Cambodia: Banks, MFIs raise interest rates following Fed move

Many banks and microfinance institutions (MFIs) in Cambodia have increased interest rates for deposits in dollar and riel currency by approximately 0.5 percent and 1 percent per annum respectively but not decreased rates for loans in the last three months, according to senior officials in the industry.

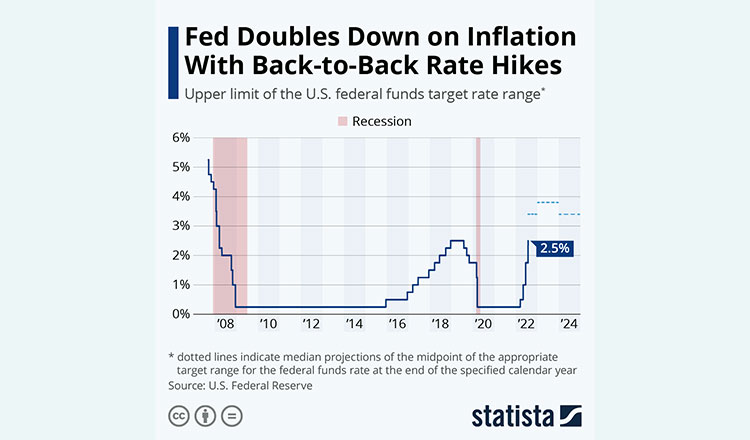

The Federal Open Market Committee (FOMC) of the US central bank Federal Reserve raised the target range for federal funds — benchmark interest rate at which commercial banks borrow and lend their excess reserves to other financial institutions — to a range from 2.25 percent to 2.5 percent.

Sok Voeun, chairman of Cambodia Microfinance Institution (CMA), told Khmer Times that about 40 percent of total investment capital in five microfinance deposit-taking institutions (MDI) are loans from overseas and local lenders, while the rest are from public deposits or savings. General MFIs get loans from only overseas and local lenders to use as capital.

“There must be a relationship and effect regarding the interest rate. Actually, we also have sources of capital from the US and Europe. When their central banks raise interest rates for commercial banks, while our lenders also get loans from those banks or management funds, they have to pay more interest to those institutions,” Voeun said.

“Our overseas lenders have to charge us higher interest rates so that they can maintain margin at a proper level. That’s why we as the borrowers need to raise a bit more to be consistent,” Voeun said, adding that both banks and MFIs in the Kingdom will also increase interest rates for loans in the future if the interest rate for loans from overseas financial sources continues to rise.

Voeun, who is also the CEO of LOLC (Cambodia) Plc, one of the five MDIs in Cambodia, went on to add that banks and MFIs have increased interest rates for deposit products in riel higher than the rate for dollar as those financial institutions have been facing a shortage of riel banknotes.

“Raising interest rates is not good as it would affect the economy. Not only institutions but also financial service consumers because they have to pay higher spending on interest. We do not raise interest for loans but if the situation is like this, we will raise it,” he said, adding that banks generally have a small percentage of foreign loans in their capital.

Neav Sokun, Chief Operating Officer at Small and Medium Enterprise Bank of Cambodia Plc (SME Bank), told Khmer Times that he also has noticed the new uptrend of interest rates among banks and MFIs in the Kingdom since March or April this year.

“The US central bank has increased its key lending rates two times. SME Bank — operated with the technical and financial guidance of the Ministry of Economic and Finance — has not raised the interest rate yet,” he said.

Cambodia currently has 58 commercial banks, nine specialised banks, and 86 microfinance institutions, with a total of 2,614 headquarters and branches as well as 3,998 automated teller machines (ATMs) throughout the country, according to the latest report of the National Bank of Cambodia (NBC) released late July.

Source: https://www.khmertimeskh.com/501128445/banks-mfis-raise-interest-rates-following-fed-move/

Thailand

Thailand