Cambodia at ‘low risk of debt distress’, says ADB

Kingdom has the lowest Debt-to-GDP ratio of all developing countries in Asia, which is expected to peak at 38.1 percent by 2028 and settle at around 37 percent of GDP by 2030 – three percentage points below the moderate risk threshold

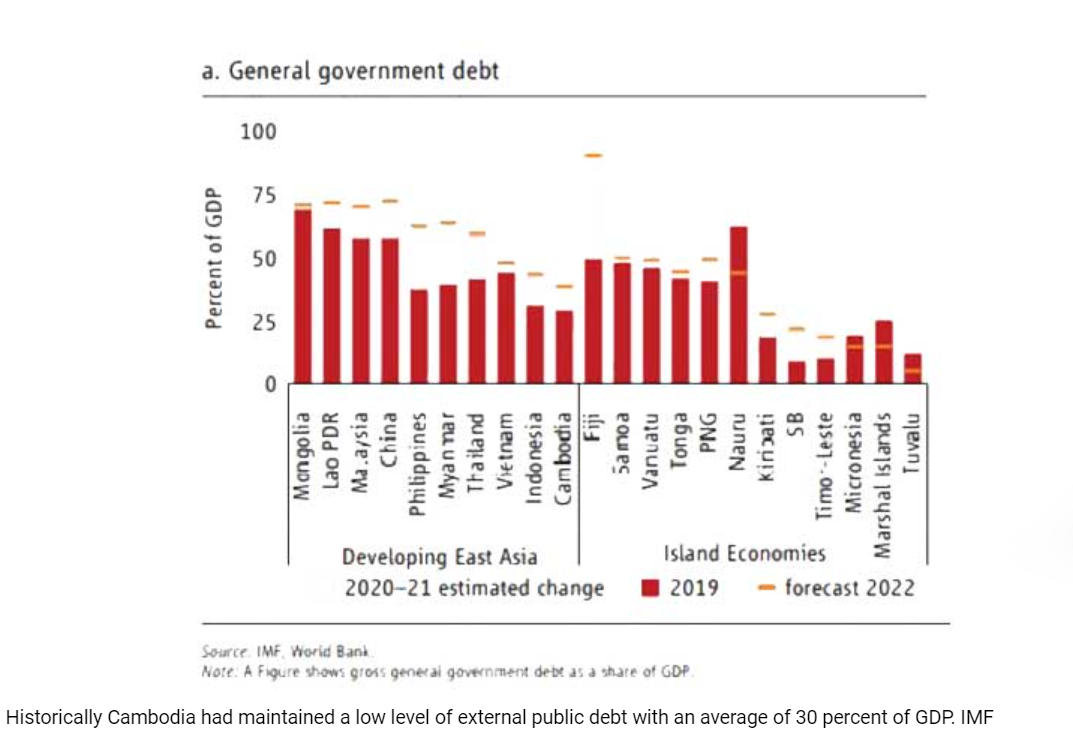

Cambodia remains at “a low risk of debt distress”, with total public external debt projected to rise to a manageable level of 36.2 percent of GDP in 2022 and 37.1 percent in 2023, according to the Asia Development Bank. This is consistent with a previous report on debt sustainability, published by the IMF at the end of the fourth quarter in 2021, which considers the macroeconomic shocks of the Covid-19 fallout.

The report found that ‘‘one debt burden threshold was breached’’, which would usually trigger a moderate risk signal. However, a bespoke model was used to offset this in the IMFs 2020 analysis.

“Under standard settings, one of the debt burden thresholds is breached, which would imply a moderate risk rating. On an exceptional basis, due to the pandemic’s largely temporary impact, 2020 was dropped from the calculations of historical average and variances.

On this basis, the sustainability threshold is not breached in the stress scenario. Overall, the analysis shows that the overall risk of debt distress is low, but debt sustainability is vulnerable to further shocks to exports and growth.”

Cambodia had historically maintained a low level of external public debt with an average of 30 percent of GDP, or $8.8 billion, until 2020, when the economic contraction and fiscal response policy bumped it up by 7 percent.

Cambodia has the lowest Debt-to-GDP ratio of all developing countries in Asia, which is expected to peak at 38.1 percent by 2028 and settle at around 37 percent of GDP by 2030 – three percentage points below the moderate risk threshold.

Cambodia is highly dependent on external borrowing, which is procured in two ways. It borrows from multilateral institutions such as ADB, IMF and WorldBank, and bilateral (directly from creditor nations, of which China comprises nearly half.

The ADB indicated that the issuance of local currency bonds was fast approaching in the region, stating that “the development of a new debt instrument market will help reduce companies’ reliance on bank credit while offering new channels for long-term financial intermediation.”

As such, the Ministry of Economy and Finance has committed to issuing the first $300 million worth of sovereign bonds as part of the Draft Law on Financial Management for 2022.

The fund from the sovereign bond will add to concessional loans from development partners for 2022 to support 35 public investment projects related to energy, irrigation, physical infrastructure and other prioritised sectors. The ministry stated that the issuance of the sovereign bond and the loan mentioned above will not create a debt burden on Cambodia, “The situation of Cambodia’s public debt remains at low risk as key debt indicators are well below the respective indicative thresholds.”

In December 2021, the Government Securities Law was adopted by the RGC. This allowed the issuance of debt securities either domestically or in external markets and any currency denomination. This policy move coincides with the update of the securities exchange rules of business, opening the ways for a much more active financial sector and debt financing for the public and private sectors for future growth and prosperity.

Source: https://www.khmertimeskh.com/501057037/cambodia-at-low-risk-of-debt-distress-says-adb/

Thailand

Thailand