Cambodia: Kingdom’s public debt-to-GDP ratio remains low risk, says IMF

Cambodia’s public debt-to-GDP ratio remains low risk this year. This means the Kingdom is able to afford more debt to maintain economic growth while assuring good returns on its investments, says Jarkko Turunen, a senior economist at the International Monetary Fund (IMF).

Turunen, who leads the IMF team conducting the 2018 Article IV consultation with Cambodia, said the Kingdom’s debt-to-GDP ratio remains at 30 per cent this year.

He said this allows it to borrow more for economic growth and that the ceiling of public debt-to-GDP ratio could be as large as 40 per cent in the medium term.

There is a need for infrastructure development in Cambodia, he said, and that some public funding will come from borrowings.

“Borrowing for infrastructure development in Cambodia at this moment is [generally] at favourable terms. As long as that is the case and the investment is efficient, I think there is room to borrow more for infrastructure.”

“We have done an analysis that suggests that as a medium-term target, some years out, a reasonable level or a ceiling for debt could be around 40 per cent [of GDP],” Turunen said.

However, he said that financing additional infrastructure spending would also require addressing gaps through direct taxes, such as higher real estate taxes, as this would help boost growth while reducing income inequality.

He did not disclose the present amount of the total national debt.

A draft of the 2018 national budget released late last year said the Cambodian government plans to borrow an additional one billion in Special Drawing Rights (SDR), equal to $1.4 billion, to meet its planned budget for this year. This will bring the total national debt to $7.6 billion by the end of the year, compared to $6.2 billion in June last year.

By June this year, the national debt had been driven largely through bilateral and multilateral concessional loans, principally from China. The Kingdom owes China roughly $2.9 billion – nearly half its total debt.

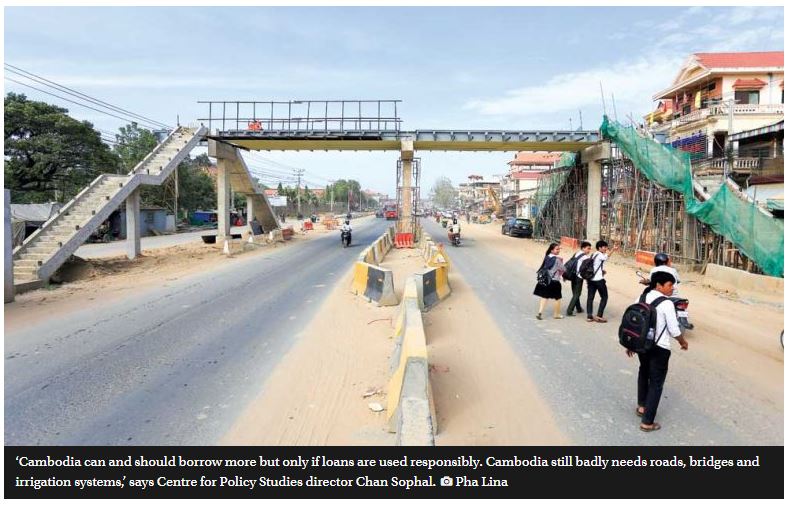

Centre for Policy Studies director Chan Sophal agreed on Wednesday that Cambodia’s current level of outstanding debt is manageable, given the Kingdom’s country status.

“Cambodia can and should borrow more but only if loans are used responsibly. Cambodia still badly needs roads, bridges and irrigation systems, but these have to be constructed with [acceptable] quality,” he said.

Supreme National Economic Council senior advisor Mey Kalyan said the government has been very cautious about controlling public debt. While the debt level is not an issue, he said relying so much on foreign borrowing could pose a challenge.

“If we rely so much on foreign currency borrowing, when an unpredictable event occurs externally, [it will be] difficult to curtail the issue.”

“We should find a way to [stimulate] local borrowing, and I think issuing government bonds in Khmer riel [is] a good option,” he said.

Source: https://www.phnompenhpost.com/business/kingdoms-public-debt-gdp-ratio-remains-low-risk-says-imf

Thailand

Thailand