Indonesia raises palm oil export quota as farmers face ’emergency’

INDONESIA has raised the palm oil export quota in a bid to cut soaring inventories of the edible oil, a Trade Ministry official said on Tuesday (Jul 5), as a council member in a plantation area warned farmers faced an “emergency” due to tumbling prices.

The world’s top palm oil producer has been forced to overhaul its policies after a 3-week export ban that ended on May 23 caused a massive build-up of domestic stocks and angered farmers by sending prices of palm fruit lower.

Indonesia has since Monday lifted the export quota to 7 times the amount producers sell at home, compared with 5 times previously, senior official Veri Anggrijono said. The ministry had as of Monday issued export permits for a total of 2.4 million tonnes of palm oil products under its so-called domestic market obligation (DMO) scheme and its export acceleration programme, he said.

Based on the smaller quota and the acceleration programme, Indonesian companies could export a total of 3.4 million tonnes. Veri did not provide an estimate of volumes expected under the new quota.

“Our objective is to speed up exports so storage would be freed up and the palm fruit of farmers can be absorbed,” said Veri, adding there was no time limit on the latest export ratio.

Dozens of mills have halted buying palm fruit from independent farmers after storage tanks had filled up, farmers group APKASINDO said.

“Worse than the pandemic”

In the Lamandau region on Borneo island, palm oil fruit prices had slumped to between 800 rupiah (S$0.07) to 1,100 rupiah per kg on Tuesday, from around 3,600 rupiah before the export ban, council member Budi Rahmat told Indonesia’s parliament.

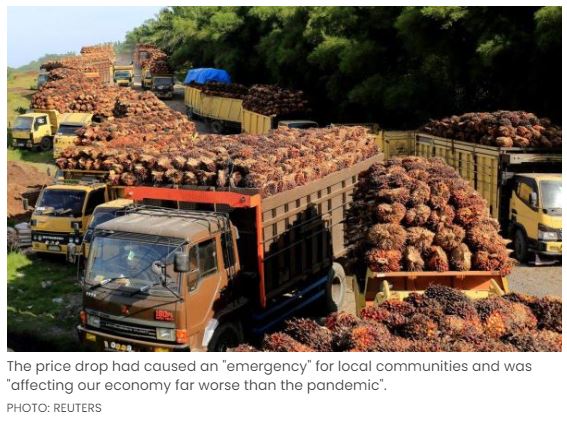

The price drop had caused an “emergency” for local communities and was “affecting our economy far worse than the pandemic”, Budi said, noting thousands of tonnes of palm fruit had also ended up rotting since mills could not process supply.

Farmer Ridho Ikhsan, from Riau province on Sumatra island, said farmers were forced to sell at a loss because if they did not harvest the fruit trees would be damaged.

The harvest had also been large, he said, noting storage tanks at mills and at Dumai port were full.

In a bid to boost local demand, a senior minister said Indonesia may raise the mandatory content of palm oil in biodiesel to 35 per cent or 40 per cent from 30 per cent currently.

The Indonesian policy shifts showed how palm oil inventories had become “highly burdensome” after the export ban in May aimed at capping cooking oil prices, said Anilkumar Bagani, research head of Mumbai-based vegetable oils broker Sunvin Group.

Indonesia’s policy reversals have helped push Malaysian palm oil benchmark futures sharply lower, with prices losing more than 11 per cent since Indonesia flagged plan for larger exports at the weekend. The latest fall comes after a 22 per cent drop in prices in June, which was the biggest monthly fall since October 2008. REUTERS

Thailand

Thailand