Cambodia: Central bank rolls out Retail Pay system

The National Bank of Cambodia (NBC) on January 26 officially launched the Retail Pay system, a government effort to reduce cash consumption and boost the use of electronic payments in the economy.

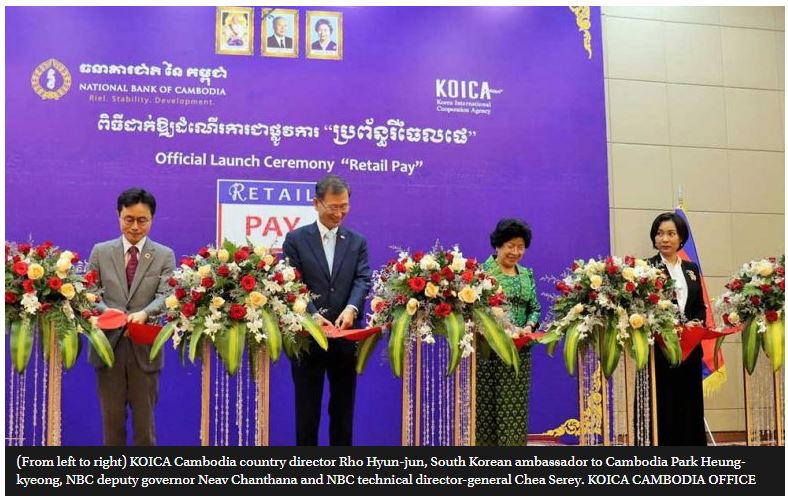

Presiding over the launch, NBC deputy governor Neav Chanthana said Retail Pay is a crucial component of Cambodian financial infrastructure, noting that the system was developed with the support of the Korea International Cooperation Agency (KOICA).

Backed by an $8 million grant from South Korea through KOICA, she said the two countries had agreed to unite forces on enhancing the Kingdom’s national retail payment system.

Hailing Retail Pay as “a new milestone for Cambodia”, Chanthana said the system “will play an important role in contributing to the economic development by providing safe, efficient and fast payments that facilitate timely trade settlement.”

KOICA Cambodia country director Rho Hyun-jun said his agency is working on planning, designing, implementing, testing and deploying the three mechanisms integrated into Retail Pay, as well as the Electronic Clearing System (ECS), which is an electronic method to transfer funds.

The three components are Real-Time Fund Transfer (RFT), Mobile Payment System (MPS) and QR-Code Payment System (QPS).

Rho said: “The goal of this project is establish a safe, reliable and efficient system of payment and modernise information and communications technology infrastructure.”

NBC technical director-general Chea Serey said the system will streamline transfers between participating financial institutions.

She said: “We’ve set up the Retail Pay system with certain people in mind, such as those in rural areas who may not have a smartphone, so that even phones with just the basic features can access it.

“This is distinct from the [NBC-backed] Bakong service where users must have a smartphone to install the app and use it.”

She said Retail Pay also allows cross-currency transfers in riel and dollars, while Bakong only permits cash transfers between e-wallets. “Merchants can easily make payments through the Retail Pay system, which will help reduce the use of cash.”

Association of Banks in Cambodia president In Channy said the reduction in cash payments fostered by the system would greatly benefit operators and consumers.

He said its RFT, MPS and QPS mechanisms will be a godsend for Retail Pay’s 22 member financial institutions to provide their customers with flexible payment options.

“The system will enable member banks and customers to more quickly transfer funds from one bank account to another at lower costs, and be an engine of national economic growth,” Channy said.

Cambodia Microfinance Association (CMA) chairman Kea Borann pointed out that the pace of digital information growth in the Kingdom’s financial industry continues to climb, shaping the way it operates and adopts transformational technology in pursuit of efficiency and fulfilling customers’ digital needs.

He said the RFT, MPS and QPS components of Retail Pay will expand the banking market. “It will provide customers with convenience while ensuring transparency and safety.”

Source: https://www.phnompenhpost.com/business/central-bank-rolls-out-retail-pay-system

Thailand

Thailand