Malaysia: Buckle up for higher inflation

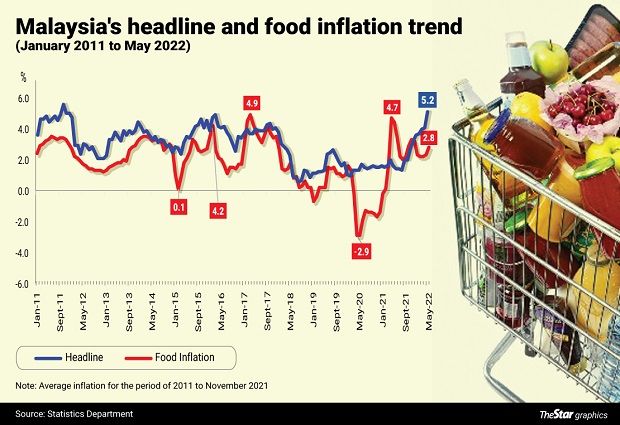

PETALING JAYA: Barely three days after Malaysia reported its highest food inflation in 11 years, economists are warning consumers to brace themselves for higher inflationary pressure in the coming months.

There is also further bad news. Alongside the higher prices, Malaysians also need to endure increased borrowing costs ahead, as the central bank is likely to raise interest rates to tame inflation.

To be fair, Bank Negara finds itself in a tight spot, considering that many central banks are already raising their rates amid the intensifying price pressures globally.

As a country that is highly dependent on food imports worth RM63.6bil in 2021, Malaysia is highly exposed to the rise in global food prices.

This is worsened by the weaker ringgit, making imports more expensive.

Amid such a situation, economists said the government’s recent decision to remove subsidies on bottled cooking oil, eggs, as well as the ceiling price for eggs and chicken, would contribute to higher prices.

TA Research said the subsidy rationalisation could cause food prices to increase as high as 5.7% in July or August this year.

For comparison, food prices jumped by 5.2%, the highest rate since November 2011.“Although the government revoked the decision to float chicken prices towards the end of the week, we still view chicken prices to remain high given high input costs including animal costs and labour.

“Though no new price ceiling for chicken is announced at the point of writing, we don’t see much difference.

“To note, cooking oil, chicken, and eggs contribute about 2.1% of the total Consumer Price Index basket,” it said in a note.

Meanwhile, CGS-CIMB Research said the risk of adjustment to subsidised fuel prices, namely RON95 petrol and diesel, raises concerns on inflationary outlook.

“(It) presents further upside risks, though we think this is a story for 2023.

“As such, we project Malaysia’s headline inflation to average 3.1% year-on-year (y-o-y) in 2022 and 3.2% y-o-y in 2023,” it said in a note.

CGS-CIMB Research noted that Malaysia’s headline inflation accelerated to 2.8% y-o-y in May, surpassing market expectations.

Core inflation, on the other hand, rose to 2.4% y-o-y, the highest since July 2017.

The May headline inflation was above the 2.6% median growth forecast of a Reuters poll of economists and higher than the 2.3% increase recorded in April.

In a statement, the Statistics Department chief statistician Datuk Seri Mohd Uzir Mahidin said that 93% of the items in the food group witnessed an increase in prices.

Of these, about 29.4% items increased in the range of less than 5%, 37.7% increased between 5% to 10% while 32% increased more than 10%.

Mohd Uzir noted that chicken prices, the largest component in the meat subgroup, rose 13.4% y-o-y, due to the rising cost of feed coupled with an increase in demand.

With inflationary pressures likely to intensify going forward, monetary policy tightening is unavoidable, according to most economists.

A common expectation was that Malaysia’s benchmark interest rate – the overnight policy rate (OPR) – could be raised by a total of 50 basis points (bps) in the second half of 2022.AmBank Research, on the other hand, expected Bank Negara to act more aggressively by hiking the OPR by 50 bps just in July.

This would bring the OPR to 2.5%, in comparison to the pandemic-level of 1.75%.

It is noteworthy that the central bank raised its rate by 25 bps in May this year.

CGS-CIMB Research said that the strong uptick in core inflation may prompt Bank Negara to raise the OPR by 25 bps on July 6, followed by another 25 bps hike in September.

“We maintain our end-2022 OPR forecast of 2.5%,” it said.

Meanwhile, Kenanga Research said the probability of Bank Negara raising its OPR in a 25-bps increments at each of its remaining three monetary policy committee meetings in 2022 has increased.

This is on the back of emerging inflation fears, improvement in the domestic labour market and expectations of a strong economic recovery.

“However, growing uncertainty and recession fears may change the central bank’s tightening narrative.

“The 2022 headline inflation forecast (has been) revised up to 3.3% from 2.9% (2021: 2.5%) as supply bottlenecks continue to impinge on food prices,” according to Kenanga Research.

AmBank Research forecast the nation’s headline inflation in 2022 to be between 2.8% to 3%.

With the first five months’ average at 2.4%, to achieve our target of 2.8% to 3%, the next seven months’ average should hover between 3% and 3.5% which is seen within our target.

“Last year’s average between June 2021 to December 2021 was 2.8%,” it said in a note.

Source: https://www.thestar.com.my/business/business-news/2022/06/28/buckle-up-for-higher-inflation

Thailand

Thailand