Philippine peso breaches 50

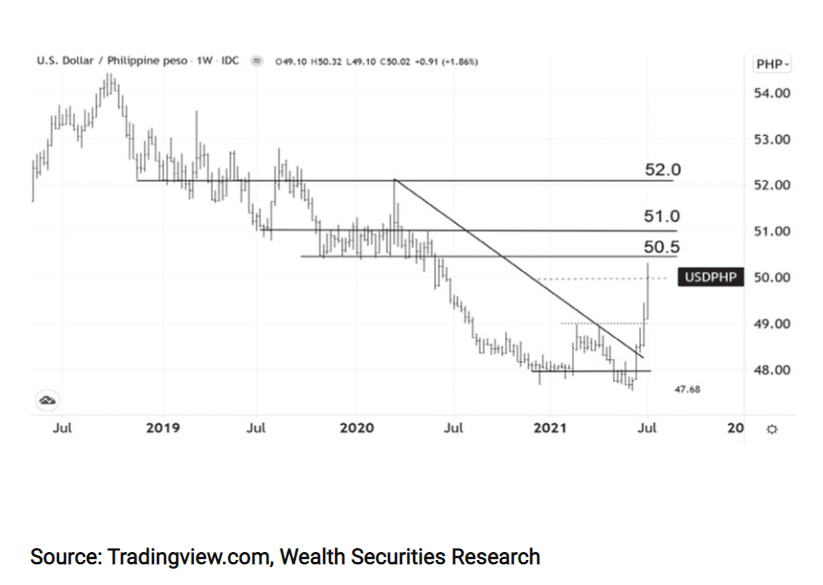

The Philippine peso slumped to a one-year low last week amid a strengthening US dollar and volatile oil prices. As a result, the peso weakened to 50.17 last Friday before closing at 50.08. This is the biggest one-week drop since 2013. Year-to-date, the peso has declined by 4.27 percent. The recent weakness of the peso has brought it to solid resistance levels. These technical resistance levels are at 50.5, 51.0, and 52.0 for USD/PHP.

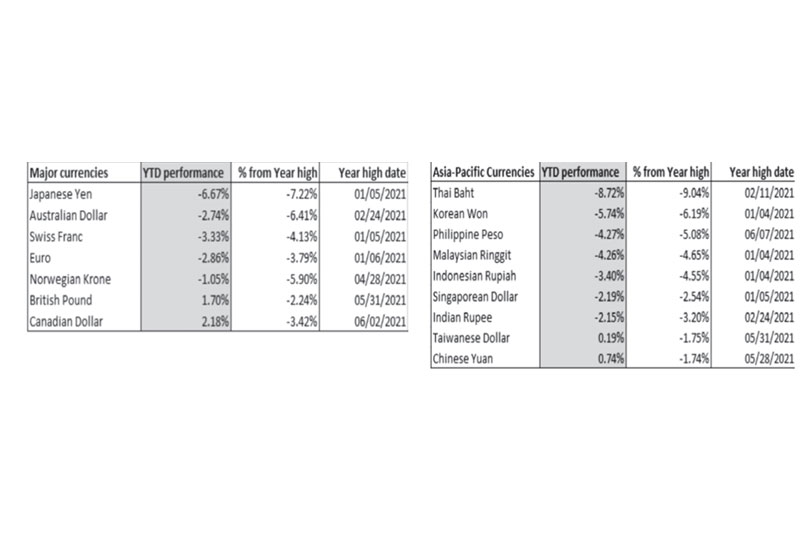

Peso among the last to fall

Amid extremely bearish sentiment early this year, the US dollar has made a strong comeback. In fact, the US dollar index (DXY) hit bottom as early as January when the euro, Swiss franc, and the Japanese yen topped out. The Aussie dollar topped out next in February. The Chinese yuan, Canadian dollar, and the Philippine peso were among the last to fall against the US dollar. The weakness came after the Fed’s hawkish pivot in mid-June.

Source: Bloomberg, Wealth Securities Research

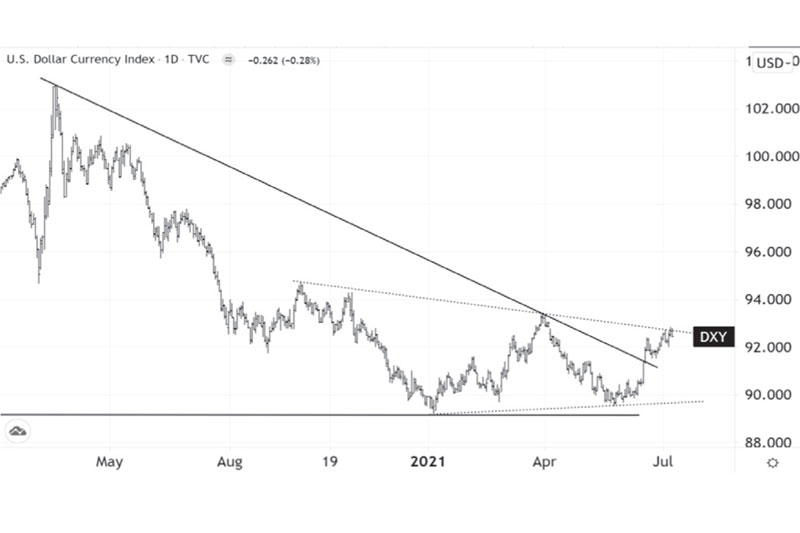

US dollar index hits 3-month high

The DXY traded at a high of 92.84 last Wednesday, its highest in three months. The strong move came after minutes of the June FOMC meeting confirmed that the Fed is moving toward tapering its QE program as early as this year. From a technical standpoint, the DXY is at a crucial level. A break above 93 would lead to continued weakness in most major and EM currencies.

Source: Tradingview.com, Wealth Securities Research

OPEC deadlock drives oil price turmoil

The peso’s weakness is also partly attributed to the failure of the Organization of Petroleum Exporting Countries and its allies (OPEC+) to reach a consensus on oil output. As a result, WTI crude oil prices briefly surged to a six-year high of 76.98 per barrel last week before reversing and closing at 74.56 last Friday. The disagreement between Saudi Arabia and UAE about raising output led investors to believe that the OPEC+ group would soon abandon output limits set early this year. Despite the reversal, however, oil prices are still up 50 percent year-to-date and 80 percent year-on-year. With the Philippines importing most of its oil requirements, the volatility in oil prices adds pressure to the peso.

Strong dollar, not weak peso – Diokno

In a virtual briefing last week, BSP Governor Benjamin Diokno noted that the depreciation is not unique to the peso, citing the general strengthening of the US dollar against almost all currencies. “That means that it is the dollar that is strong, not the peso that is weak,” he said. Diokno reiterated that the BSP continues to let market forces determine the peso-dollar rate, participating in the market only to minimize fluctuations and maintain price stability. He likewise emphasized that the peso would continue to get support from the nation’s ample foreign reserves, a steady inflow of OFW remittances, BPO revenues, and foreign direct investments.

Source: https://www.philstar.com/business/2021/07/12/2111781/philippine-peso-breaches-50

Thailand

Thailand