Philippines: Pandemic bill stokes gov’t debt to P9.8 trillion in 2020

MANILA, Philippines — As widely expected, the Duterte administration capped 2020 with a much heavier debt burden after the coronavirus pandemic stoked a borrowing spree amid falling tax receipts.

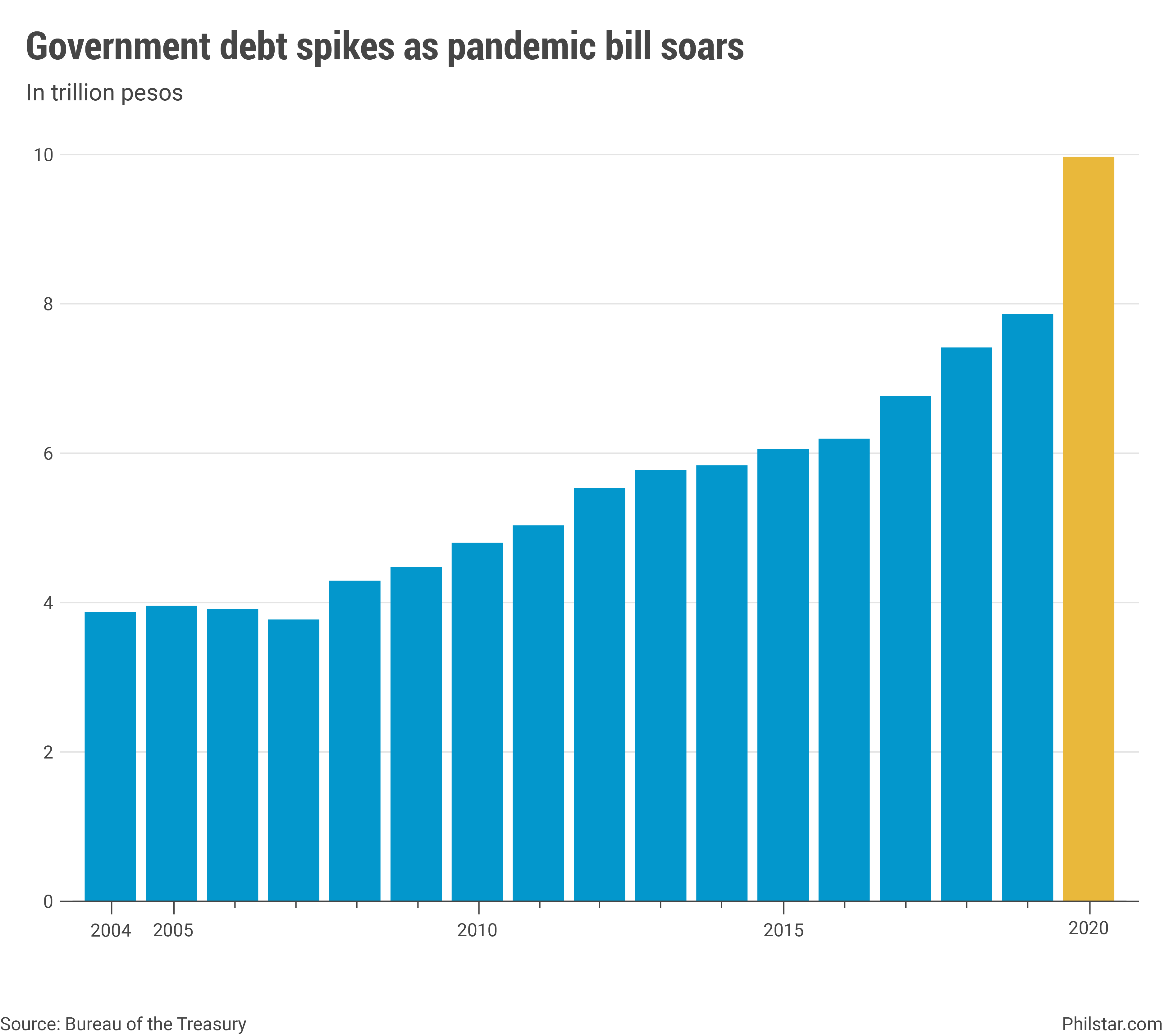

The state’s outstanding liabilities swelled to P9.8 trillion as of December last year, representing a dramatic 26.7% jump from end-2019, latest data from the Bureau of the Treasury showed.

Month-on-month, liabilities actually declined 3.3% from November after the government paid its P540-billion loan to the central bank. That last-minute decrease was pivotal for obligations to fall below the government’s record-high forecast of P10.2 trillion last year.

But the reprieve from rising debt load was likely to be temporary. For one, the Duterte administration quickly renewed its loan from the Bangko Sentral ng Pilipinas which should have ballooned debt numbers anew last month. More broadly, government expects to cap 2021 with P12 trillion in debt, reflecting the need to continue funding a growing pandemic bill.

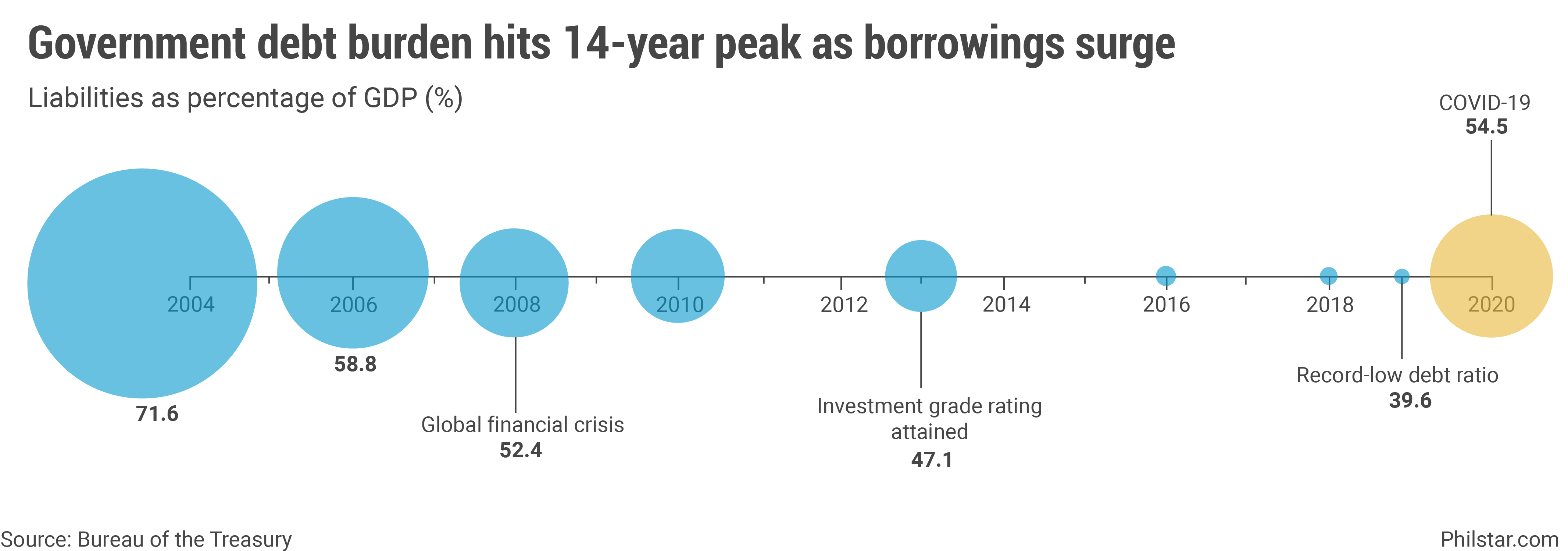

Policymakers watch the debt ratio closely, and consistently targets to bring them down to manageable levels. When this level is achieved differ across territories— for instance, in the European Union, members are mandated not to exceed 60% of GDP— but the Duterte administration wanted to bring ours down as much as 37% by the time it leaves office in June 2022.

That target had since been abandoned ever since public costs soared with the pandemic.

The debt ratio is also closely followed by credit rating agencies in gauging a country’s ability to meet its obligations. Since 2013, the Philippines has been under investment grade status, allowing the state and private sector to borrow at low cost. Economic managers had been insistent to protect this rating over fears that a downgrade would lead to higher interest payments. This, in turn, had triggered to hesitation to launch a convincing fiscal push.

But despite the absence of a massive fiscal stimulus, spending still increased, and with it debt. Last year, domestic debt jumped 30.6% year-on-year to P6.7 trillion, while foreign obligations reached P3.1 trillion, up a smaller 19.1%.

Indeed, local debts cornered the bigger 68.35% share of the total debt pile, while the balance of 31.65% were sourced abroad.

Locally, nearly all of debts were raised through the sale of government securities like Treasury bonds and bills which the Treasury bureau floats every week. Offshore, the government relied on loans from multilateral agencies like the World Bank which tend to be cheap in nature, while also selling foreign-currency bonds to investors.

The government borrows to bridge its budget deficit and settle old debts.

Source: https://www.philstar.com/business/2021/02/02/2074807/pandemic-bill-stokes-govt-debt-p98-trillion-2020

Thailand

Thailand