Bank Indonesia Set to Hold Despite Hawkish Turn: Decision Guide

(Bloomberg) — Indonesia’s central bank is expected to keep its key interest rate at a record low despite a recent hawkish shift in its messaging, seeking to balance support for the economic recovery with currency stability.

Bank Indonesia is expected to keep the seven-day reverse repurchase rate at 3.5% on Thursday, according to all 31 economists surveyed by Bloomberg. Governor Perry Warjiyo — who surprised at last month’s meeting by announcing an increase to the reserve requirement ratio, an initial tightening move — has said BI may allow government bond yields to rise to support the rupiah but will keep the policy rate low until more signs of price pressure appear.

Indonesia’s recovery is being tested by the omicron outbreak, which has prompted tighter movement curbs in regions including the Jakarta area and Bali. The government sees omicron having less economic impact than previous Covid waves, and it expects the recovery to strengthen in the first quarter of the year. Still, prolonged restrictions could derail household demand, the main driver of Indonesia’s economy.

“Bank Indonesia might not have seen any firm reason yet to hasten a rate hike,” said Josua Pardede, chief economist at PT Bank Permata in Jakarta, “especially with domestic consumption growth still quite far from the pre-pandemic level.”

Rupiah volatility has been manageable after the central bank started reducing excess liquidity in anticipation of monetary tightening from the U.S. Federal Reserve, Pardede said. He expects BI to raise the benchmark rate by 75 basis points this year, with an initial hike late in the second quarter at the earliest.

Here’s what to look out for in Thursday’s decision:

Sustaining Growth

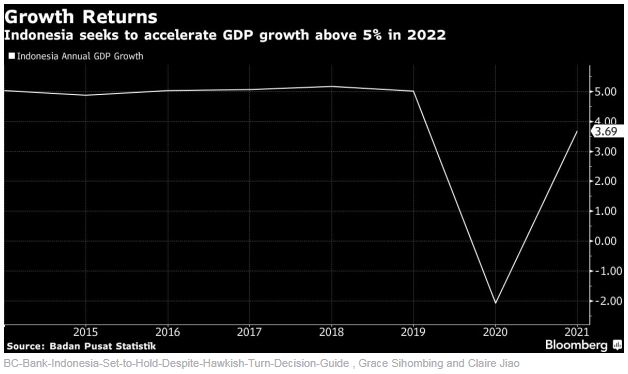

Gross domestic product growth accelerated in the final quarter of 2021 thanks to a commodity boom that boosted exports and looser restrictions that allowed consumption to revive. Full-year growth in Southeast Asia’s largest economy bounced back to 3.69% after a contraction of 2.07% in 2020.

However, with household spending rising only 2% last year — compared to average annual gains of 5% before the pandemic — the central bank will need to keep policy supportive of growth for now, said David Sumual, economist at PT Bank Central Asia. He expects Bank Indonesia to raise rates by 50-100 basis points in the second half of the year.

The central bank projects GDP to expand 4.7%-5.5% this year. Fiscal and monetary authorities have pledged to exit pandemic support policies in a measured fashion to avoid harming the recovery momentum.

Inflation Track

The central bank will closely monitor price pressures this year after headline inflation reached 2.18% in January, the fastest pace since May 2020. Core inflation picked up to 1.84%, still below the target band.

Brian Tan, economist at Barclays Bank Plc., said the return of inflation to Bank Indonesia’s 2%-4% target will give the central bank greater confidence to normalize monetary policy, especially if the tightening cycle from the Fed — which is expected to start raising rates next month — turns out to be more aggressive than anticipated.

“BI could be pressured into keeping up with more policy rate hikes of its own,” Tan said. His base case is for three 25-basis point rate hikes in the second through fourth quarters.

Bank Indonesia expects consumer prices to build up in July-September as the recovery firms up, but to remain within the target range.

Rupiah Stability

The rupiah is Asia’s biggest loser so far this year, down more than 0.7% against the dollar, but it continues to trade in a stable range despite the hawkish shift from the Fed policy, analysts at Goldman Sachs Group Inc. said.

“For now, this FX stability gives BI some leeway in deciding the pace of domestic policy normalization,” said Goldman’s Andrew Tilton and Jonathan Sequeira, who also forecast 75 basis point of policy rate hikes in the second half of 2022.

Thailand

Thailand