Phillipines: ADB sees slower growth, inflation as COVID-19 outbreak bites

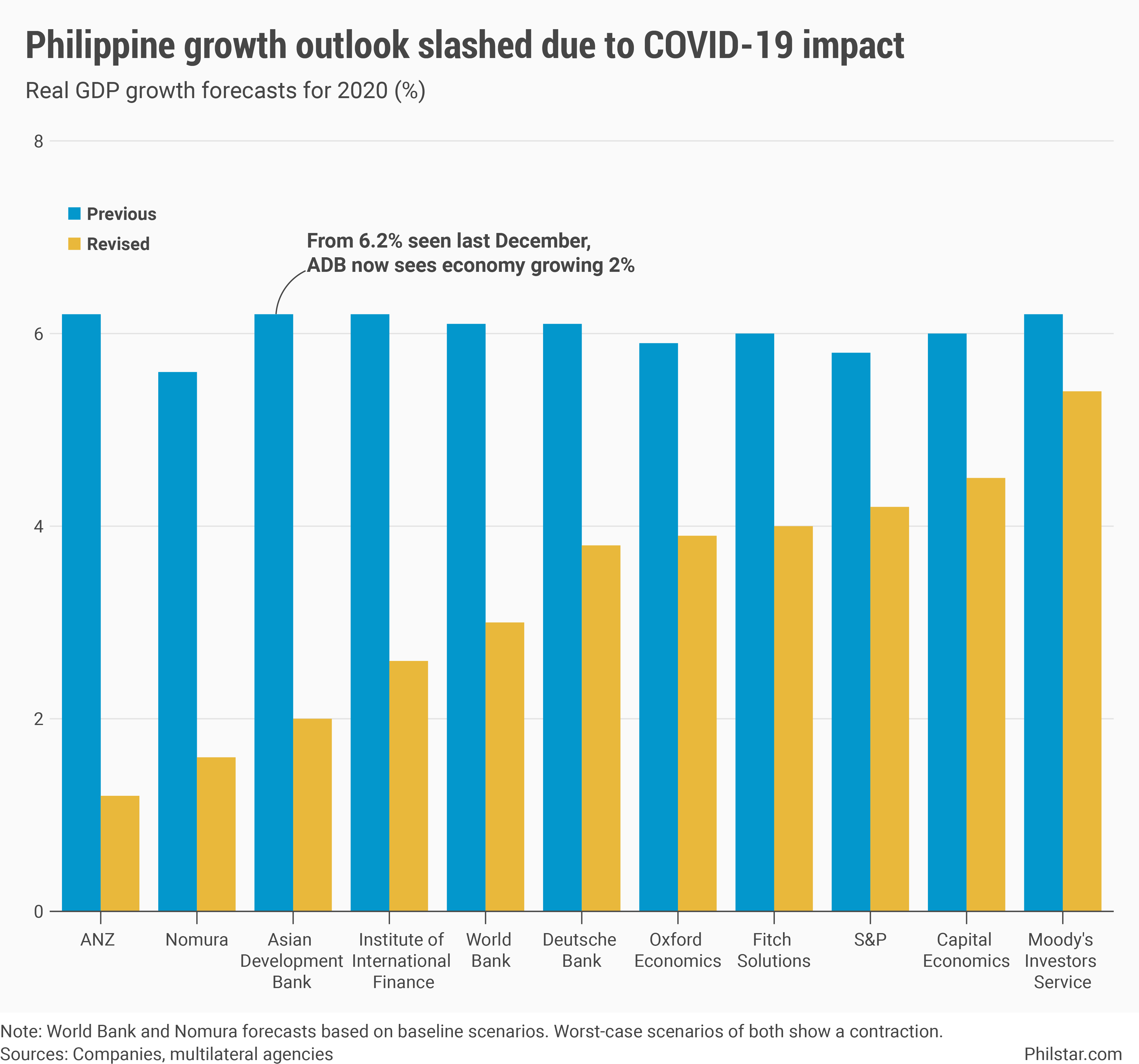

MANILA, Philippines — The Asian Development Bank (ADB) significantly slashed its growth projections for the Philippines and rest of the region this year, the latest institution to turn sour on the economy as preoccupied governments shift resources to containing the global coronavirus disease-2019 (COVID-19) pandemic.

In its latest Asian Development Outlook report released Friday, the Manila-based lender said local economic growth is likely to slow to 2% this year, down from its previous forecast of 6.2% in December 2019.

The outlook was also way weaker than the 5.9% gross domestic product (GDP) growth notched last year, the yet to be revisited government target of 6.5-7.5% this year, and the National Economic and Development Authority’s 4.3% baseline forecast that considered the impact of the local outbreak.

“COVID-19 has buried signs of improvement in the global economy that appeared at the beginning of 2020,” ADB said in its report.

Separately, Kelly Bird, the lender’s country director for the Philippines, said in a statement: “This unprecedented and extraordinary public health emergency brought about by the COVID-19 pandemic will substantially slow down economic growth this year, with most of the contraction in the economy occurring in the second quarter.”

The latest projections took into account COVID-19 cases as of March 20, which had since risen to 1 million globally as of Friday, with “serious outbreaks” across Asia, where bleaker assumptions were painted.

Despite an expected slowdown due to weaker consumption, the Philippines is still seen to grow faster than Southeast Asia on average, where economic expansion would likely slow to just 1% this year. In the wider developing Asia, which includes China, growth is seen faster at 2.2% for 2020.

Trade is also expected to slump across Asia as lockdowns to contain the virus delay shipments.

The regional slowdown is bound to happen, ADB said, “despite expansionary government policies” such as central bank rate cuts that lower bank loan rates and fiscal stimulus measures, both of which are being deployed in the Philippines.

Forecasts assume epidemic containment this year, and a “return to normal next year” when growth should accelerate. For developing Asia, ADB sees growth to hit 6.2% in 2021, while a slower 4.7% expansion is likely for Southeast Asia. Philippine growth, meanwhile, would likely bounce back to 6.5% next year.

“We are anticipating a bounce back starting in the second half of this year, supported by the government’s stimulus spending and easier monetary policies,” Bird said.

Inflation to slow

On the flip side, weaker growth this year also means “inflation should remain tame,” ADB said.

For the Philippines, consumer prices could ease at 2.2% and 2.4% this year and the next, respectively, falling within the central bank’s 2-4% target.

“Price pressures caused by African swine fever counter lower global oil prices,” the lender said.

Apart from ADB, the World Bank, credit raters Fitch Ratings, S&P Global Ratings and Moody’s Investors Service earlier all cut their growth forecasts for the Philippines because of the lingering impact of COVID-19 on economic activity. Some banks and think tanks also made the same downward adjustments.

Source: https://www.philstar.com/business/2020/04/03/2005240/adb-sees-slower-growth-inflation-covid-19-outbreak-bites

Thailand

Thailand