Cambodia: Boosting financial inclusion through technology

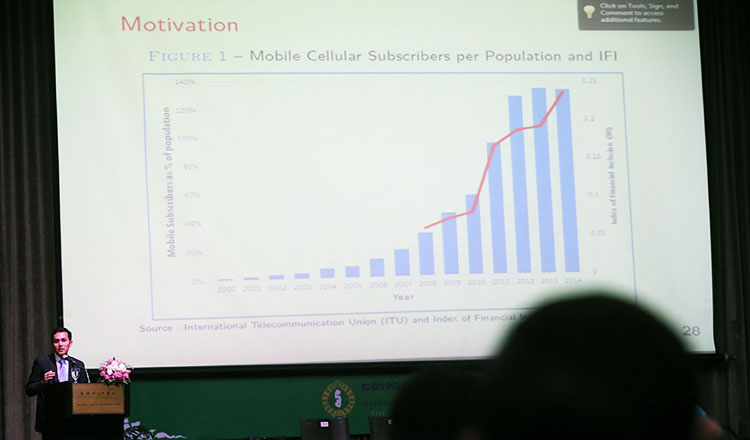

Information and communication technologies, particularly smart phones, can play a key role in boosting financial inclusion in Cambodia, according to researchers at the Fourth Annual NBC Macroeconomic Conference held yesterday in Phnom Penh.

Financial inclusion means individuals and businesses enjoy access to useful and affordable financial products and services, such as credit, savings, insurance and payments.

During his presentation, Lay Sok Heng, a researcher at the National Bank of Cambodia, explained that mobile phones, particularly smart phones, are very useful in expanding access to financial services, and suggested companies spread awareness of financial tools by creating informative mobile apps.

“As the trend of using smart phone is increasing, we should encourage developers to develop apps that provide information of financial knowledge and the financial sector, particularly information relating to financial products and services,” he said.

Seng Kimty, a lecturer at Pannasastra University, said mobile phones reduce the cost of financial transactions and can play a critical role in strengthening financial inclusion.

“Beyond reducing such costs, mobile phones also permit customers to interact more directly with their banks, check their account balance as well as initiate transactions from wherever they are.”

He explained that households using mobile phones are more likely to be interested in borrowing money than those that do not use the devices. Households where mobile phones are a staple of daily life are more likely to take up credit offered by microfinance institutions and invest it in productive ways.

“Our results reveal that the use of mobile phones is likely to promote financial inclusion in terms of households’ access to credit,” Mr Kimty said.

NBC director general Chea Serey also spoke during the conference and was quick to acknowledge ICT’s role in bolstering financial inclusion, reducing costs and saving time for financial institutions and customers.

“Financial inclusion has experience amazing growth in the last 17 years, keeping up with the country’s own economic development,” she said.

She praised Cambodia’s ICT sector and its role in the rapid development of services like mobile banking and online payments.

Ms Serey said the NBC is now working to strengthen regulation of the ICT sector and fight cybercrime.

Source: http://www.khmertimeskh.com/5094117/boosting-financial-inclusion-technology/

Thailand

Thailand