Asian business confidence wallows near three-year low

SINGAPORE (Reuters) – A very cautious optimism remains among Asian companies in the fourth quarter as they wait to see whether there will be any breakthrough in a trade dispute between the United States and China, a Thomson Reuters/INSEAD survey showed.

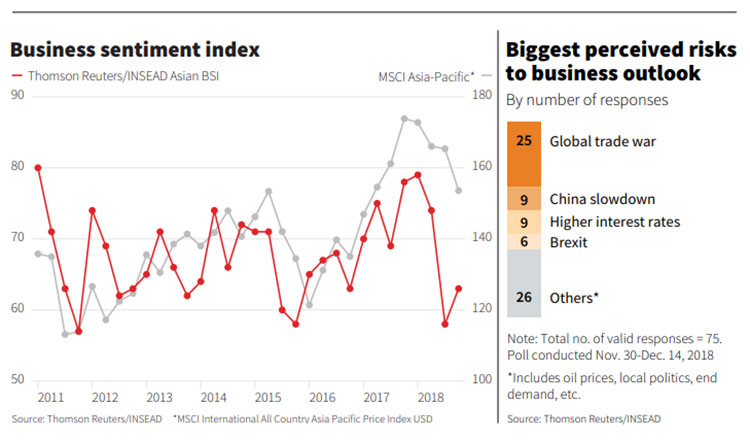

Representing the six-month outlook of 84 firms, the Thomson Reuters/INSEAD Asian Business Sentiment Index edged up to 63 in the October-December quarter, slightly above a near three-year low of 58 seen in the previous period.

Anything above 50 indicates a positive outlook. But the latest result still marks one of the lowest readings since a rout in Chinese stocks in mid-2015 rattled world markets.

“This confirms the reading of the previous quarter: there is more uncertainty, there are increasing concerns about growth,” said Antonio Fatas, a Singapore-based economics professor at global business school INSEAD.

“This doesn’t mean there is going to be a crisis over the next quarters, but if there is one, this is an indication that it wouldn’t be a large surprise to some.”

Once again, a global trade war was cited as the chief business risk by respondents. A slowdown in the world’s second-biggest economy China and higher interest rates were also cited as risk factors. The survey was conducted in 11 Asia-Pacific countries, across a range of sectors from Nov 30 to Dec. 14.

US President Donald Trump and Chinese leader Xi Jinping earlier this month agreed to a truce that delayed a planned Jan. 1 increase of US tariffs to 25 percent from 10 percent on $200 billion of Chinese goods while they negotiate a trade deal.

But that deal remains far from certain.

Trump has long railed against China’s trade surplus with the United States, and Washington accuses Beijing of not playing fairly on trade. China calls the United States protectionist and has resisted what it views as attempts to intimidate it.

The dispute between the world’s two biggest economies, threatens businesses throughout the region due to global value chains.

Firms in the tech and telecoms sector – where valuations have already been hit by concerns over slowing global demand – were one of the most pessimistic in the survey with their lowest-ever reading of 44.

“Everyone is under pressure from valuations anyway in this sector,” said Suresh Sidhu, chief executive officer of Malaysian telecoms firm edotco Group Sdn Bhd.

“The fact that the trade war and currencies, particularly if you are Asian, start to mess with your revenue and earnings models has added another whammy.”

Firms in Taiwan, an important node in the global electronics industry, had the most negative outlook by country in the survey at 17. On a country basis, that marked the steepest fall in the quarter, from 58 in Q3.

Companies in other mature economies such as Korea and Japan were among the most pessimistic, while firms in the Philippines, Thailand, Malaysia – the rapidly developing Southeast Asia region – were the most optimistic.

However, even for emerging Asia, there are concerns over the scramble to keep up with rising US interest rates as regional central banks move to defend their currencies against a strengthening US dollar.

Rising rates was a concern flagged by Thai-based hotel operator Minor International PCL, which recently acquired a Spanish hotel group in a multi-billion dollar deal.

“This is the biggest acquisition we have done in our history so any movement in interest rates definitely impacts our cost of funding,” said the firm’s investor relations director Supitcha Fooanant.

Growth fears, Mr Xi speech, grip world stocks ahead of Fed meeting

Other respondents to the survey included Mahindra and Mahindra Ltd, PT Kalbe Farma Tbk, PT Hanson International Tbk, Canon Inc, Suzuki Motor Corp, Metropolitan Bank and Trust Co and Sembcorp Marine Ltd.

Source: https://www.khmertimeskh.com/50561297/asian-business-confidence-wallows-near-three-year-low/

Thailand

Thailand