Cambodia: Interest increases in Kingdom’s liquefied natural gas sector

Cambodia’s energy sector may soon swing towards liquefied natural gas (LNG) as the country attempts to increase its domestic energy capacity amid rising demand and to shift away from coal-powered electricity, but energy experts have doubts about the product’s sustainability.

In a research paper, global law firm White and Case said international investors are watching Cambodia’s energy sector closely for opportunities to get in on the ground floor of Cambodia’s nascent LNG sector.

The firm said the “cautious optimism” surrounding the sector is buoyed by Cambodia’s growth goals, the Electricite du Cambodge’s (EdC) strong credit, a sizeable reserve of US dollars and growing concerns about hydro and coal power.

The downsides listed in the paper include the lack of LNG infrastructure, the scarcity of legislation governing the sector, a power grid in need of critical upgrades and competition from solar power.

Despite often being viewed as more environmentally friendly than coal-fired power, natural gas is just as destructive to the environment, according to the Institute or Energy Economics and Financial Analysis (IEEFA).

A 2020 IEEFA report said methane emissions from natural gas have been vastly underestimated by 25 to 60 percent in studies.

“Methane poses the greatest threat to the warming climate. If you leak more than 2 percent or 3 percent of methane, it is worse for the climate than coal. Methane survives in the atmosphere for a shorter period than coal’s carbon dioxide, but over 20 years has 86 times the planet-warming potential,” the IEEFA said.

Country director of EnergyLab Cambodia Bridget McIntosh said using gas to offset solar when clouds appear or the sun goes down is advisable, but it shouldn’t be relied on as a main contributor to the grid.

She noted that besides being just as much a threat to the environment as coal, because of methane leakage, the costs associated with burning gas for electricity are far higher than solar, McIntosh said.

McIntosh said Cambodia produced Southeast Asia’s cheapest solar energy in 2019, at a cost of 3.877 cents per kilowatt per hour (c/kWh). Three years prior, solar energy cost 9.2 c/kWh. She added that storage costs for solar energy have been decreasing as well, with the cost halving over the past two years.

“Gas rather than coal has a part to play in Cambodia’s electricity system, but as a balancing fuel and not a baseload power. We don’t need baseload power anymore: We need dispatchable power sources to fill in when cheap renewable power is not available,” she said.

However, it appears LNG could be too valuable an investment for international investors to pass up.

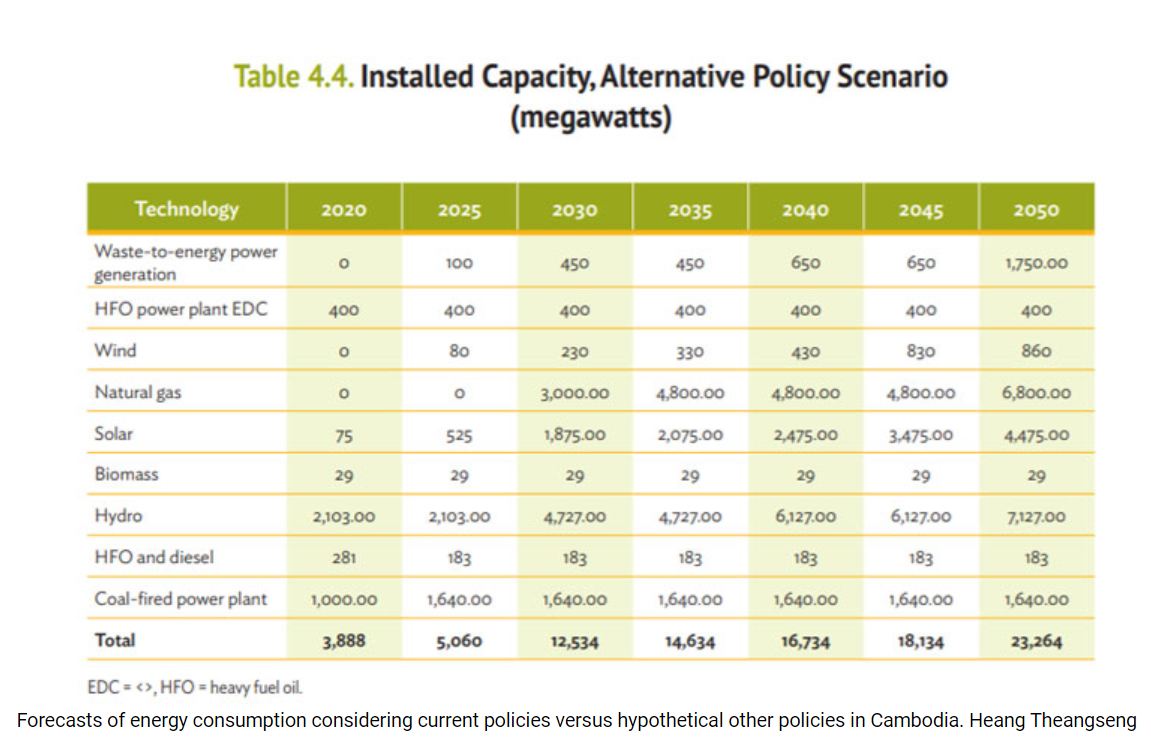

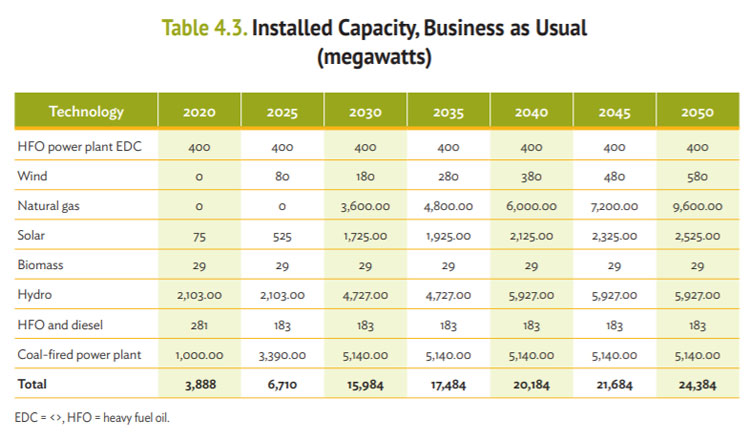

The White and Case research paper noted: “At a recent intergovernmental energy forum, the Ministry of Mines and Energy outlined its vision that LNG and natural gas will comprise important components of Cambodia’s power mixture in the near future and its plan for up to 3,600 mW [megawatt] gas-fired power plants by 2030.”

It continued: “In a meeting with the Ministry of Mines and Energy in November 2020, the ambassador of Japan to Cambodia noted that Japanese firms are considering investing in a waste-to-energy plant and LNG storage stations in Cambodia.”

Source: https://www.khmertimeskh.com/50861140/interest-increases-in-kingdoms-liquefied-natural-gas-sector/

Thailand

Thailand