Asian markets mark uptick in foreign capital inflows

Asian stock markets, including the Stock Exchange of Thailand (SET), are increasingly attracting foreign funds as investors shift away from lower-yield US 10-year bonds because of signs of increasing inflation.

The foreign fund inflows are expected to greatly benefit large-cap stocks as foreign investors prefer stocks with high liquidity, while analysts are waiting for more concrete signs of inflows before adjusting this year’s SET Index target.

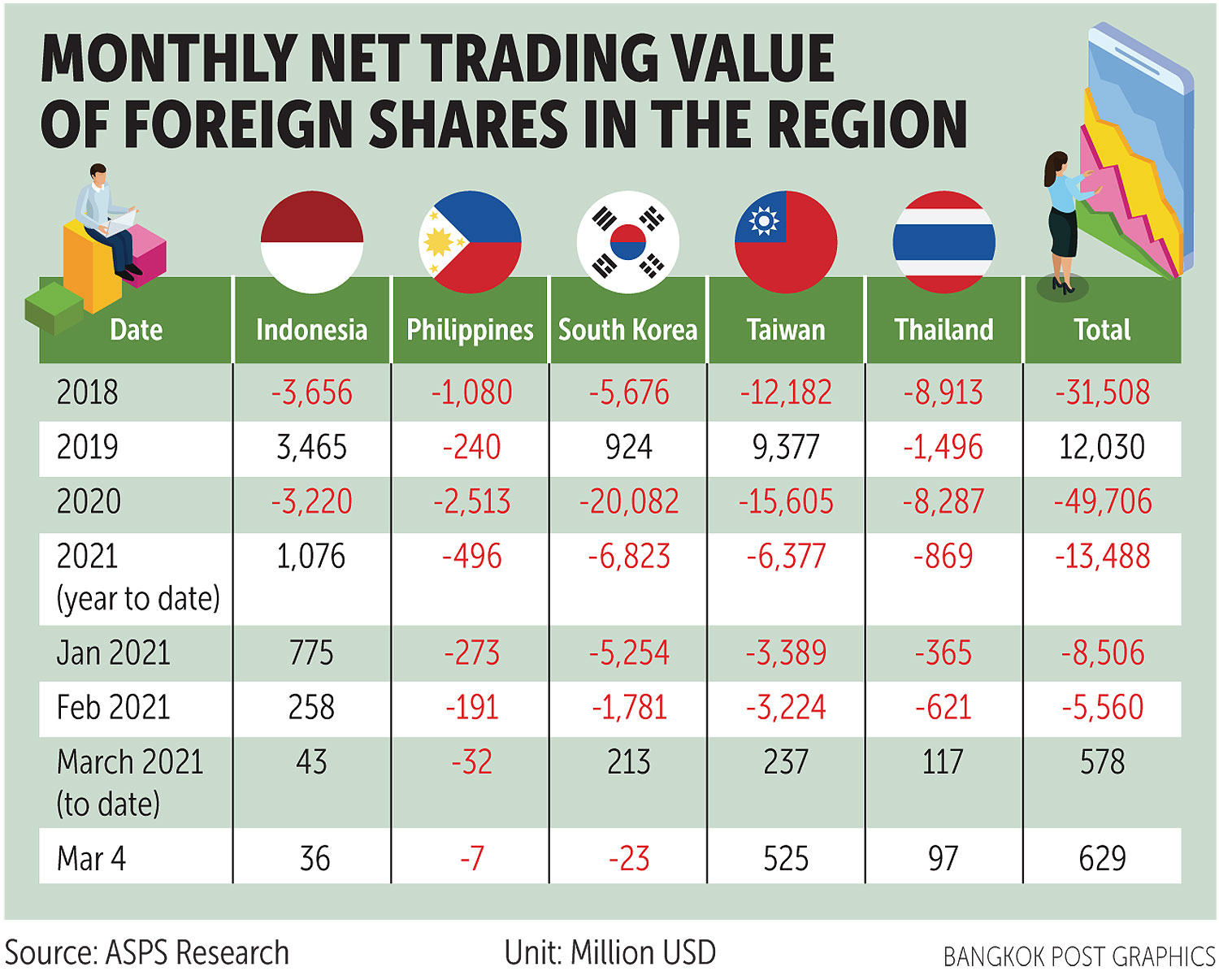

Asia Plus Securities (ASPS) Research said the Thai stock market and Asian bourses, excluding the Philippines, all recorded positive figures for foreign capital inflows this month after experiencing selling from foreign investors for over a year, driving Asian stock markets’ year-to-date returns to higher levels than those of European and US counterparts.

While Indian, Indonesian and Thai stock markets rose 7.7%, 6.7% and 6.5%, respectively, the German market and Nasdaq rose just 2.6% and 0.8%, respectively, the research noted.

Following signs of a US economic recovery, investors also began moving from tech stocks to cyclical stocks, notably in the Nasdaq 100 where most tech stocks are concentrated.

According to data from ASPS, the Nasdaq 100 underperformed compared with traditional markets this year while cyclical stocks — those that are expected to rise following the economic recovery such as Chevron, Goldman Sachs and Boeing — surged 22.6%, 26.8% and 6.7%, respectively, year-to-date.

“Fund flow continues to move from secure assets to riskier assets. Most of the weight fell on cyclical stocks as well as laggard Asian stock markets. The Thai stock market has also benefited from the flows,” ASPS said.

With regard to investment strategy, ASPS recommends investment in stocks that are likely to be boosted by the economic recovery and sit at a low price.

ASPS’s top picks from this group are Asia Aviation Plc (AAV), Bangkok Dusit Medical Services (BDMS) and Central Pattana Plc (CPN).

AAV will benefit from the reopening of borders and an increase in domestic and international flights, which are expected to take place around a month after vaccination programmes worldwide take effect, said ASPS.

Domestic travel is expected to increase from the second quarter.

AAV also has a chance of recovering from rock bottom in the first quarter through revenue from promotions, such as early ticket sales, said the research.

BDMS is showing signs of improvement thanks to global vaccine distribution, allowing medical tourists to travel again.

Domestic patients are also using its services again, said ASPS.

CPN is expected to reach a low in the first quarter, recovering once all malls have resumed their services, the lockdown has eased and vaccines are distributed in Thailand.

“We believe CPN’s earnings in 2021 will continue to increase from 2020. The company plans to sell more new assets into the real estate investment trust this year, which will generate additional profits,” said the research.

Paiboon Nalinthangkurn, chairman of the Federation of Thai Capital Market Organizations, said analysts are likely to revise their SET Index target this year if foreign funds continue to flow into regional and Thai stock markets. With the inflows, Thai stocks will likely recover faster than expected, he said.

“Emerging markets are more attractive than developed markets this year because stock prices in Asian markets are still cheaper than in developed markets like the US,” said Mr Paiboon.

Foreign investors’ purchases of Thai stocks stood at 2.3 billion baht on March 5.

Source: https://www.bangkokpost.com/business/2081887/asian-markets-mark-uptick-in-foreign-capital-inflows

Thailand

Thailand