Brunei – AMBD: Understanding credit cards, interest charges

AUTORITI Monetari Brunei Darussalam (AMBD) has issued information to further boost public awareness on credit cards and more understanding of credit card interest.

In its advisory, AMBD said, “A credit card is a flexible and useful tool, either as a means of payment or as an alternative source of funds at times of emergencies. While credit cardholders can reap benefits from its usage, it is very important that users understand how to utilise credit cards responsibly. This also includes understanding how interest on credit cards is applied and calculated. This article aims to provide users with guidance on how to make good use of your credit card, and to better manage its usage.

“Credit cardholders are encouraged to check with their respective financial institution on how interest rates on credit cards are calculated. For example, some financial institutions may charge interest on credit cardholders on a daily rate.

“One should take note that for credit cards issued by Islamic banks, the term ‘interest charge’ is represented as ‘administration fee’.”

Highlighting on Transactors versus Revolvers and the different types of credit cardholders, the AMBD advisory said, “Transactors tend to pay their credit card bills in full. They are therefore perceived to have a lower level of credit risk, overall. For example: Hussein bought groceries worth BND$250 using his credit card, but pays the balance in full when the bill comes.

“As for Revolvers, they carry an outstanding balance from month to month. They are generally perceived to have a higher risk of defaulting, especially when they accumulate a significant amount of unpaid balances. Therefore, Revolvers need to ensure that they pay their outstanding balances on time and be extra wary of compounding interest and late payments fees.

For example: Siti bought a new computer costing BND$1,200 using her credit card, but only pays the minimum amount due when the bill comes.

“One should also act responsibly and avoid the consequences of late repayments. Credit Bureau, Autoriti Monetari Brunei Darussalam (CB, AMBD) collects, compiles and consolidates both banking and non-banking (such as utilities) information to generate an individual/ company’s credit score and subsequently the credit report for the individual/ company. With these tools, financial institutions are able to make credit assessments on an individual’s loan application.

“Credit cardholders with irregular repayments will be seen as high risk, and this may lead to financial institutions being less inclined to grant them new credit facilities.

“Customers should also understand the term ‘Compounding Interests’, which refers to the interest on top of the initially charged interest which individuals are required to pay on top of the outstanding amount from their credit facility. Furthermore, a late fee is usually incurred for payments made after the due date.

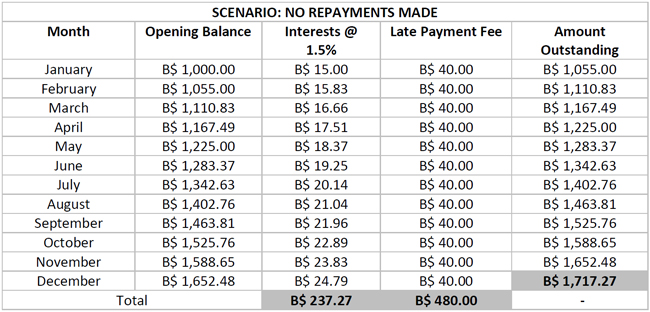

“For example: Abu bought a new laptop costing BND1,000 using his credit card. Assuming he does not make any repayments at all, the interest charge stands at 1.5 per cent per month and his late payment fee is fixed at BND40 per month.

“After a year, Abu’s total accumulative outstanding credit card balance will have shot up from BND1,000 to BND1,717.27 – almost double the amount he initially owed. Therefore, it is important to make your repayments to avoid these unnecessary charges. You will also be saving your money.”

AMBD also outlined some tips for the better management of credit cards through budgeting and self-control: “Use your credit cards wisely, preferably only for emergency purposes. Track your credit card spending against your financial capacity. Budgeting and knowing your needs and wants will help you from overspending.

“Customers should also know their due date by keep tracking of your repayment due dates and ensure monthly obligations are paid on time to avoid unnecessary additional charges. Any outstanding balance, including interests that are not cleared by the due date, will be compounded in the next payment statement.

“Customers need to pay above the minimum amount due on a timely basis. One should also pay your credit card bills in full and on time once you receive your bill. A normal billing cycle is usually 28 to 31 days, with a grace period between the end of a billing cycle and the payment due date. As such, when the opportunity arises, pay your credit card in full before the end of the grace period, as it will prevent you from incurring any interest charges.

“Customers should also take note of charges incurred using the cash advance facility. Credit cardholders are also advised to be extra wary on utilising the cash advance facility on their credit card, as interest charges are incurred instantly after withdrawal. Charges using this facility are often incurred on a daily rate, causing outstanding balance to accumulate very quickly.

“Customers can leverage on your bank’s zero per cent interest instalments plan. Some financial institutions allow credit card balances to be converted into monthly instalment plans of six, 12, 18 or 24 months with a one-time processing fee, and zero per cent interest charge on installment.

“For example, Abu uses his credit card to purchase a new computer worth BND1,000. After converting the repayment to 12 monthly instalments, he only needs to pay BND83.33 per month, after paying the processing fee.

“There is also payment convenience whereby utilising internet banking or mobile banking apps can give you the convenience to track your credit card balance, and make repayments on time. Credit cardholders should also take advantage of the direct debit facilities available to avoid missing your payment schedule.

“The bottom line is there is absolutely nothing wrong with owning a credit card, as it acts as an alternative emergency source of fund aside from cash savings. However, it is important that credit cards are used responsibly.

“If you are interested in signing up for a credit card, ensure that you speak to a sales representative of your preferred financial institution to understand information such as credit card payment due dates, fees and charges that you might incur, as well as penalties for non-payment.”

Contact AMBD’s Financial Consumer Issues at [email protected] for more information, or follow AMBD on Instagram @autoriti_monetary.

Source: https://borneobulletin.com.bn/ambd-understanding-credit-cards-interest-charges/

Thailand

Thailand