Cambodia: 2022 earliest return projected for pre-pandemic growth rates

Moody’s yesterday reaffirmed Cambodia’s B2 credit rating as the country anticipates lifting curfew measures instituted last month to curtail the spread of the pandemic.

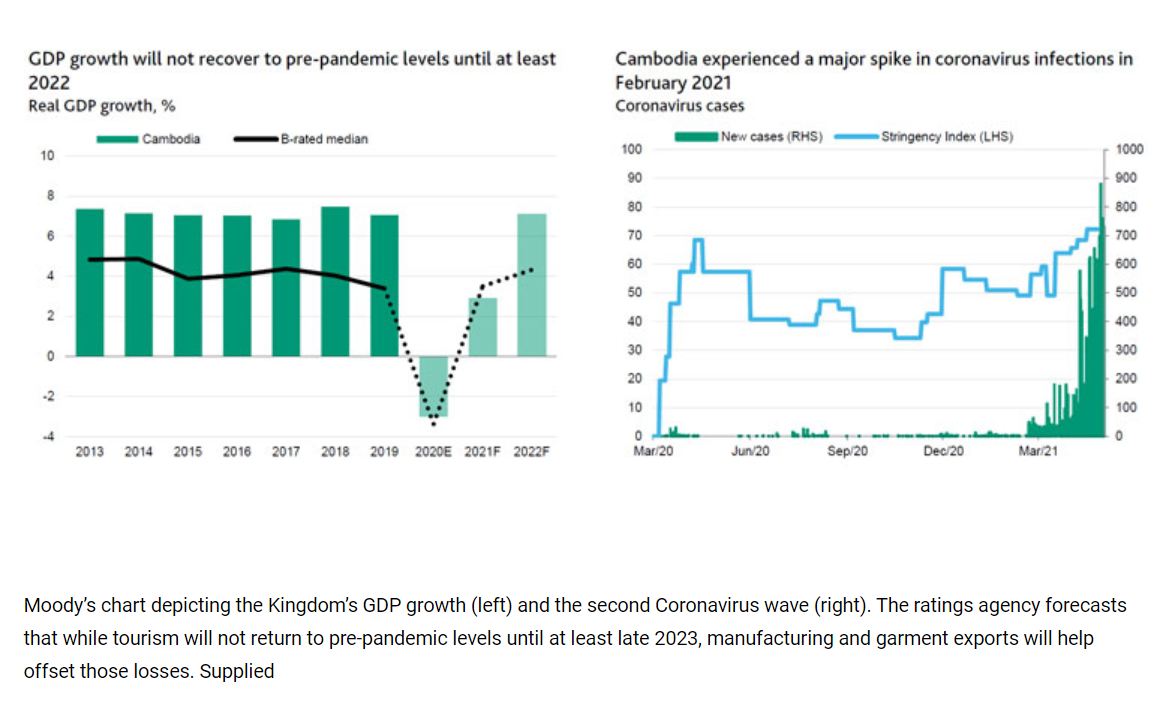

The ratings agency said that it expects 2.9 percent gross domestic product (GDP) growth after last year’s contraction. However, it noted that pre-pandemic growth will not be reached until at least 2022.

“The pandemic has put significant strain on Cambodia’s economic growth drivers. Travel restrictions have largely shut down the country’s tourism and hospitality sector. At the same time, the economic slump in the EU and the US – both large export markets for Cambodia – has weighed heavily on exports of garments, which comprise over 60 percent of Cambodia’s total exports,” Moody’s said.

The highest credit score attained was under the “fiscal strength category” (Baa2), indicating conviction in the government’s ability to carry a higher debt burden at affordable rates more than others.

Moody’s said the score was “underpinned by moderate government debt burden and high debt affordability because of the highly concessional nature of its borrowings”.

It noted that the government allocated about 5 percent of its GDP for large stimulus measures by drawing upon its fiscal savings and tapping into foreign loans. Moody’s projects that further stimulus is forthcoming to help mitigate the COVID-19 fallout.

“We expect the debt burden to peak at 38.7 percent of GDP in 2022 but moderate thereafter as economic growth and the government’s fiscal position stabilises,” the report said.

Cambodia’s economic strength was assigned a “B1” rating. High “Aaa” scores in “real GDP change” and “volatility in real GDP” were offset by lower ratings in “scale of economy” (“B”) and “national income” (“Caa”), lowering the average rating.

Moody’s explained it had downgraded its initial “Baa1” score because of high credit growth in the real estate and construction sectors, both of which are prone to sudden corrections after nearly a decade of low volatility.

The Kingdom’s construction sector has stagnated since the pandemic caused a 5.3 percent contraction in 2020. Construction is forecast to grow by 3.3 percent this year after having registered double-digit growth from 2016 to 2019, according to Ministry of Economy and Finance projections.

“Economic growth has also increasingly been led by construction activity, especially in the real estate sector, which together directly accounted for more than 15 percent of GDP in 2019. A substantial share of investment in real estate is driven by foreign capital. The small size of the economy and low incomes present sources of vulnerability, with domestic purchasing power unable to counter a shortfall in external demand,” Moody’s said.

The report also predicted a “muted recovery in growth” this year as tourism and garment exports remain weak during a resurgence of COVID-19 infections.

Economic growth will be most affected by contraction in tourism.Moody’s projects that 2021 visitor arrivals will be approximately 80 percent below 2019 levels. However, a strong manufacturing base and economic recoveries in the US and China – two of the Kingdom’s largest trading partners – may help offset the loss in tourism, particularly as bicycle and electrical exports continue to grow, the report said.

“Although we expect arrival numbers to pick up slowly over the second half of 2021, a steady recovery is unlikely until vaccine rollouts gather pace – both globally and within Cambodia – or travel agreements are struck, most likely starting with Cambodia’s fellow ASEAN members or China,” Moody’s said, noting that travel with not return to pre-pandemic levels until 2023 at the earliest.

Institutional and governance strength ranked lowest in the categories evaluated, with Cambodia sharing its “B3” rating with the likes of Papua New Guinea, Tanzania and Uganda.

Moody’s said high dollarisation and constraints on monetary policy resulted in the score. It also noted that Cambodia’s rankings in rule of law and control of corruption “have steadily fallen from 2012 peaks”. A “Ba” score was given for Cambodia’s susceptibility to event risk. The category evaluates countries’ vulnerability to sudden political, banking or environmental shifts.

Moody’s cited that the adverse impact of the pandemic on Cambodia’s economy poses severe risks for the asset quality in its financial system. Microfinance institutions, which had loans of around $6 billion [23 percent of 2020 GDP] as of March 2021, are particularly exposed as much of their exposure is to families with incomes from vulnerable sectors.

Source: https://www.khmertimeskh.com/50859569/2022-earliest-return-projected-for-pre-pandemic-growth-rates/

Thailand

Thailand