Cambodia may dodge threat from record global debt levels

Global debt levels grew by a record $24 trillion last year with pressure to rein in debt in the face of inflation possibly affecting growth in many countries. However, Cambodia may be in a better position than most, according to a recently published Moody’s Analytics report.

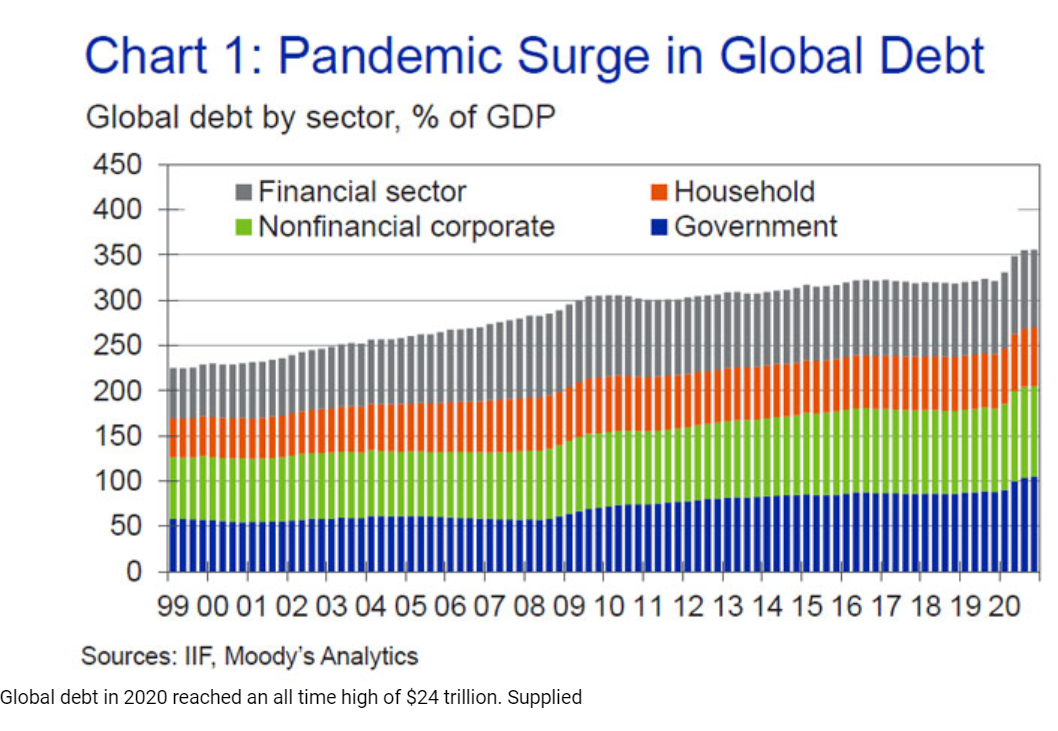

Global leverage – the percentage of global outstanding debt versus global gross domestic product (GDP) – increased 34 percent to reach 366 percent in 2020.

As governments spent big to mitigate the economic ramifications of the pandemic, household and corporate debt also rose in varying degrees across the globe.

“Despite improved growth prospects in the US and China, elevated debt burdens across the globe heighten risks to growth and financial stability,” the report said.

“This is especially so in emerging markets and in Southern Europe, where third and fourth waves of the COVID-19 pandemic are swelling, domestic demand is anaemic and jobs and incomes have suffered sustained blows.”

While Cambodia suffers through its second wave of the pandemic, the medium- to long-term impacts of prevention measures – which have eliminated jobs, slashed incomes and pushed people into poverty in some cases – remain unclear.

The latest indicators show that Cambodia’s economy may be resilient, but question marks surround the rising level of consumer debt.

Credit Bureau Cambodia (CBC) reported that in the first quarter of 2021 the consumer loan balance totalled $10.39 billion, an increase of 6.44 percent from Q42020.

The balance is split almost evenly between personal finance loans and mortgages, with credit cards only accounting for 0.6 percent of the outstanding debt.

Households have increasingly turned to microfinance institutions (MFIs) and banks for short term-relief to salary cuts and unemployment.

Last year, the National Bank of Cambodia published a directive to all financial institutions and banks to restructure their loans in an effort to ease the financial burden on the struggling population.

Local media have reported that $4.2 billion of loans were restructured last year. The CBC also reported a 25 percent overall increase in Q12021 in loans delinquent for at least 30 days from Q42020.

Cambodia’s debt-to-national GDP ratio was about 28 percent in 2020 and totalled $8.8 billion, according to the General Department of International Cooperation and Debt Management.

By this indicator, the economy appears to be well suited to be insulated from the economic shocks and debt risks that may result from a massive overall increase in global debt.

The Moody’s report indicated that in neighbouring Vietnam, the liberalisation of its real estate market in 2015 led to an increase in household and corporate debt that could pose problems for its economy down the line. “Given Vietnam’s rapid economic growth over the past decade, it should be no surprise that the real estate market has similarly expanded. But the increasing amount of leverage in property development generates considerable risk that could multiply any unforeseen slowdown or shock to the economy in Vietnam,” the report said.

Cambodia is experiencing a massively growing real estate market as well and, as the pandemic lingers, increased debt in the sector combined with low demand may point to a similar increased risk.

While national debt levels indicate low credit risks, household and corporate debt in the property sector will bear watching and may need to be addressed sooner rather than later to keep Cambodia growing at the rate it was accustomed to before the pandemic.

Prior to COVID-19, Cambodia was growing at an average rate of about 7 percent before the GDP decreased 3.1 percent in 2020. The Asian Development Bank predicts the Kingdom’s GDP to bounce back to 4 percent growth this year and 5.5 percent in 2022.

Source: https://www.khmertimeskh.com/50858188/cambodia-may-dodge-threat-from-record-global-debt-levels/

Thailand

Thailand