Cambodia’s international reserves broadly adequate

Cambodia’s international reserves are broadly adequate, the Executive Board of the International Monetary Fund (IMF), which concluded the Article IV consultation with Cambodia, said.

“The current account deficit in 2021 was mostly, but not fully, offset by similar magnitude of capital inflows along with valuation effects stemming from non-US$-denominated assets,” the directors said.

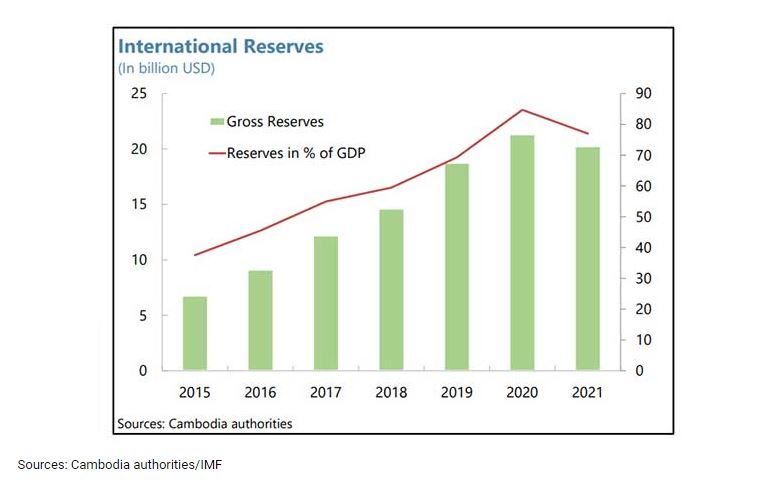

They said the gross reserves decreased slightly, by $0.4 billion. Reserves were 80 percent of the estimated 2021 GDP. This corresponds to close to eight months of prospective imports, which is higher than the optimal level of four months of imports as implied by the ARA tool for credit-constrained economies, they pointed out.

However, the directors cautioned that although the current level of reserves is adequate, a high level of international reserves remains advisable, as Cambodia is a highly export-dependent economy, operating in a fixed-exchange rate regime with a high degree of dollarisation.

Meanwhile, the directors noted that the most notable characteristic of Cambodian dollarization is that it had

continued across the three dimensions of “financial,” “payment,” and “real” dollarization in the process of rebuilding the financial system from scratch after its collapse by the Khmer Rouge.

“As there were essentially no financial assets after the Khmer Rouge regime, Cambodia had no options but to deploy the internationally accepted currency,” they said.

The US dollars played key roles in saving (as a store of value) and payment (as a measure of settlement). The widespread use of USD, including display of prices (as a unit of account), began during the United Nations Transitional Authority in Cambodia (UNTAC)’s period after the establishment of peace in 1991, with massive aid inflows of USD to revive its economy.

The dollarization process was also reinforced through credit creation with web of USD lending and deposit, the directors said, adding that from other countries’ experiences, dollarization tends to be reversed when the local currency is stabilized with moderate inflation rate under the process of “de-dollarization” efforts.

However, despite price stability both in inflation rate and nominal exchange rate, “financial dollarization” in Cambodia has continued to expand with growing foreign currency deposits (FCDs). The directors noted that this is an exceptional situation compared with neighbouring peers like Viet Nam and Laos.

IMF said dollarization in Cambodia remains persistent in part due to its external sector development with continued FX inflows, financial deepening with foreign currency credit creation, and the network externalities.

“The dollarization has been supported by its external sector development as well as the current pattern of financial sector development. At the same time, dollarization has been reinforced progressively over a long period as the various economic actors have reached a self-restraining Nash equilibrium that stabilizes the system,” the international agency pointed out.

Under Article IV of the IMF’s Articles of Agreement, the IMF holds bilateral discussions with members, usually every year. A staff team visits the country, collects economic and financial information, and discusses with officials the country’s economic developments and policies. On return to headquarters, the staff prepares a report, which forms the basis for discussion by the Executive Board.

At the conclusion of the discussion, the Managing Director, as Chairman of the Board, summarises the views of Executive Directors, and this summary is transmitted to the country’s authorities, an IMF release said.

Source: https://www.khmertimeskh.com/501206095/cambodias-international-reserves-broadly-adequate/

Thailand

Thailand