Cash usage in Vietnam remains highest in ASEAN

The preference of cash usage in Vietnam is of the highest in ASEAN, according to Standard Chartered’s latest report.

The report, titled “Cash digitization in ASEAN – What it means for the future corporate treasurers and consumers,” revealed although there is a rise in alternative electronic means of payments in the region, cash still dominates.

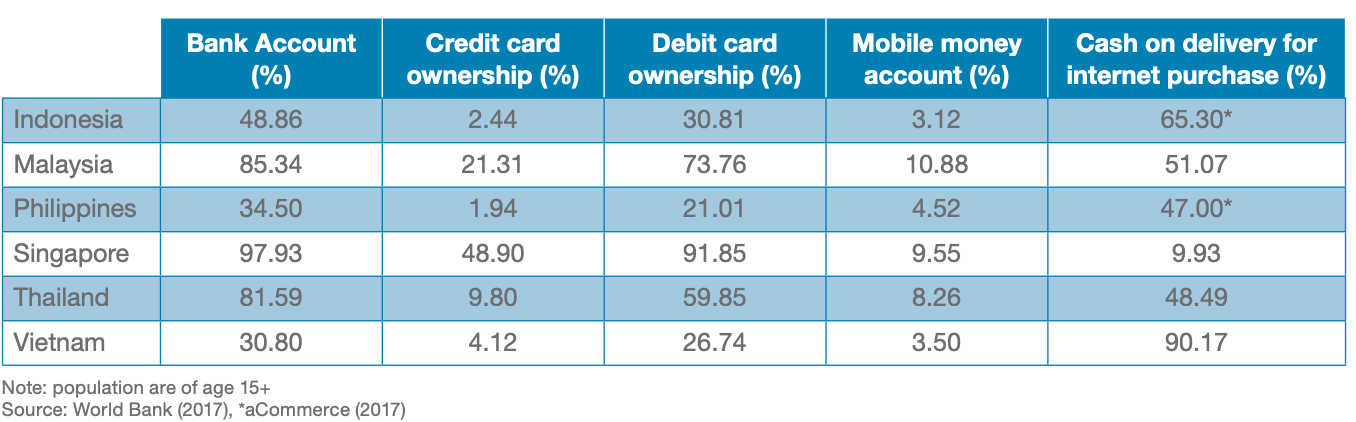

According to the report, cash usage accounts for more than 70% of transactions in the Philippines and Indonesia, and 43% in Singapore. Among six ASEAN countries under survey, Vietnam has the lowest penetration of bank account at 30.6%, and among the lowest in the rate of credit card and debit card ownership at 4.12% and 26.72%, respectively, higher than Indonesia and the Philippines.

However, the country posted the highest rate of cash on delivery for internet purchase at 90.17%, significantly higher than the second ranked Indonesia of 65.30%.

“Apart from Singapore that holds a ‘stand out’ position in the Digital Evolution Index 2017 by Tufts University and Mastercard, the traditional means of banking and payments remain more popular for the rest of ASEAN. While the penetration of bank accounts has shown improving numbers in some countries, card penetration is relatively low with less than 50%. And in most of ASEAN, the preferred way to pay for online purchases is cash on delivery,” stated the report.

While the region may not be turning cashless at the snap of a finger, technology can help deliver features to attract consumers to embrace digital channels, added the bank.

For example, the implementation of instant payments across most markets in ASEAN makes fund transfers faster, simpler, and more efficient. Instant payments clearing infrastructure is fast becoming the base for a number of innovative-use cases across industries.

The use of cash deposit machine is expected to reduce the average cost of cash handing to the total cash being handled to 0.5 – 1%, against the 2 – 2.5% of the conventional way.

Prospects of noncash payment remain positive

Despite the domination of cash usage, the prospects of noncash payment in Vietnam and the region remain positive.

There are currently around 20 e-wallets apps in Vietnam, including Vi Viet, Zalo Pay, 123Pay, Baokim, Bankplus, MoMo, Payoo, and Wepay. According to the State Bank of Vietnam, the value of e-wallets transactions in 2017 exceeded VND53 trillion (US$2.2 billion), an increase of 64% from the previous year.

With the non-cash payments initiative aimed at reducing the cash transactions ratio to under 10% during the 2016–2020 period, e-wallets payments are expected to gain more traction. Many foreign operators, such as Samsung Pay, Alipay and Amazon, have also entered the local market to tap this growing potential.

According to Worldpay, the market share of e-wallets in Singapore is expected to increase from 13% (from 2017) to 21% (in 2021), meanwhile, e-wallets payments are expected to rise to 6% of total payments by 2022.

The report suggested different types of e-wallets have emerged in these markets, targeting different segments to serve different purposes. For example, customers of Thai state-owned enterprise PTT can use the company’s e-wallet to make digital payments at its gas stations and retail outlets, including PTT-run cafés and restaurants.

Additionally, new tech companies are creating e-wallets that first connect to their main business and subsequently expand to include other merchants. AirAsia’s Bigpay, Singapore-based Grabpay, Indonesia’s Gopay by Go-jek are some examples, while Alipay and WeChat Pay entered the market to accommodate their Chinese users travelling to ASEAN.

Standard Chartered pointed to four reasons of high cash usage despite the awareness of digital payments options, including lack of understanding of how digital payments methods work and how to start using them; privacy concerns regarding confidentiality of financial records; perception that cash is still the simplest and most straightforward payment method; merchants, especially SMEs, are still reluctant to absorb the costs of e-payments methods.

Thailand

Thailand