Thailand: New levy for second home tweaked

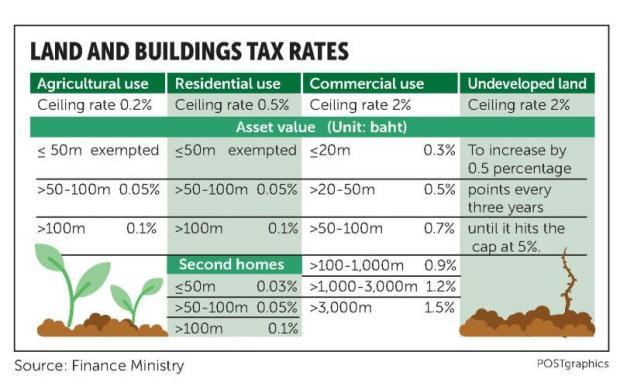

People owning second homes may face land and buildings taxes in the range of 0.03-0.1% of the appraisal price, depending on the value of the property, says an informed source at the Finance Ministry.

Second homes will be charged from 0.03% for those with appraisal prices of up to 50 million baht, 0.05% for homes valued over 50 million but under 100 million, and 0.1% for homes valued above 100 million. The effective tax rates for second homes have been tweaked from the previous range of 0.03% to 0.3%.

When the land and buildings tax comes into effect next year, the tax levied on first homes and land used for agricultural purposes will start at appraisal prices of 50 million baht. The rate of 0.05% will be applied to first homes worth between 50 million baht and 100 million and 0.1% for homes above 100 million.

The new property tax, which will replace the outdated house and land tax and the local development tax, will soon be deliberated by the National Legislative Assembly (NLA) after winning cabinet approval last week and being reviewed by the Council of State.

The NLA may still water down the land and buildings tax, like it did for the inheritance and the gift taxes. The inheritance tax bill initially proposed by the government sought a 10% levy on bequests exceeding 50 million baht. This was altered by the NLA to 5% of the amount above 100 million baht for descendants and 10% for others.

For gifts, 5% applies to portions above 20 million baht when the beneficiaries are descendants.

The source said the property tax to be levied on commercial and industrial use will range 0.3-1.5%, depending on value.

The tax on vacant land will increase by 0.5% every three years until it is capped at 5%.

Source: http://www.bangkokpost.com/business/news/1221822/new-levy-for-second-home-tweaked

Thailand

Thailand