Cambodia: Return of FDI to pre-pandemic levels seen as key to economic growth

While Covid-19 has had an overall negative effect on global foreign direct investment (FDI), Cambodia appears to be prepared to withstand this deficit as international companies look to diversify their investments in the Kingdom.

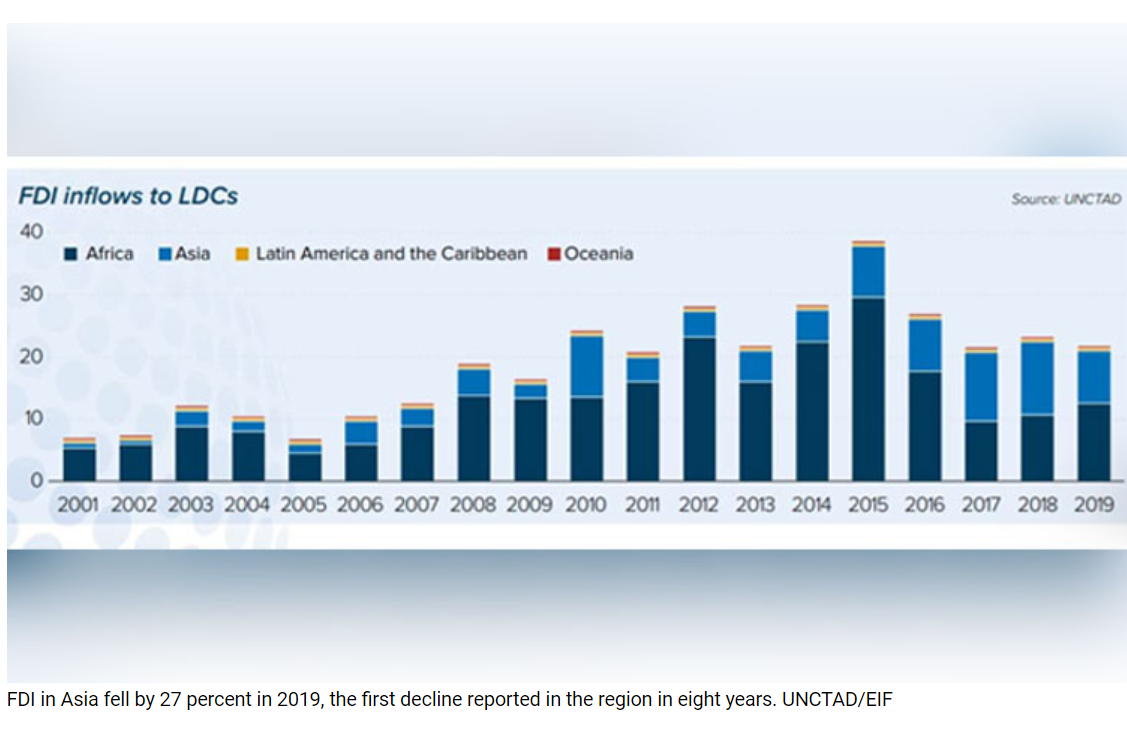

According to Enhanced Integrated Framework (EIF), a multilateral partnership dedicated to assisting least developed countries (LDCs), FDI fell in Asia by 27 percent to $9 billion in 2019. This was the first time Asia saw an aggregate decline in FDI in eight years.

Despite this, Cambodia reported its highest ever FDI in 2019, valued at $3.7 billion, according to the 2020 World Investment Report by UNCTAD.

Its main investors were China, which accounted for 43 percent of FDI in the Kingdom, South Korea which contributed 11 percent, Vietnam at seven percent and Japan and Singapore, tied at six percent each.

According to global credit insurer Coface, FDI decreased worldwide by 49 percent during the first semester of 2020 compared to the same period in 2019.

Sven Callebaut, an EIF international trade advisor to the Ministry of Commerce, said Cambodia should benefit from a diversification of investments from countries which have historically invested infrastructure in the Kingdom.

Callebaut said free trade agreements (FTAs) have helped drive this diversification. While FDI in LDCs typically involve extracting resources, these FTAS have helped spur investment into other sectors such as agribusiness.

One example is China, Cambodia’s largest investor, investing in mango production facilities.

Callebaut says these types of investments are more valuable because they can support the local population as well as small and medium-sized enterprises. He said Cambodia has been experiencing lower rates of Official Development Assistance (ODA) while realising increased FDI, which represents a positive trend.

Whereas countries like Japan and South Korea have invested in hard infrastructure in the past, such as roads and airports, they are now focusing on soft infrastructure like logistics and education.

While SMEs have been hit hard by the pandemic, Callebaut said they can still benefit from FDI by becoming suppliers for larger multinational companies.

“We want to see the standard of SMEs raise to the point where they can be suppliers of big multinationals that are investing in Cambodia,” he said.

He said the current challenge is attracting the right investors to the right priority sectors and he expects that a forthcoming investment law from the Council for the Development of Cambodia will provide these parameters to attract more investments.

Laws like these, he said, are essential to attracting international investors.

According to EIF, Cambodia was among the top LDC recipients of FDI in 2019, along with Bangladesh, Myanmar, Ethiopia and Mozambique.

“Most FDI in LDCs goes towards resource extraction, which brings limited employment or value-added benefits to LDC economies, leaving them among the least integrated into global value chains,” EIF said in a brief.

Overall, LDCs only accounted for 1.4 percent of global FDI from 2017-2019, according to the UN Conference on Trade and Development (UNCTAD), and was valued at $21-22 billion.

According to EIF, the reasons for such low FDI in LDCs included those nations not marketing themselves properly with accurate and relevant information for potential investors, “poorly designed investment policy frameworks that result in lower investment competitiveness” and “higher perceptions of political risk”.

Source: https://www.khmertimeskh.com/50874299/return-of-fdi-to-pre-pandemic-levels-seen-as-key-to-economic-growth/

Thailand

Thailand