Brunei: Financing to agricultural sector records major jump

LOANS/financing to the agricultural sector in Brunei Darussalam increased from BND11.9 million in 2015 to BND23.8 million in 2018. This aligns with the country’s diversification aspiration.

According to Autoriti Monetari Brunei Darussalam (AMBD), Brunei Darussalam’s financial system, in which Islamic and conventional financial institutions co-exist in parallel, recorded an overall asset base of BND21.9 billion as at year-end 2018.

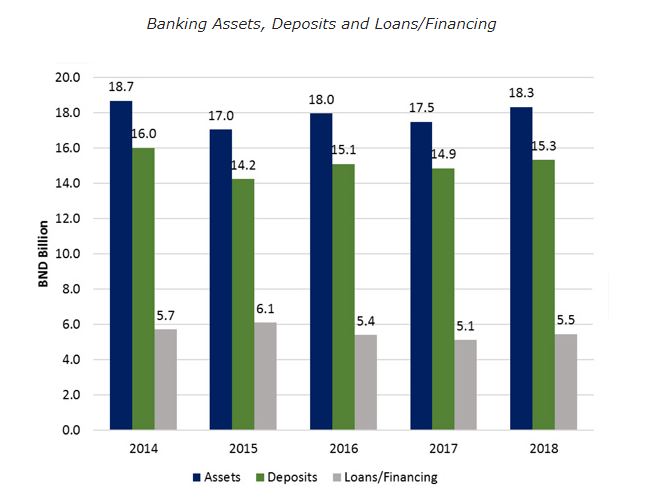

Within this dual financial system, the banking industry continues to dominate with a recorded asset base of BND18.3 billion which accounts for 83.5 per cent of the total assets of the financial system.

AMBD adopts a risk-based supervisory framework that is consistent with the Basel Core Principles (BCPs) and Core Principles for Islamic Finance Regulation. This supervisory approach allows AMBD to identify and monitor areas which present the greatest potential risk to each bank’s financial soundness.

Utilising the collected data, alongside on-site inspections, has allowed AMBD to qualitatively assess the adequacy of the banks’ risk management capabilities and, subsequently, implement corrective measures needed to mitigate identified risks.

AMBD has made significant progress in its compliance with the Basel Core Principles (BCP) since its announcement in 2016 to commit to the implementation of the Basel II framework by 2020, a regulatory framework for all licensed banks including Perbadanan Tabung Amanah Islam Brunei (TAIB).

Towards this end, AMBD has successfully introduced all three pillars of the Basel II framework, where the pillars are complementary and mutually reinforces one another.

Finance Companies Assets, Deposits and Loans/Financing

SOURCE: BANKING, AMBD, 2018 UNAUDITED FIGURES

SOURCE: BANKING, AMBD, 2018 UNAUDITED FIGURES

They comprise the minimum capital requirements for the risks that banks face (Pillar 1); the supervisory review of banks’ capital adequacy and internal assessment processes (Pillar 2); and market discipline, through effective public disclosures to encourage safe and sound banking practices (Pillar 3). Simultaneously, the regulations issued to Islamic and conventional banks represent the necessary key components for effective implementation of the Basel II framework.

The overall key financial soundness indicators in the banking industry remained at healthy levels.

The banking system continued to be strong with an aggregate capital adequacy ratio of 18.4 per cent and remains highly liquid with a liquidity ratio of 51.6 per cent in 2018.

As shown in the chart, the assets and deposits of the banking industry have increased by 4.8 per cent year-on-year from BND17.5 billion to BND18.3 billion, and 3.2 per cent year-on-year from BND14.9 billion to BND15.3 billion respectively as at year-end 2018.

During the same period, loans/financing had also recorded an increase of 6.2 per cent from BND5.1 billion in 2017 to BND5.5 billion in 2018.

The rise in total loans/financing was mainly contributed by the corporate sector, with a growth of 17.8 per cent from BND2.2 billion in 2017 to BND2.5 billion in 2018.

The sectors that majorly contributed to the increase were transportation, financial and manufacturing.

The loans/financing to deposit ratio (excluding government deposits) stood at 40.9 per cent in 2018 which is still considered low and indicates that the banking industry has the capacity to offer a greater amount of loans/financing to facilitate the real sector growth in the economy.

Finance companies’ profitability remained robust amidst declines in assets, deposits and loans/financing by 4.9 per cent, 6.0 per cent and 1.1 per cent respectively as shown in the chart. Profit before tax improved significantly in 2018 by 9.7 per cent or BND6.0 million compared to the previous year.

Furthermore, the amount of Non-Performing Financing to Loans/Financing has also decreased in 2018 by 22.4 per cent or BND4.3 million year-on-year.

This has contributed to a decline in the Non-Performing Financing to Loans/Financing ratio from 1.2 per cent to one per cent.

Household loans/financing continued to be the predominant sector at 53.3 per cent of total loans/financing, with personal loans/financing still representing the largest sector at 28.1 per cent.

According to the National Accounts Statistics published by the Department of Economic Planning and Development (JPKE), household final consumption expenditure grew moderately by 4.3 per cent year-on-year in current prices in 2018.

Despite this, household sector loans/financing declined 2.1 per cent year-on-year from BND3.0 billion to BND2.9 billion in 2018.

These opposing trends might be symptomatic of a change in consumer behaviour with less reliance on bank credit to finance household consumption. This is also supported by the rise in the total value of debit card transactions by 18.1 per cent year-on-year from BND424.9 million in 2017 to BND500.6 million in 2018.

Furthermore, the usage of debit cards compared to credit cards is much preferred as indicated by the increasing share of debit cards (of the total transactions) from 55.1 per cent in 2015 to 63.1 per cent in 2018.

This is perceived by AMBD as more prudent financial management and increased awareness of the risks of high indebtedness within the public.

Notwithstanding these positive developments, domestic demand for new vehicles grew at a slower rate in 2018.

Data from the ASEAN Automotive Federation (AAF) showed a modest improvement in vehicle sales in the country by 0.2 per cent year-on-year as of year-end 2018 from 11,209 vehicles to 11,226 vehicles.

Brunei Darussalam saw a decline in the number of accounts for new vehicle financing in 2018 by 15.9 per cent year-on-year and a rise of a similar magnitude (14.6 per cent year-on-year) was observed for used vehicle financing.

In terms of value, the total amount of used car financing surged by 62.3 per cent year-on-year from BND113.2 million to BND183.8 million.

This further suggests a shift in consumers’ preference from new to used cars.

In the residential property market, 2018 saw a continued downward trend for the Residential Property Price Index (RPPI) highlighting the continuation of the property market downturn.

In spite of the drop, there were promising signs for the property market in 2018 where the number of transactions (415 transactions) and the total value of transactions (BND110.1 million) was recorded the highest and second highest respectively since 2015.

Continued buying activities will help to boost the residential property market with the existence of a significant inventory of unsold residential properties in the country, suggesting that the recovery stage of the residential property market cycle is likely to be gradual.

AMBD, as the regulator of financial institutions, will continue to closely monitor the developments in the financial sector whilst strengthening its supervisory and regulatory framework, in line with international standards and best practices.

Source: https://borneobulletin.com.bn/financing-to-agricultural-sector-records-major-jump/

Thailand

Thailand