Cambodia to ink cross-border payment deals with Laos, Vietnam soon

National Bank of Cambodia (NBC) will soon sign agreements with the Bank of the Lao P.D.R (BOL), the State Bank of Vietnam (SBV) and other countries in the region to boost the usage of the local currency in the economy through technological advancement that makes it easier for the people, said a senior official.

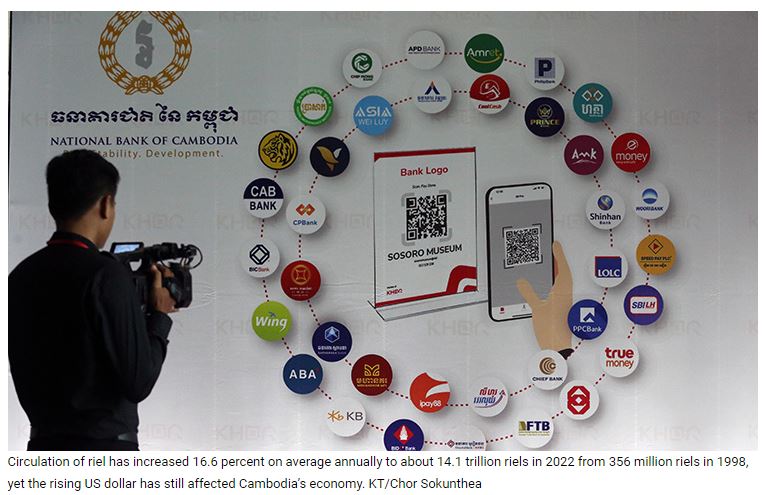

The official pointed out that the new cross-border payment coverage would expand the riel circulation as users are required to scan QRs in those countries to pay in riel for products or services they purchase overseas from the accounts they created with banks or microfinance institutions (MFIs) with riel in Cambodia because QRs cannot be scanned with US-dollar.

Addressing an event to promote usage of riel attended by approximately 300 people who are local authorities, provincial banking officials and students in Stoung district of Kampong Thom province, NBC’s Deputy Governor Chea Serey said that riel usage would also be promoted when tourists come and make payments in riel with Cambodia’s merchants.

“When tourists visit our country, merchants need to have QR codes that enable them to scan in riel to make payments. So, if they place QR codes in US dollars at their counters, tourists would be unable to scan to make payments to them. All these things would further boost usage of riel,” Serey said without mentioning when exactly the deals will be reached.

Serey further pointed out that the demand for riel usage has been increasing gradually as the circulation of riel in Cambodia has increased 16.6 percent on average annually to about 14.1 trillion riels in 2022 from approximately 356 million riels in 1998, but the rising US dollar has still affected Cambodia’s economy, especially the inflation in terms of the foreign exchange.

Cambodia’s central bank leading economist explained that the rising value of US dollars against other foreign currencies with falling value may also affect the country’s tourism as foreign tourists need to convert their respective local currencies to US dollars to pay for products or services in US dollar in Cambodia even though their prices do not increase.

“For example, our sellers do not increase the price of their coffee, but tourists who used to visit our country with dollars exchange for their local currencies at an exchange to pay the coffee at a price, but later when the dollar appreciates, their local currencies would lose value. So, they have to pay more for the coffee that we here sell at the same price,” she said.

Speaking on Wednesday at an interaction with nearly 20,000 factory workers in Por Senchey district of Phnom Penh, Prime Minister Hun Sen said the circulation of riel has been sufficient in Cambodia’s economy, adding the government has allowed foreign businesspeople and investors not to convert US dollar to riel to pay wages to their employees at their factories.

The Premier further said that Cambodia’s stable exchange rate between local and foreign currencies has kept the purchasing power of the cash earned by the people including factory workers in the country in a strong position as business owners are not required to convert US dollar to riel to pay wages to their employees or workers.

“Among workers, there is no loss of wage due to the exchange rate as the government has provided owners of factories or companies with room to pay wages to their workers with foreign currency, which is not applied in other countries that require them to deposit money in banks and pay wages in their respective local currencies,” he said.

He said that the government has put its efforts into maintaining Cambodia’s macroeconomic stability such as curbing inflation and keeping purchasing power of the people as well as workers’ cash strong by preventing partial loss of income or wages of workers due to the falling value to the riel—Cambodia’s official currency—versus US dollar.

Source: https://www.khmertimeskh.com/501308897/cambodia-to-ink-cross-border-payment-deals-with-laos-vietnam-soon/

English

English