Cambodia: Tax system to be updated to make payment easy, evasion tough

The General Department of Taxation (GDT) during a meeting on Tuesday announced a work plan for this year with an emphasis on developing a system that will make paying taxes easy and evasion difficult.

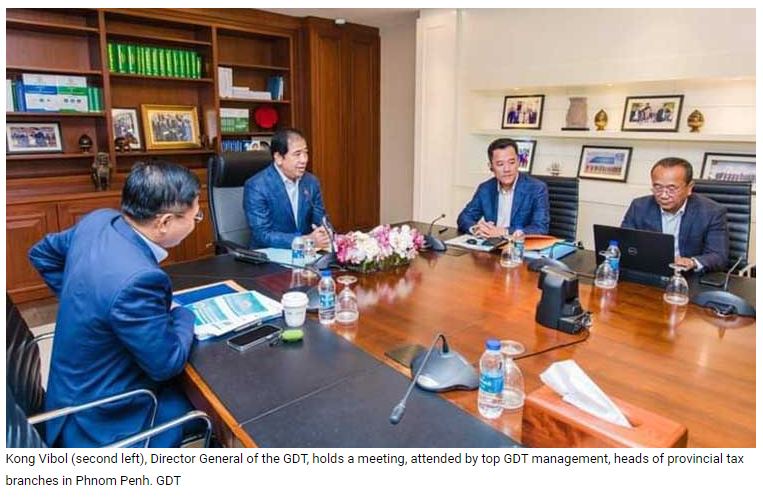

Kong Vibol, Minister Delegate to the Prime Minister and Royal Government in charge as the Director General of the GDT, chaired the meeting, attended by the top GDT management, heads and deputy heads of provincial tax branches and officials under the GDT.

According to the GDT release, the actual tax collection via the online income management system in February this year was about $238.60 million, 6.68 percent of the Financial Law Plan for Management 2023. It’s an increase of $14.64 million, 6.54 percent, compared to February 2022.

In the first two months of 2023, e-commerce tax revenue was $14.87 million.

The total tax revenue for January and February was about $539.23 million, 15.10 percent of the Financial Law Plan for Management 2023, and $27 million, 5.27 percent, more than tax collection in the same period of 2022.

GDT’s taxpayer consultation service grew 18,766 times during the first two months of 2023 by making 11,098 phone calls, 5,880 GDT Live Chats and 1,183 Facebook messages, among others.

To ensure the success and effectiveness of the tax system, the GDT will continue to collaborate in anti-money laundering, terrorism funding, and financing the weapons of mass destruction frameworks.

It plans to conduct study visits to developed countries to understand their tax administration processes and organise and update the GDT tax revenue collection system, mainly e-commerce, tax collection management mechanism and use of blockchain technology for tax mop-up.

The GDT will prepare the e-administration operation system and supporting infrastructure to perform hierarchy tasks using the digital format that will ensure speed and efficiency.

The GDT has initiated e-administration to enhance the quality of public service. It will be implemented by the second half of 2023.

To modernise the information technology applications, the GDT will invest in developing technology, especially the analytical function, by gathering inputs from all users.

“The noticeable positive result in tax revenue is the result of active participation from all GDT officials in tax collection,” Vibol said.

Source: https://www.khmertimeskh.com/501255720/tax-system-to-be-updated-to-make-payment-easy-evasion-tough/

Thailand

Thailand