Cambodia: Insurance penetration less than 1 percent in kingdom

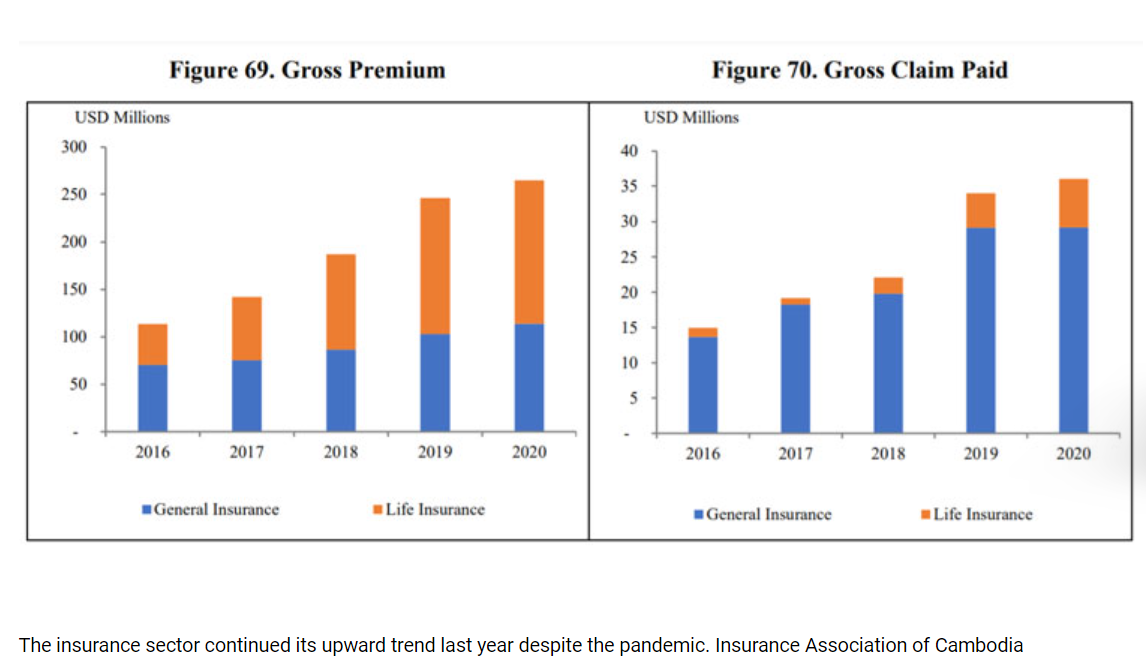

The insurance sector in Cambodia proved resilient in 2020 despite the pandemic, with total gross premiums nationwide increasing by 7.8 percent to $264.9 million.

However, there remains ample room for growth, as Forte Insurance Group Chief Executive Officer Youk Chamroeunrith told Khmer Times that insurance penetration in the country is still at less than 1 percent.

According to figures released in the National Bank of Cambodia’s Financial Stability Review, general insurance sales grew by 10.5 percent in 2020, with the biggest increases seen in property insurance, which represented 6.4 percent of total growth, medical insurance (2.2 percent) and miscellaneous insurance (1.9 percent) leading the way.

Property and medical insurance represented the largest percentage of premiums, at 35.4 percent, followed by general insurance, which accounted for 18.4 percent of total premiums.

General insurance companies saw an increase of 0.2 percent in the amount of claims paid in 2020, which rose from $29.1 million in 2019 to $29.2 million in 2020.

Chamroeunrith said medical insurance has been rising in popularity as a result of Covid-19 as customers have started realising the importance of protecting their health and finances.

But the vast majority of the population remains uninsured, representing a massive opportunity, he said.

“Insurance penetration in Cambodia is still very low compared with neighbouring countries. It is lower than 1 percent. Hence, there is huge potential for insurance to grow faster in the future. Factors that will continue to contribute to the growth of insurance include favourable macroeconomic conditions, political stability, a growing middle class, a more robust regulatory framework and support from relevant regulators to promote the growth, awareness and understanding as well as trust in the insurance industry,” he said.

He added that not being able to physically meet potential customers has hurt business because selling insurance often requires in-person communication.

Moreover, as incomes have dropped, so have insurance policies while fewer potential first-time homebuyers are able to afford it.

“Clients’ financial situations are a very important factor in determining whether they can renew their insurance policies. We have seen a number of clients who wanted to renew their insurance policies but, because of their financial condition, they were not able to do so. The negative financial impact has also affected new take-up rates of insurance,” he said.

The seismic shift in the rules of business brought about by Covid-19 forced Forte to go online, where the company has found some success, he said.

“During this pandemic, we have initiated and developed new products to be offered purely online. One of our big milestones is serving as consortium leader for the Covid-19 insurance product offered to overseas travellers coming to Cambodia. This product is purchased purely online from a platform we developed and manage,” he said.

Other companies are also sensing opportunity in the Cambodian market.

Speaking at a webinar about a potential Canada-ASEAN free trade agreement last week, Manulife emerging markets General Manager Sachin Shah said Manulife was the leading provider of life insurance in Cambodia and expected the industry to grow further in the region in the future.

He said Asia represents 40 percent of the company’s business, while the United States accounts for 30 percent and Canada accounts for the other 30 percent.

ASEAN states account for about 20 to 25 percent of business in Asia and, over the next three to five years, Shah said he expects it to grow to 30 to 40 percent of Manulife’s Asia footprint.

He added that, as people begin to have more disposable income, with that grows a desire to save and make major purchases such as motorcycles, cars or homes. In addition, they think of investing in their health, in education for their children and in their retirement.

Shah said a free trade agreement between Canada and ASEAN could accelerate this process, which would naturally open the door for more opportunities in the insurance sector.

Source: https://www.khmertimeskh.com/50870668/insurance-penetration-less-than-1-percent-in-kingdom/

Thailand

Thailand