Emerging opportunity

Equities in Asia’s emerging markets rode a wave of global growth last year, with shares that make up the MSCI Emerging Markets Index delivering a 37% return, but will the big gains continue this year?

Some of the world’s top asset managers describe the global outlook for 2018 as a “very positive one” with “room to run”. The growth experienced last year is not about to come to an end, especially for emerging markets (EM) and US equities, they believe. But the returns will be a bit lower.

“It has been a difficult few years where there were negative returns, so we need to take [2017 performance] in the context of the asset class rebounding from a very low level,” said Emily Whiting, client portfolio manager for emerging market equity at JP Morgan Asset Management.

The company is the seventh largest asset manager in the world with assets under management (AUM) of US$1.9 trillion.

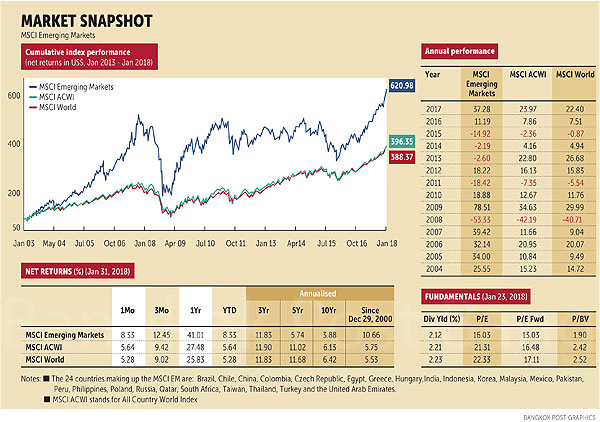

The net return on the MSCI-EM Index, which includes large and mid-cap stocks with a capitalisation of $5.88 trillion in 24 countries, surged by 37.3% in 2017, beating the 19.4% climb in the Standard & Poor’s 500, the broad gauge of US stocks. Last year’s performance represented a big turnaround from contractions of 11.2% in 2016, 14.9% in 2015 and 2.2% in 2014.

The rally has continued into this year with the index rising 12.45% in the past three months with a dividend yield of 2.12% and a price/earnings ratio (P/E) of 16.03 times, compared with 25.1 times for the S&P as of Jan 31.

When Morgan Stanley Capital International launched its EM index in 1988, it consisted of just 10 countries representing less than 1% of world market capitalisation. Today the index represents 10% of world market cap, and MSCI itself has some $1.6 trillion in assets benchmarked to it.

Ms Whiting noted, however, that the MSCI-EM Index is being pulled up to a great degree by just a few super performers.

“The earnings growth has kicked in with a very narrow market leadership in 2017 when you see Chinese internet stocks, in particular, have outstripped the market such as Alibaba and Tencent, both up over 65-70% last year,” she said.

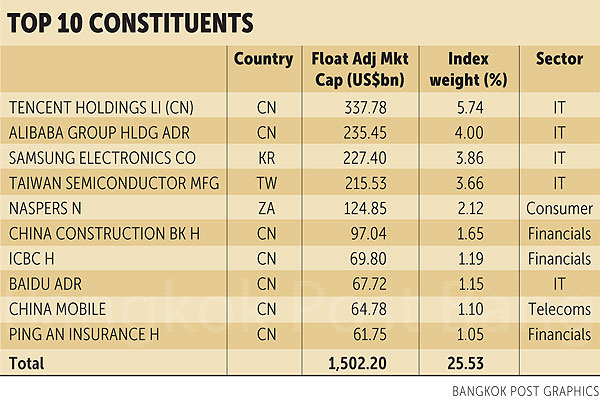

The 846 companies within the index are dominated by Asian companies from China (30.8%), South Korea (14.71%), Taiwan (11.19%) and India (8.37%). The top five constituents are Tencent Holdings of China with a weighting of 5.74%, Alibaba (4%), Samsung Electronics (3.86%), Taiwan Semiconductor (3.66%), and the South African internet, media and entertainment group Naspers (2.12%).

Ms Whiting said IT shares accounted for 27% of the index and finance stocks 24%. Yet IT drove 50% of the return in 2017.

“The main message we have is that the [earnings] story is just getting back on track,” she said. “We have come through years of earnings recession and the fact that we are seeing that turned around shows that the reciprocal upturn is coming through, but the structural long-term story remains firmly on track including demographics, middle-class emergence, superior growth — those are all still there.”

Given looming elections in Cambodia, Malaysia, Thailand and Indonesia along with tensions in the Korean Peninsula as well as the South China Sea, Ms Whiting said it would be naive to say that asset managers do not have concerns in Asia. But in the context of investment, they “aspire to be long-term investors” and are looking at stocks based on fundamentals. What they do not do is “invest based on how we foresee political situations turning”.

“There will always be noise, there will always be political instability and that’s why they are emerging markets. Historically, big political events have never caused long-term dislocation in markets. They have created a lot of short-term noise, but you also see that globally,” she said. “With North Korea, there have been huge headlines but interestingly, South Korea was actually one of the top performers in 2017”.

Ms Whiting said JP Morgan Asset Management was overweight in markets that are “cheap with positive momentum” and strong fundamentals, such as South Korea but not the country’s equity funds given “concern over corporate governance”.

“We like the Asia side of China with very good entrepreneurial companies, good management that is trying to align [with the interests of] minority investors,” she continued. “We get lots of great ideas there. It’s very consumer-driven as well and that is tied to the service side.

“With South Korea, it really depends on your time frame. Operationally there are fantastically performing companies like Samsung but you also have the flip side — companies that don’t prioritise minority investors so there is that concern about whether we will get the money back.”

In Asean, JP Morgan likes domestic stories and is overweight on the financial sector including Indonesia and Thailand, but not Malaysia where it has never found the “right ideas with the right duration”.

“India is another interesting EM market,” she said, noting that while Indian equities look expensive, in the long term it is a very promising market, especially for private-sector banks.

Stocks will not be as cheap this year but the price/earnings (P/E) ratio in emerging markets remains near the long-term average. The forward P/E ratio of the MSCI-EM was 13.03 times as of Jan 31, above its five-year average of 10 times.

“All the flows that came in last year were not quite at the level that we saw a couple of years ago so our view is, we had a good run in the last year, but if you believe that all these fundamentals continue to be in place, there are a lot of tailwinds to the asset class, it remains a good time to invest if you are a long-term investor. This is the accumulation stage,” said Ms Whiting.

Isabelle Mateos y Lago, chief multi-asset strategist at BlackRock, said the exceptional returns of 2017 were unlikely to be repeated this year given the prospect of rising inflation and interest rates. But the economic and earnings backdrop is still positive for equities. Equities in Japan look “well positioned” and there are “greatest opportunities” in Asia, she added.

BalckRock sees inflation making a “modest” comeback led by the US. It expects the Federal Reserve to raise interest rates three times this year, by 25 basis points each time. US tax cuts could “boost near-term growth” and “quicken the Fed’s pace” while the euro zone and Japan will be “behind” on policy normalisation, said Ms Mateos y Lago.

“We got very lucky in 2017. The bad things that could have happened — in particular a lot of fear around the French presidential election, certain things that Donald Trump threatened to do — these didn’t happen,” she told Asia Focus.

“Inflation (globally) was expected to rise and also didn’t. That meant interest rates (globally) fell, that means financial conditions remain very supportive and that boosted stocks. We expect strong returns going forward in equities in particular, but not as strong as last year.”

Ms Mateos y Lago said BlackRock sees emerging markets as “a sweet spot” with Asian ones in particular doing well, but the asset class as a whole is still supported by several factors including valuations. While prices have gone up, they are still relatively less expensive than in other parts of the world at similar points in their market cycles.

Merrill Lynch strategist Ajay Kapur told CNBC recently that EM stocks are trading below two times book value, well below the three-times level that historically ends emerging market rallies.

“Global investors are still underweight here (EMs), both in fixed income and in stocks, so there is quite a bit of scope for inflows to continue. The growth prospects are also excellent and that’s both supported by external demand which is supportive for commodities and materials, but also the domestic growth environment which, until now, has been somewhat subdued in many cases but has the potential to pick up further,” Ms Mateos y Lago said.

In terms of risks, BlackRock expects low market volatility against a stable economic backdrop. For China, asset managers believe much-needed economic reforms risk slowing growth and triggering “temporary credit crunches” while the outcome of North American Free Trade Agreement renegotiations could be a “bellwether” for global trade risks this year.

BlackRock, the biggest asset manager in the world with $6 trillion under management, is overweight on Asian equities in EMs (China, India, Indonesia and Thailand), Japan and Europe (Germany and France) but it sees the US as “already expensive”.

It likes financials across the board, along with IT shares in the US but not Asia because Chinese IT stocks are more expensive, she added.

Source: https://www.bangkokpost.com/business/finance/1418491/emerging-opportunity

Thailand

Thailand