Economists Moving Up Expectations for Southeast Asia Rate Hikes

(Bloomberg) — Economists have brought forward their expectations on when some central banks in Southeast Asia, including in Indonesia and Malaysia, will raise their benchmark rates as they battle inflation.

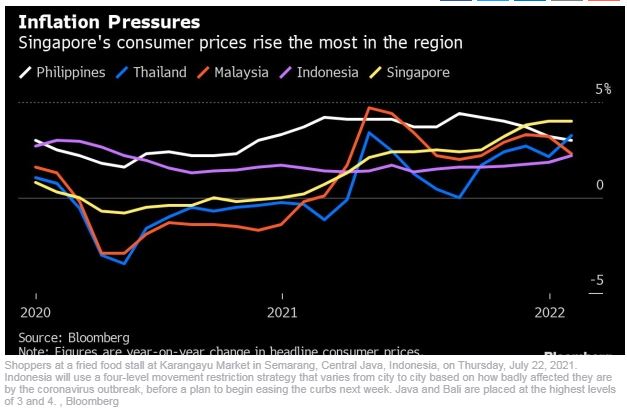

Some policy makers are shifting their focus toward battling inflation as it becomes a risk to their pandemic recoveries. Prices of key commodities, which had already been surging, rose sharply after the Russia’s invasion of Ukraine, adding further upward pressure on prices.

Indonesia is expected to increase its seven-day reverse repurchase rate in the third quarter of 2022, according to the median estimates of economists surveyed by Bloomberg, earlier than the previous outlook for a quarter of percentage point hike in the fourth quarter.

Malaysia’s record low benchmark rates will likely increase by 25 basis points in both the third and fourth quarters, reaching 2.25% by the end of this year, six months ahead of the previous forecast.

Economists also see a half of a percentage point raise in the Philippines’ key rate in the fourth quarter compared to an increase of 25 basis points previously. Thailand, meanwhile, is still expected to stay on hold this year.

Other nations like Singapore, which uses foreign exchange as its tool to stabilize prices, is expected to further tighten policy at its next meeting April, after it surprised markets with its first unscheduled adjustment in seven years in January.

Thailand

Thailand