Cambodia: MFIs increasing fees after 2017 rate cap: IMF

A 2017 decision to limit interest rates to protect borrowers from high interest rates has resulted in microfinance institutions (MFIs) increasing their fees and turning away from smaller clients, according to an International Monetary Fund working paper.

In March 2017, the National Bank of Cambodia (NBC) imposed an 18 percent limit on annual interest rates to alleviate repayment burden on borrowers and strengthen the microfinance sector.

The measure “is aimed at protecting the interest of people, especially poor ones, and preventing them from falling into deep debts, as well as curbing microfinance institutions and credit operators from charging a very high interest rate [to] their customers,” the NBC said in a 2017 statement.

Previously, MFIs offered loans to customers with an interest rate of between 20 percent and 30 percent per annum. However, the IMF found that microfinance institutions have turned to charging higher fees to offset the loss in interest income.

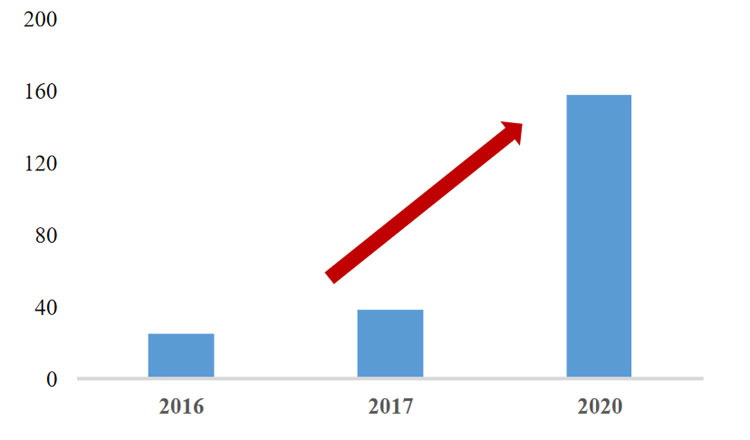

“Loan-related commission fees have tripled on average across all [MFIs],” said Dyna Heng, Joshua Bosshart and Bomakra Heng, authors of the working paper titled “Impacts of Interest Rate Cap on Financial Inclusion in Cambodia.”

Fees as a percentage of loans increased from 0.5 percent in 2016 to 1.7 percent in 2019. Average interest income fell from 20.8 percent to 14.2 percent annually during the same period, according to their analysis.

Small loans (below $500) decreased by almost 50 percent while larger loans (between $500 and $1,000) doubled, the authors also found.

They said MFIs generally have higher administrative costs – far exceeding the 18 percent cap – largely because of the higher risk loan categories they are servicing. The authors said that operation costs account for approximately 43 percent of total expenses and smaller MFIs having the burden of even higher costs.

“Compared to commercial banks, the operation cost is about three times higher for [microdeposit institutions] and 6.5 times [larger] for MFIs. For instance, disbursing a $500 loan in rural areas costs about 15 percent of total loans including staff time, transportation and communication. For such microfinance loans, although technology has helped keep costs as low as possible, it cannot yet replace the last-mile human contact,” the paper said.

As a result, the authors warned that that enforcement of the cap risks reversing financial inclusion efforts to date and creates incentives for unregulated entities to emerge and grow.

“Some [MFIs] have turned away from small borrowers and shifted toward larger ones. The impact of the cap on the number of borrowers has varied across financial institutions, depending on operation cost, funding costs and the segment of clients learned,” they said.

Source: https://www.khmertimeskh.com/50859581/mfis-increasing-fees-after-2017-rate-cap-imf/

Thailand

Thailand