Cambodia: Sovereign bond plans may be caught in regional economic headwinds

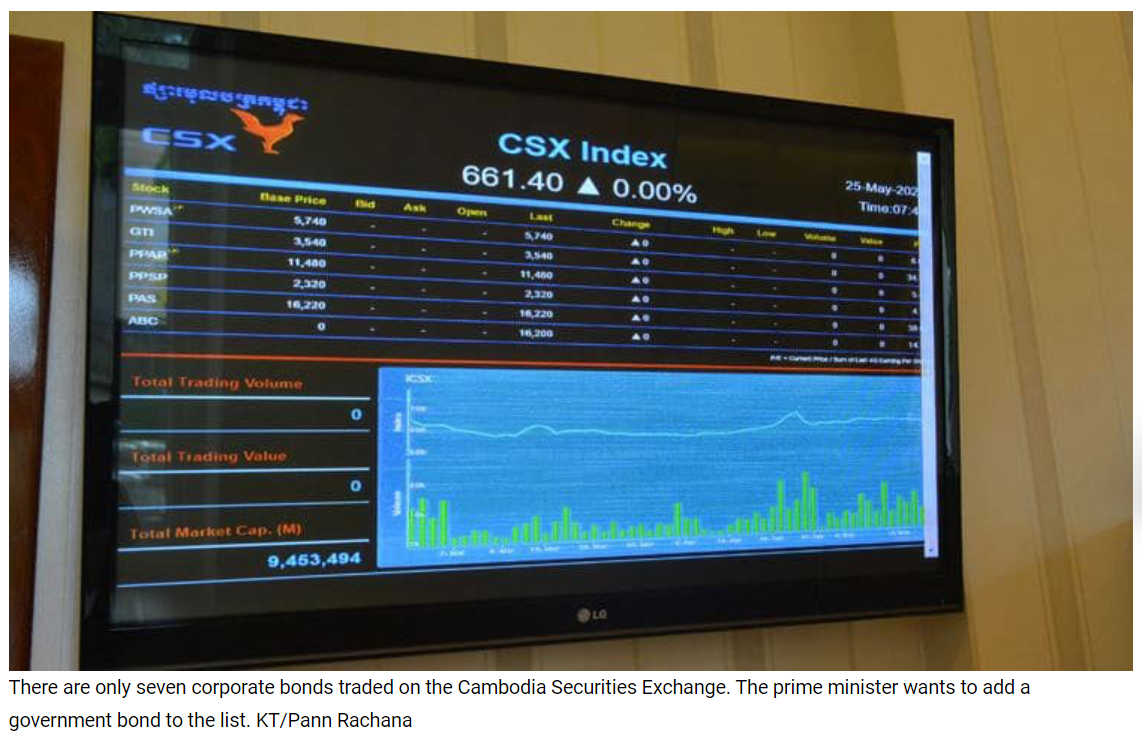

Cambodia only has seven corporate bonds listed on the Cambodia Securities Exchange, with another awaiting regulatory approval, but it has long had its eyes on issuing sovereign debt.

The Ministry of Economy and Finance said last month that legal preparations for a state bond will be complete by early 2022.

The plan is to list the state bond on the capital market to collect funds for the country’s development, easing its reliance on taxes and loans from other countries and development partners.

Even if the paperwork is in place by next year the timing may not be good for a Cambodian sovereign bond.

The world’s third-biggest credit ratings company, Fitch, currently has 31 negative outlooks on the sovereign debt of countries it covers and only five positive outlooks. It says it doesn’t think the negatives and positives will equal out until the start of 2023. It forecasts slowing economic growth around the world in the fourth quarter, continuing through 2022.

The Asia-Pacific region may end up missing out on upgrades.

“Things look pretty good as far as the major economies are concerned… in many emerging markets, especially in the Asia-Pacific region, we saw a lot of pandemic -related setbacks,” said Fitch economist Maxime Darmet.

His colleague, Stephen Schwartz had a warning for countries, such as Cambodia, that depend on visitors from abroad for a large chunk of their economic growth.

“Economic performance in the Asia-Pacific region varies widely. The recovery leaders are China, Vietnam and Taiwan. The laggards are Japan, the Philippines and Thailand. Tourism-reliant economies are the hardest hit,” said the head of Asia-Pacific sovereign ratings.

The Coronavirus pandemic is not the only threat to economic growth in the region. The US central bank is widely expected to start cutting the huge amount of bonds it buys every month. In 2013 the Federal Reserve’s announcement that it would roll back its policy of quantitative easing led to a so-called “taper tantrum” that sent US Treasury yields soaring.

“When the tapering starts, as we think in November, there could be pressures on capital flows out of emerging markets and it will certainly narrow the window for further easing across the region so we could be in for a bumpy ride,” said Schwartz. “The markets that we tend to look out for are the frontier markets with those extreme liquidity pressures… and also a handful of emerging markets… like Indonesia, the Philippines, even Malaysia. We need to watch out for the ripple through effects on those markets,” he said.

Possibly with an eye on issuing a sovereign bond next year, Prime Minister Hun Sen reassured investors in July that Cambodia was not going bankrupt from the Coronavirus pandemic. For the first seven months of this year, he said, Cambodia generated more than $3 billion of income, $1.7 billion from taxes and $1.4 billion million as customs income.

“For the remaining five months, we will generate up to about $2 billion,” he said.

Source: https://www.khmertimeskh.com/50931074/sovereign-bond-plans-may-be-caught-in-regional-economic-headwinds/

English

English