Cambodian banks need to safeguard against higher bad loans

Launching a loan restructuring program, or similar initiatives such as loan repayment assistance or a loan moratorium, is common practice among ASEAN+3 governments responding to the financial distress caused by the COVID-19 pandemic. From a financial stability perspective, however, the loan restructuring program runs the risk of masking the true quality of loans. Banks are not required to classify restructured loans as non-performing so they may not set aside enough provisions.

As the pandemic transitions into the endemic phase and economies start to recover, regulators are phasing out the COVID-19 related loan restructuring support, raising the question of whether banks are ready to embrace this challenge and go back to normal practice.

This is particularly pertinent in Cambodia. Cambodia’s central bank, the National Bank of Cambodia (NBC), introduced its loan restructuring program in March 2020 and phased it out in June 2022. Now is the perfect time to evaluate the implications on the banking sector, as analyzed in the recently published AMRO 2022 Annual Consultation Report on Cambodia.

Cambodia’s loan restructuring program

In March 2020, at the early stage of the pandemic when Cambodia’s key growth drivers were hit hard, the NBC swiftly introduced the loan restructuring program to ease the burden on borrowers who had lost their primary income sources and faced repayment difficulties. This program was initially planned to run until the end of 2020 and only loans in four priority sectors – garment, tourism, transportation, and construction – could be restructured without downgrading the classification or setting aside more provisions.

After the first announcement, the NBC extended the program and relaxed the requirement several times to adapt to the constantly changing COVID-19 pandemic and economic conditions. The first two policy amendments were made in November 2020 and May 2021 so that more borrowers could benefit from the program by extending the forbearance period and allowing loans to be restructured multiple times. The loan restructuring program was also expanded from the four priority sectors to all sectors in November 2020.

Since June 2021, when the economy started gaining momentum, more prudential arrangements have been made for an orderly exit from the restructuring program. These arrangements included requiring banks to make higher provisions, to prohibit restructuring loans multiple times, and to reclassify restructured loans. On reclassification, the NBC set the assessment period for each loan to six months, starting from the first repayment after restructuring. During the assessment period, no reclassification or additional provisions are needed. As of end-May 2022, 43 percent of restructured loans are in the assessment period.

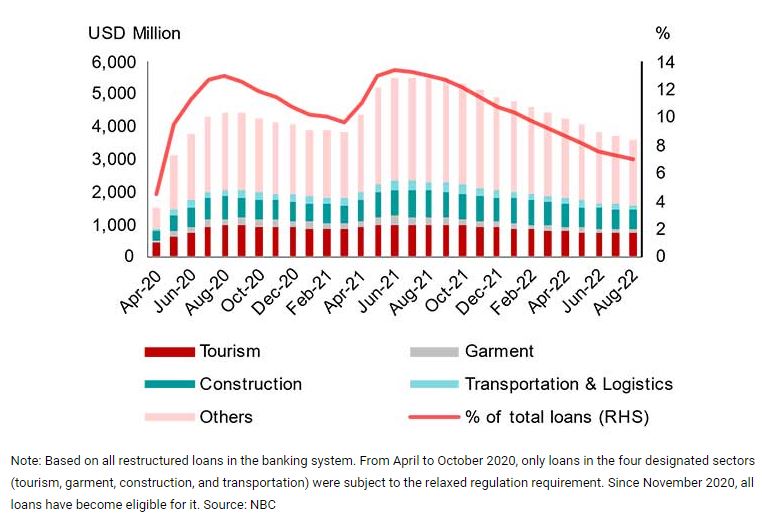

Throughout the implementation period, Cambodia’s loan restructuring program assisted borrowers in recovering from the pandemic (Figure 1). Restructured loans reached the first peak at 12.4 percent of total loans in August 2020 as the global economy was hit hard, and the second peak at 12.8 percent in June 2021 amid the surge of the Delta variant and tightening domestic mobility restrictions. The outstanding restructured loans have since steadily declined − on the back of the economic recovery and prudential requirements made by the NBC − to only 7 percent of total loans in August 2022.

How do Cambodian banks perform and cope with the potential risk of rising bad loans?

From the perspective of banks’ asset quality, the non-performing loan (NPL) ratio rose during 2022 as reclassification began, after staying relatively flat in 2021. Since January 2022, restructured loans that need more restructuring or are already non-viable are classified as NPLs, pushing up the NPL ratio to 3.2 percent of total loans in August 2022, the highest since mid-2018. 43 percent of restructured loans were still in the assessment period by the end of May 2022. This means they are not reclassified yet, and the loan quality is and probably will be unknown until end-2022. The NPL ratio may rise further when banks complete their assessment of all loans.

On the level of provisioning, Cambodian banks have some room for improvement. Under the loan restructuring program, looser requirements imply that provisioning may be inadequate during the forbearance period, albeit they have helped banks’ profitability and liquidity conditions in the short-term. Since no additional provisions were required for restructured loans, the provision-to-NPL ratio has declined to the 80-90 percent range from 113 percent in 2019. Therefore, the amount of provisions might not be sufficient to cover future losses, considering the masked NPL ratio. Although banks have restarted provisioning for restructured loans since December 2021, as required by the NBC, the progress remains slow during the ongoing assessment period.

Policy implications for post-pandemic period

For the NBC, it is crucial to check if banks’ capital adequacy level will be sufficient after all the assessments of restructured loans are finished. A simulation exercise conducted by AMRO concludes that the Common Equity Tier 1 (CET1) capital would be deducted to compensate for the shortfall of provisions. The good news is that even in the worst scenario, where all loans turn out to be “loss”, the CET1 ratio and capital adequacy ratio (CAR) will still be above 17 and 20 percent, respectively, which remain well above the regulatory requirement. This positive result is supported by improved profitability since Q3 2021 as well as a solid CAR over time.

It must be noted that our simulation exercise only considers the legacy issue of restructured loans instead of any potential risks, and the computed results of provisions are dependent on the authorities’ guidance instead of the expected credit loss. Therefore, the NBC should continue to closely monitor and evaluate the loan quality in a timely manner to maintain the resilience of its banking sector.

Source: https://www.khmertimeskh.com/501206709/cambodian-banks-need-to-safeguard-against-higher-bad-loans/

Thailand

Thailand