisioning requirements will be a headwind to loan growth, but not for new banks.

Source: https://www.khmertimeskh.com/50560798/large-private-sector-debt-to-cause-high-credit-risk-in-economy/

Thailand

Thailand