Cambodia records region’s steepest tax-to-GDP ratio rise

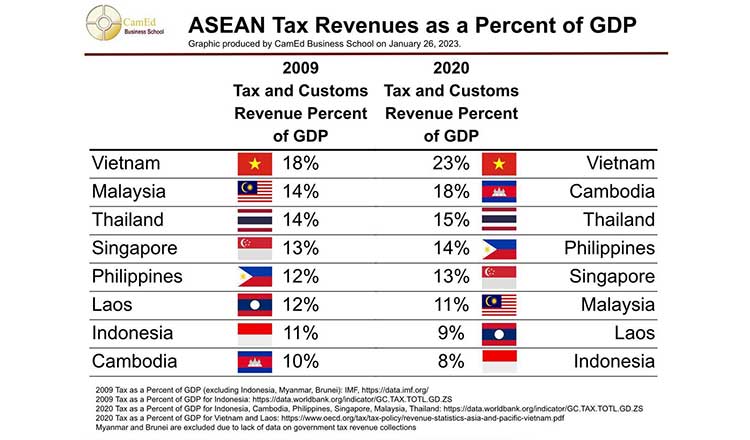

The tax-to-GDP ratio in Cambodia registered an 80 percent growth, from 10 percent of the GDP in 2009 to 18 percent in 2020, the highest rise among the eight countries of the Southeast Asia region featured in a study by the CamEd Business School, recently, reigniting debates about whether the rising level of taxation is good for attracting investors and suited for the continued development of the country.

According to the study, in 2020, Cambodia stood in the top layer, next to Vietnam which has a tax-to-GDP ratio of 23 percent, whereas the Kingdom had the lowest ratio in 2009 among the countries. Vietnam’s tax-to-GDP ratio was 18 percent in 2009.

The tax-to-GDP ratio for the study took into account revenue collection from both tax and customs.

The study, meanwhile, revealed that Singapore, considered a developed country of the region, has maintained an unchanged 13 percent tax-to-GDP level during the period, while in the case of Indonesia, the leading economy of the region, the ratio, in fact, went down from 11 percent in 2009 to eight percent in 2020, the lowest in the year among the eight countries.

Many from the business sector believe that the Cambodian government needs to balance taxation levels by taking into account the investment requirements of the country. In theory, lower tax rates can attract more business investments, domestically as well as from abroad, and can create more jobs and income and work as a general booster for the economy.

According to Anthony Galliano, President of the American Chamber of Commerce in Cambodia (AmCham), the cost of doing business in the Kingdom is increasing at the same time global inflationary pressures are presenting challenges to business margins.

Anthony told Khmer Times that investors generally take into account key criteria when deciding whether to invest in a county and these include its economic and financial fundamentals. “Aggregating government costs – taxes, national social security healthcare and pension contributions, seniority payments, licences, fees such as the Annual Declaration of Commercial Enterprises and ACAR – the total costs in some industries now approach 50 percent of revenues, and this is prior to operating costs such as rent and salaries. This could discourage future investment and has to be addressed with further investment incentives,” he said.

According to Anthony, the key metrics are the government’s investment policy, trade policy, investment promotion incentives and facilitation, infrastructure and public governance, besides the tax policy. “The execution of tax policy is inclusive of collection of tax revenue so governments can fulfill their functions, but the design of policy greatly influences the tax burden and how taxation is administered, which will be a consequence of business cost and returns on investment. The ideal tax policy enables the government to achieve public policy objectives while balancing a favourable investment climate,” he pointed out.

Babulal Parihar, Vice President of the Indian Chamber of Commerce (InCham), said it is time the Cambodian government reviewed some of the taxes that are high compared to other developed economies in the Asean region. The General Department of Taxation (GDT) may consider the proposal to reduce the Profit Tax Rate as well as Withholding Tax Rate, he suggested.

“GDT can also consider adopting different profit tax rates for different industries to promote those industries. The annual profit tax can also

have slabs wherein small companies are exempted or required to pay lower taxes,” Babulal said.

“The government can also consider lowering the Withholding Tax from 15 percent to 10 percent as practically this tax also becomes an extra burden on companies,” he added.

Casey Barnett, President and Founder of CamEd Business School, however, said the increase in tax collection from 2009 and 2020 is the result of improved tax administration and reforms carried out by GDT, especially reforms to improve the skills of tax officials, meritocracy, and digitalization of tax services.

“A well-functioning tax administration supports the sustainability of government services and the establishment of a fair playing field for private enterprises. I have confidence that the GDT can achieve targets set by policymakers,” Barnett said.

Tom Hesketh, Executive Director of the European Chamber of Commerce (EuroCham), said the rising tax-to-GDP ratio can be a sign that the grey economy, year by year, is reducing. “If tax and customs officials are able to generate a higher portion of revenue from formally registered sources, it provides funds that the government can use to improve public services,” he said, adding that this in turn can provide a great boost in confidence for foreign investors considering Cambodia as a business destination.

In 2023, the government targets KHR 23 trillion (approximately $5.5 billion) as revenue from tax and customs duty, an increase of nearly 16 percent compared to 2022.

Cambodia has two institutions for collecting taxes. One is the GDT, which focusses on internal taxes such as income tax, salary tax, value-added tax, and property tax, and the other is the General Department of Customs and Excise (GDCE), which collects taxes on goods entering and leaving the country.

The GDT alone has been given a target of $3.5 billion for the year, $750 million more than 2022 target. Last year, GDT collected $3.45 billion as taxes, 22 percent more than the target for the year.

Source: https://www.khmertimeskh.com/501229682/cambodia-records-regions-steepest-tax-to-gdp-ratio-rise/

Thailand

Thailand