China+One strategy to fuel Malaysia’s growth

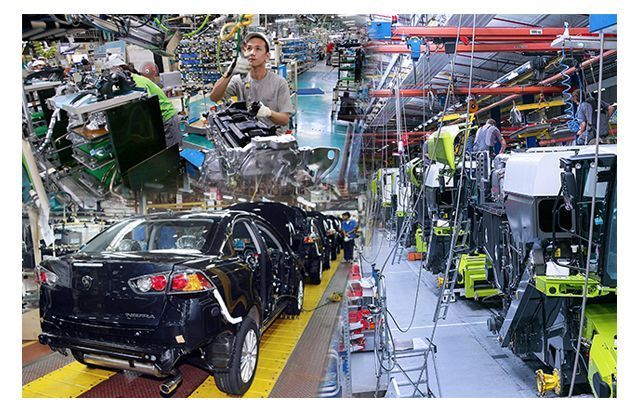

PETALING JAYA: Malaysia, the fifth largest economy in Asean, stands to benefit from the “China+One” strategy as global manufacturers trim their dependence on China.

Noting that the strategy is being pursued by “every multinational corporation”, CGS-CIMB Research said this will lead to the reconfiguration of supply chains.

This in turn will provide trade and investment opportunities for Asean countries like Malaysia, Vietnam and Thailand.

CGS-CIMB Research opined that Asean’s numerous free trade agreements, along with its lower cost base and efficient supply chains, make the China-Asean manufacturing partnership formidable.

“China and Asean have become more closely integrated as supply chains have converged.

“Asean’s share of global exports will rise as China’s share moderates and consolidates, in our view,” it said in a note yesterday.

CGS-CIMB Research believes that Asean offers a multi-year structural investment story, with favourable demographics that comprises a growing middle class and rising disposable incomes.

“Asean’s neutral stance amid US-China tensions establishes the region as an attractive foreign direct investment (FDI) destination for eager investors.

“With the exception of Myanmar and Laos, the relative political stability in the region and robust sovereign and corporate balance sheets make this regional bloc attractive to global investors in both the private and listed equity space, in our view,” it added.

The “China+One” global factory strategy is one of the five structural growth themes for Asean, according to CGS-CIMB Research.

The other growth themes are the reopening of China and Asean; rise of the Asean middle class; peaking interest rates and the digitalisation of Asean.

For the reopening theme, two Malaysian stocks are preferred by CGS-CIMB Research, namely, Genting Malaysia Bhd and Malaysia Airports Holdings Bhd

and Malaysia Airports Holdings Bhd .

.

Meanwhile, under the theme of rising Asean middle class, the research house preferred MR DIY Group (M) Bhd as well as Axiata Group Bhd

as well as Axiata Group Bhd ’s Indonesian listed subsidiary, PT XL Axiata Tbk.

’s Indonesian listed subsidiary, PT XL Axiata Tbk.

CGS-CIMB Research also highlighted five structural tailwinds for Asean, moving forward.

These tailwinds are fertile macroeconomic conditions; high turnover contribution; strong FDI inflows; revenge tourism and renewed confidence towards a rejuvenated market.

Commenting on market turnover, the research house noted that one key trend is the rapid rise of Vietnam, where it has begun to rival Indonesia and Singapore.

“The interest in Malaysia and the Philippines remains lacklustre,” it said.

CGS-CIMB Research pointed out that Asean’s prolonged underperformance over the last 10 years has led to declining interest and investor fatigue in the region.

“We believe this underperformance is set to reverse due to a favourable macroeconomic environment, including structural FDI flows in the region, due to the ongoing geopolitical tensions between China and the West.

“We believe Vietnam’s emergence as a global manufacturing hub is pivotal and will contribute to investors’ attention to the region as a viable alternative to China as a manufacturing hub,” it said.

Source: https://www.thestar.com.my/business/business-news/2023/03/07/chinaone-strategy-to-fuel-malaysias-growth

Thailand

Thailand