Asia’s Economic Recovery Put at Risk by Slow Pace of Shots

Asian nations led the world in crushing Covid-19 in 2020. Now some are being hamstrung by border closures and other rules they imposed to stay safe, potentially putting them behind the U.S. and other countries in leading the global economic recovery.

Countries such as China, Thailand and Australia virtually halted the coronavirus within their borders by shutting off entry to most outsiders and aggressively quashing infections that slipped in. Their citizens live near-normal lives and their economies, with some exceptions, haven’t crashed as hard as those in the West. China managed to grow its gross domestic product by 2.3% last year.

But that success made it less urgent for many Asian countries to move quickly in vaccinating their citizens, since few are falling sick.

Most countries in Asia have only vaccinated a small percentage of their populations, and most Asian economies won’t reach herd immunity until 2022, Goldman Sachs estimates.

The U.S. and U.K. will likely have vaccinated half their residents by May, Goldman Sachs forecasts.

That could leave some Asian countries in a holding pattern, forced to keep their borders sealed since their populations have developed little natural immunity to the disease, even as swaths of the world reopen businesses and international travel.

“The irony of Asia being successful in controlling Covid-19 is … that Asia’s going to be later in getting to herd immunity,” said Andrew Tilton, Goldman Sachs’s chief Asia Pacific economist.

He said the Americas and Europe could show the biggest economic gains over the next few quarters, while Asia rebounds more slowly — albeit from a stronger base — or in some cases deteriorates.

Plenty of factors could change that scenario. Vaccine rollouts may be delayed, or new virus strains may lower the effectiveness of inoculations.

Many people in Asia remain happy to accept tighter travel and other restrictions, given the trade-off in lower death tolls.

And some Asian countries have adapted well to closed borders. China, which sends more tourists abroad than it receives at home, is enjoying a boost in domestic travel spending, while its factories pump out goods for the rest of the world.

“Most economies that have controlled Covid have become stricter about their borders rather than more relaxed, because they’ve discovered their domestic economies can function at a reasonable level of health without international travel,” said Richard Yetsenga, chief economist at ANZ bank in Australia.

Still, closed borders and other Covid-19 containment policies come with costs, making it harder for countries to attract investors, foreign workers, tourists and students. Local citizens that need to go abroad can’t return home easily.

In Australia, closed borders shaved off 20% of the $31 billion it takes in annually from international students last year, according to Phil Honeywood, chief executive of the International Education Association of Australia. This year is expected to be worse, with little clarity on when students will be allowed back in.

Ravi Singh, managing director of Global Reach, an agency that helps funnel South Asian students to global universities, said it has seen a 50% reduction in the number of students registering for Australian university recruitment events, and a doubling of inquiries about universities in the U.K. and Canada.

“The situation is slightly dire” for countries like Australia, he said. “Students cannot wait endlessly.”

New Zealand, which has kept its Covid-19 cases below 2,500 thanks to one of the world’s strictest lockdown and quarantine programs, is taking a hit because it is so reliant on foreign labor and tourism.

ANZ estimates that New Zealand’s economy is likely 5% smaller without tourism, though that hole has so far been filled by a stimulus-fueled housing boom that won’t last forever, said Sharon Zollner, ANZ’s chief economist in New Zealand.

She predicts New Zealand’s borders won’t reopen until the end of 2021 at the earliest, and more likely early next year, pushing a full economic recovery to mid-2022.

“People are starting to think Covid is all over and that we dodged a bullet,” Ms. Zollner said. “But our forecasts actually show the economy going a bit sideways this year.”

Overall GDP growth is still expected to be strong across Asia, in part because last year was so bad, which makes year-over-year percentage gains look good. Still, many economists believe it will be Western nations that lead growth this year.

Moody’s Investors Service recently joined other economists in marking up their forecasts for U.S. growth this year, to 4.7% versus 4.2% in a previous outlook in November, as vaccinations make it possible for restaurants and other services businesses to normalize, and stimulus bolsters growth.

Consumer demand is rebounding faster in the U.S. and Europe than in Asia, a trend that is likely to continue as Asian vaccination rates lag and households remain wary, S&P Global Ratings wrote in a January report.

“The popular narrative is Asia is leading the recovery and digging the world out of a big hole. This is not quite right,” the report said.

The psychological strain of trying to prevent even tiny pockets of Covid-19 could weigh on confidence.

China, for all its recent economic success, is one of the most nervous about outbreaks, locking down neighborhoods and testing millions of residents when a handful of cases surfaces.

By mid-February, China had only distributed around 40% of 100 million vaccine doses planned before the start of the Lunar New Year holiday on Feb. 12.

Goldman Sachs predicts Chinese GDP growth will surge in the first quarter then be flat for much of this year, at around the 5%-6% rate it would normally expand, while the U.S. and U.K. will have very strong second and third quarters.

Thailand, where up to 20% of the economy was tied to tourism, is likely to be one of the worst sufferers from closed borders.

The country’s economic planning agency has repeatedly slashed forecasts for 2021 economic growth and now predicts the number of foreign visitors this year will be 3.2 million, less than a tenth of the 2019 total.

To reach that, the agency assumes Thailand will be able to vaccinate around 50% of its population by the end of this year — an assumption some experts think is optimistic.

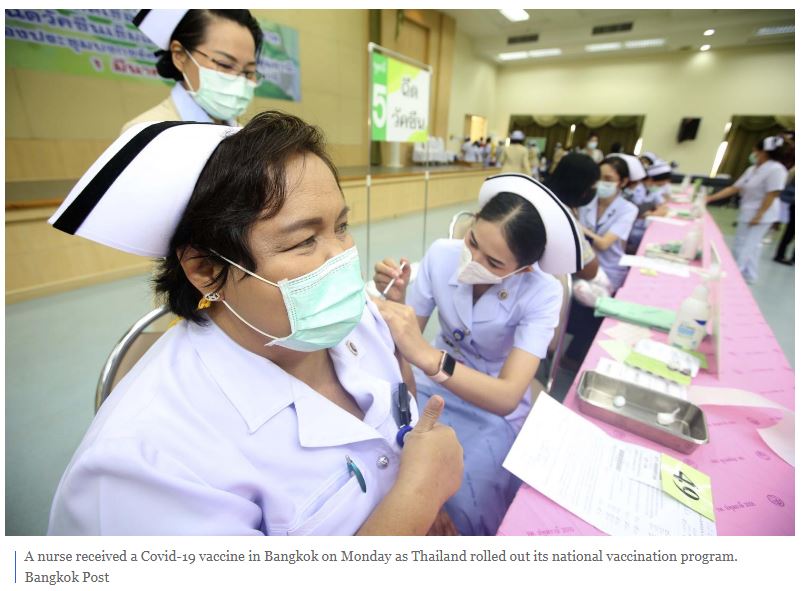

The kingdom just kicked off inoculations this week, with a relatively small number of initial doses.

In the southern island of Phuket, businesses are urging the Thai government to let them pay privately to vaccinate hotel, restaurant and travel-agency workers so they can have the confidence to let in foreign visitors.

Without such private intervention, Phuket likely won’t be able to reach herd immunity for at least another year and a half — an untenable situation, said Bhummikitti Ruktaengam, president of the Phuket Tourist Association.

Then there’s the Cook Islands, a tiny Pacific nation between New Zealand and Hawaii, where tourism accounts for around 80% of the economy. ANZ estimates its GDP fell more than 5% last year, and will contract another 15% this year.

The country sealed its borders last March and has never had a Covid-19 case. The next proposed date to open borders to New Zealand, its biggest source of tourists, is the end of this month. But with a recent string of infections reported in Auckland, Cook Islanders are skeptical.

Paul Ash, an owner of an 18-room resort on the main island of Rarotonga, said the business has lost 90% of its income and shareholders are pumping in almost $16,000 a month to keep it afloat.

He thinks his resort and others around the island can hold on for another few months.

“It’ll get to a point where it’s non-recoverable,” Mr. Ash said. “And we’re not far off that.”

Source: https://www.bangkokpost.com/business/2077939/asias-economic-recovery-put-at-risk-by-slow-pace-of-shots

Thailand

Thailand