Malaysia: Commodity rally to support ringgit

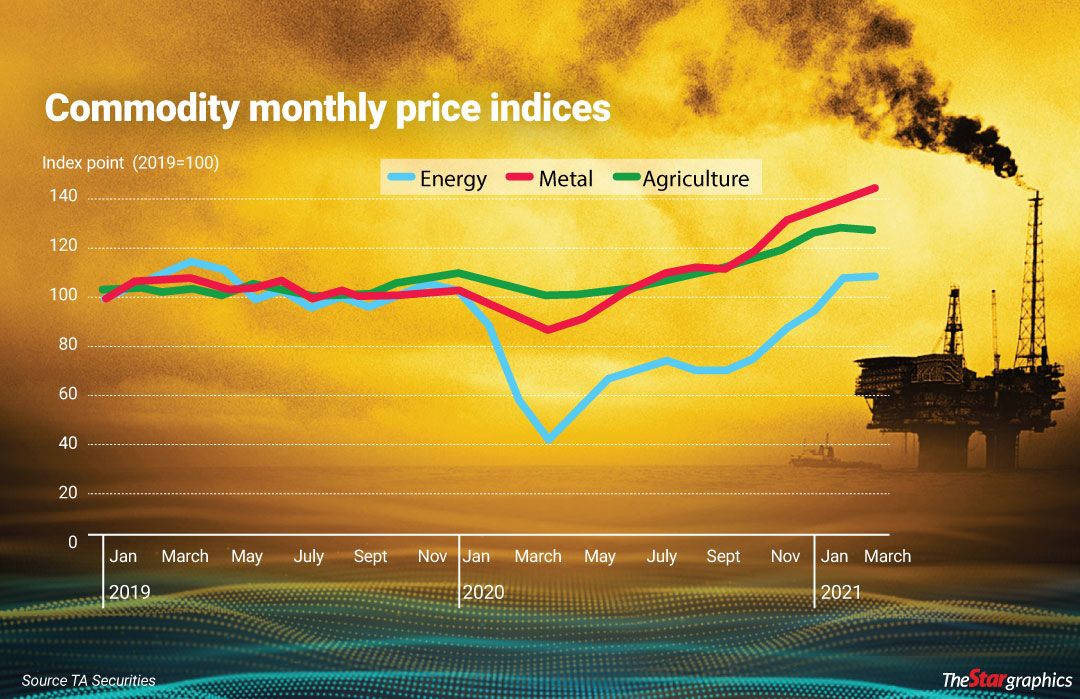

PETALING JAYA: Prices of various commodities have been on the rise, and as a producer of some of these commodities, Malaysia is a beneficiary of the price uptrend through higher proceeds from exports.

This should also translate into a stronger ringgit, giving a boost to the currency that has largely traded sideways above the RM4.10 mark against the United States dollar since March 2021.

Theoretically, a country’s stronger exports exceeding imports would help to strengthen the currency as demand for the legal tender increases.

In the case of Malaysia, the country has enjoyed higher prices for crude oil, crude palm oil (CPO) and tin, among others.

CPO spot prices have soared 134% year-on-year (y-o-y) to historic levels of RM4,761 per tonne. Brent-grade crude oil has almost doubled in the past one year from US$35.75 (RM147.93) per barrel to US$67.69 (RM280.10).

Meanwhile, data from the Kuala Lumpur Tin Market showed that tin prices have surged by almost 57% since the beginning of the year to RM128,887 per tonne.

While there are concerns on whether the rally in commodity prices could be sustained, experts largely believe that the prices would remain higher than the levels seen a year earlier.

Speaking with StarBiz, MIDF Research economist Abdul Mui’zz Morhalim said the recent rise in commodity prices was mainly due to tight supply conditions.

Looking ahead, judging from the improving demand outlook, he expects commodity prices to remain high, especially if the tight supply continues into the latter part of the year.

The high commodity prices, along with the sustained current account surplus and positive interest rate differentials compared to the US, are expected to support the ringgit.

“Overall, we expect the ringgit will appreciate this year.

“At the moment, we maintain our view that the ringgit will strengthen towards RM3.95 per US dollar by the end of 2021, ” he said.

Commenting on the soft ringgit condition in the past several months, Abdul Mui’zz attributed the weakness to the financial market volatility that had caused the US dollar to strengthen, and in turn weaken the ringgit.

“The rise in inflation has led to growing expectations that the US Federal Reserve (Fed) will start to tighten its monetary policy.

“However, the Fed policymakers had stressed there is no urgency to adjust the policy interest rates and that the Fed would ensure its monetary policy remains accommodative to support the US economic recovery, ” he said.

Socio-Economic Research Centre executive director Lee Heng Guie, (pic) on the other hand, feels that the ringgit would continue to trade sideways against the US dollar amid getting support from firming commodity prices.

He pointed out that a weak correlation has been observed between the ringgit and commodity prices. “Expect the ringgit to settle at RM4.00 against the US dollar by end-2021, ” he told StarBiz.As at press time, the ringgit was trading at RM4.13 against the greenback, slightly weaker than RM4.01 on Jan 1. However, it is noteworthy that the ringgit is currently stronger on a y-o-y basis, considering that the currency traded over RM4.30 per US dollar in May 2020.

Lee said that while the continued strong demand for our exports helps the ringgit, capital flows are still a dominant driver of the ringgit.

Persistent foreign selling of Malaysia-listed shares, the prolonged movement restrictions and their consequential impact on the economy as well as the political uncertainties will likely weigh on investor sentiment regarding the ringgit, according to him.

“Furthermore, Bank Negara’s lifting of the export conversion rule of export proceeds, netting off export proceeds in its permitted foreign currency obligations will ease upside to the ringgit.

“On the external side, the strong US economic recovery, firmer labour market conditions and higher inflation outlook may fuel the sooner-than-expected normalisation of the federal funds rate.

“This expectation along with financial volatility and higher rise in bond yields could reset investors’ firmer view about the US dollar index, and hence, a softer ringgit, ” Lee said.

Nevertheless, Lee said a strong ringgit would help to lower the cost of imported consumption, intermediate and capital goods.

This would, in turn, ease the cost of production of manufacturers and businesses via lower producer prices and consumer inflation.

Source: https://www.thestar.com.my/business/business-news/2021/05/20/commodity-rally-to-support-ringgit

Thailand

Thailand