Economists’ forecasts for Singapore’s 2021 growth fall within upgraded official range

ECONOMISTS were unsurprised by the upward revision of Singapore’s official full-year growth forecast on Wednesday, with most of their own maintained forecasts falling within the new 6 to 7 per cent range announced by the Ministry of Trade and Industry (MTI), up from 4 to 6 per cent previously.

While manufacturing is expected to remain the key driver of growth in the rest of this year, the further easing of domestic controls and selected border reopening will support sequential recovery too, said economists. But with the recovery still stabilising, monetary policy is expected to remain on hold at the next meeting in October.

“Singapore’s economic prognosis remains resilient given the strong vaccination take-up rate, coupled with its strong export and manufacturing performance seen year to date,” said UOB economist Barnabas Gan, whose full-year growth outlook remains unchanged at 6.5 per cent.

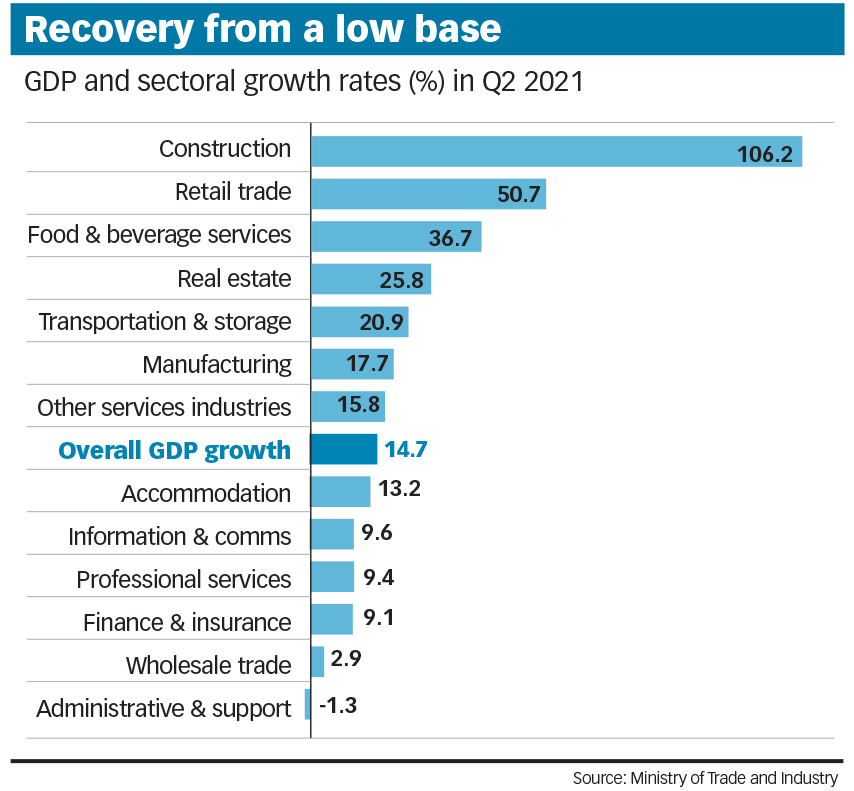

Gross domestic product (GDP) grew 14.7 per cent year on year in the second quarter, better than flash estimates of 14.3 per cent and improving upon Q1’s 1.5 per cent growth, upon a low base in the year-ago period.

In absolute terms, however, GDP remained 0.6 per cent below the pre-pandemic level of Q2 2019. And on a quarter-on-quarter seasonally-adjusted basis, the economy contracted 1.8 per cent in Q2, reversing from the growth of 3.3 per cent in Q1.

With the latest figures, the economy grew by a better-than-expected 7.7 per cent year on year in the first half of 2021. The upward revision in Q2 growth, compared to flash estimates, was due to improved performance by services and construction.

Manufacturing contributed the most to Q2 growth, accounting for 3.7 percentage points or more than a third of the total rise. The sector’s output was up 17.7 per cent year on year, extending the previous quarter’s 11.4 per cent growth, with the largest increases in transport engineering and precision engineering.

On a quarter-on-quarter seasonally-adjusted basis, however, the manufacturing sector shrank 2.5 per cent, pulling back from Q1’s 11.5 per cent growth.

While the manufacturing sector is expected to stay in expansion, current shortages of semiconductor chips may put a lid on the pace of electronics growth even though global demand remains strong, said DBS senior economist Irvin Seah.

Construction sector output more than doubled on a low base, as most domestic construction activities had been suspended in the “circuit-breaker” period a year ago. But in absolute terms, the sector’s value-added remained 29 per cent below the Q2 2019 pre-pandemic level.

The low-base effect also allowed for strong growth in retail trade, food and beverage services, real estate, and transportation and storage. All other sectors saw growth apart from administrative and support services.

But Maybank Kim Eng economists Chua Hak Bin and Lee Ju Ye observed that most sectors remain below pre-pandemic levels, apart from manufacturing, finance and insurance, and information and communications.

Maintaining their full-year forecast at 6.8 per cent, they expect manufacturing and exports to continue driving recovery in the second half, with services also picking up speed as reopening proceeds.

In 2022, they expect growth to “remain slightly above potential” at 3.5 per cent, as the services and construction sectors recover more strongly with the easing of lockdowns and border controls.

The upgraded official full-year forecast takes into account the better-than-expected first-half performance, as well as the latest external and domestic economic developments, said the MTI.

On balance, the recovery in external demand for the rest of the year remains largely on track. Vaccination rates have picked up in the United States and the eurozone, though South-east Asian growth is likely to be slower than earlier projected due to tightened pandemic curbs.

“Barring a major setback in the global economy, the Singapore economy is expected to continue to see a gradual recovery in the second half of the year, supported in large part by outward-oriented sectors,” said the MTI.

However, the recovery is still expected to remain uneven. Prospects remain strong for outward-oriented sectors such as manufacturing and wholesale trade, as well as finance and insurance, and information and communications. But aviation and tourism-related sectors are projected to recover more slowly than earlier expected.

Consumer-facing sectors should recover as domestic restrictions are eased, but are not expected to return to pre-Covid levels by the end of the year, partly due to the subdued tourism outlook.

And while the construction and marine and offshore engineering sectors are projected to see some recovery from last year’s low base, labour shortages are likely to continue weighing on this. While border restrictions may ease and alleviate this, the output of those sectors is expected to remain “substantially below pre-Covid levels” even at year-end.

MTI also flagged several downside risks: pandemic-related uncertainty, upside risks to inflation, and continued geopolitical uncertainty.

“A combination of growth normalisation in manufacturing, manpower crunch in construction, and continued drag from Covid on tourism-related sectors will make for a slower second half of the year,” said DBS’ Mr Seah, who maintains a full-year growth forecast of 6.3 per cent.

UOB’s Mr Gan noted continued concerns over how pandemic-related risks may evolve in the coming months for Singapore and its key trading partners, “as anecdotal evidence has shown how quickly issues may turn south should Covid-19 risks magnify”.

The Monetary Authority of Singapore (MAS) is likely to remain cautious about premature policy tightening, as any recovery could be derailed if Covid-19 infections surge, said Barclays economist Brian Tan.

He predicts full-year growth to come in at 6.5 per cent, and expects the MAS to stay on hold at its October policy meeting, with policy tightening more likely to begin in April 2022.

Replying to questions from the media on Wednesday, MAS chief economist Edward Robinson said that the current monetary policy stance “remains appropriate for now”, with the upgraded growth forecast range continuing to be consistent with the current policy stance.

He confirmed that the Singapore dollar nominal effective exchange rate is within the policy band, and its average level since April has been consistent with the policy stance.

OCBC head of treasury research and strategy Selena Ling also expects the MAS to maintain the status quo in October, though it could “lay the groundwork” for policy recalibration in 2022.

Further reopening and resumption of some international travel later this year “would pave the way for a more stable recovery trajectory and hence room for policy normalisation down the road”, she said, with labour market recovery and 2022 inflation expectations being the indicators to watch.

The 18.2 per cent year-on-year rebound in overall unit labour cost in Q2 – after four straight quarters of declines – suggests that there could be upward pressure on wages in 2022, she added. She expects the overall unemployment rate to improve to 2.5 per cent by year-end, and further to 2.3 per cent in 2022.

OCBC’s full-year growth forecast is 6.7 per cent for 2021, followed by “more normalised growth” of 2 to 4 per cent in 2022.

Source: https://www.businesstimes.com.sg/government-economy/economists-forecasts-for-singapores-2021-growth-fall-within-upgraded-official

Thailand

Thailand