Cambodia: Banks and FI loan restructuring extended until mid-2021

The National Bank of Cambodia (NBC) will allow banks and financial institutions to continue loan restructuring until mid-2021, according to a letter sent to the Association of Banks in Cambodia (ABC) and the Cambodia Microfinance Association (CMA) last week.

Signed by NBC Governor Chea Chanto, the letter said, “I would like to inform you [ABC and CMA] that in support the royal government’s policy on matters regarding the COVID-19 pandemic and the impact of the flash floods, NBC has decided to extend loan restructuring conditions as set out in Circular No. B7-020-001.”

NBC is extending loan restructuring to all sectors impacted by pandemic and floods, based on evaluations conducted by the banks and financial institutions. Restructuring will be dependent on a mutual understanding between banks and financial institutions and their clients and will include provisions for the reduction of interest rates and waiving of other additional fees.

The central bank will permit restructuring up to three times without any impact to the loan classification during the referred period and specified that all financial institutions must follow implementation of the extension as directed.”

CMA Head of Communi-cations Kaing Tongngy welcomed the decision on behalf of the association. He added that the policy provides all the needed legal framework for MFIs and other financial instructions to support clients still being affected by pandemic and flood disruptions to their revenue streams.

“During this difficult time, the CMA has actively monitored the enforcement of the restructuring policy by our 103 members. “This included MFIs, leasing companies, rural credit operations and some banks,” Tongngy added.

He noted that the sector has been able to maintain a relatively low non-performing loan (NPL) ratio. The current NPL figure stands around 2.5 percent, thanks in large part to the NBC policy measures implemented in March, he noted.

Say Sony, PRASAC MFI Plc ‘s senior vice-president and chief marketing officer, also welcomed the move, saying that it would be great for both clients and the banking sector because it would enable economic growth.

He emphasised that the extension of the restructuring policy would not adversely affect his institution’s performance because its clients have a very good record of credit discipline.

“This additional measure will maintain financial stability, support economic activity and ease the burden of borrowers who face continued cash-flow issues,” said Sony.

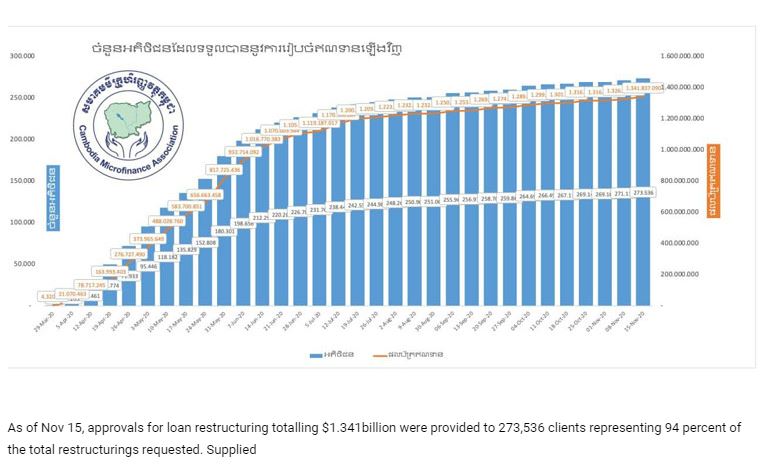

PRASAC reported an NPL ratio of 1.16 percent, up from 0.31 percent in Q3 last year. Net profit for Q3 was reported at 256,378 million riels ($63.2 million), a decrease of -13.3 percent compared with the same period last year. As of Nov 15, approvals for loan restructuring totalling $1.341 billion were provided to 273,536 clients, a figure that represents 94 percent of the total number of restructuring requests.

Source: https://www.khmertimeskh.com/50785076/banks-and-fi-loan-restructuring-extended-until-mid-2021/

Thailand

Thailand