BoT: Baht a lesser influence on exports

The purchasing power of major trade partners and production restructuring to keep up with demand are having larger effects on exports than the baht’s movement, says a senior official at the Bank of Thailand. Vachira Arromdee, assistant governor of the financial markets operations group, gave the example of the baht’s strength against the greenback between 2005 and 2009, even as Thailand’s exports expanded amid robust global economic growth.

Although the baht retreated against the US dollar during 2013-15, the country’s merchandise shipments lost momentum, Ms Vachira said at a seminar yesterday hosted by the Export-Import Bank of Thailand (Exim Thailand). Restructuring production output to match customer demand and fast-changing technology also played a significant role in export growth, she said. Thailand’s exports fell in 2013, as outdated hard disk drives were the country’s top export at that time.

Ms Vachira’s comments came amid mounting concerns that the baht’s persistent strength will stall the recovery of exports, which account for more than two-thirds of Thailand’s GDP. The baht has been among the best-performing currencies in Asia, rising nearly 5% against the dollar year-to-date.

Thai exports jumped 13.2% year-on-year in May to UScopy9.9 billion (676 billion baht), the highest in more than four years. For the first five months of 2017, exports rose 7.2% to $93.3 billion, according to Commerce Ministry data.

External factors such as geopolitical risks and the monetary policy of big economies have also played a role in guiding the baht.

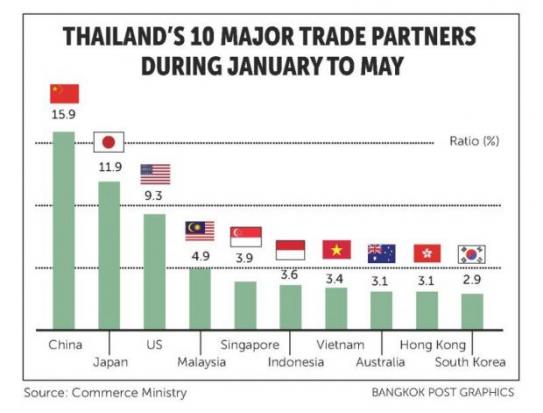

Soraphol Tulayasathien, executive director of the Macroeconomic Policy Bureau under the Fiscal Policy Office, said the pace of the baht’s gain against the dollar might not be significant, but the baht is firmer against major trade partners in Asia, which make up 25% of Thailand’s export value.

The baht’s nominal effective exchange rate is stronger than that of its trade partners, with the index surging to 110.3 from 97.2 in 2009, he said.

Exim Thailand president Pisit Serewiwattana suggested exporters take out export credit insurance to protect against buyers’ payment failure. The state-owned bank charges a premium for export credit insurance of 1,500 baht for coverage of 500,000 baht, well below the 8,000-9,000 baht premium typically charged for the same insured sum, he said.

Thailand has 2.7 million business operators, of which 30,000 are small and mid-sized enterprise exporters. Fewer than 3,000 have hedged against currency risk.

Source: http://www.bangkokpost.com/business/finance/1285447/bot-baht-a-lesser-influence-on-exports

Thailand

Thailand