Thailand: Ministry seeks nod for SME aid deal

The Finance Ministry is poised to propose to the cabinet an assistance package for small and medium-sized enterprises (SMEs) and credit cardholders early next year as part of its effort to keep a lid on bad loans and help ease the liquidity squeeze.

A working panel chaired by Finance Minister Uttama Savanayana plans to discuss with all related parties from the public and private sectors details of the measures, said Deputy Prime Minister Somkid Jatusripitak after a joint meeting with the Bank of Thailand, the Thai Bankers’ Association (TBA) and specialised financial institutions.

The measures will help ailing SMEs to survive and prevent those in a sound position from falling into trouble, he said.

The state-owned Thai Credit Guarantee Corporation (TCG) must find solutions that make commercial banks more comfortable in extending loans to SMEs reeling from the economic slowdown, said Mr Somkid.

The objective of the Office of Small and Medium Enterprise Promotion’s fund disbursal, which amounts to 10 billion baht, might be tweaked for a liquidity injection, he said.

Measures to help credit cardholders will also be on the agenda, said Mr Somkid.

The incoming aid measures for SMEs and credit cardholders are in addition to the central bank-initiated refinancing scheme targeting SMEs and credit cardholders by offering them lower interest rates.

Regulation amendment

The regulations governing both banks and TCG do not support debt restructuring of SME defaulters, so the central bank wants collaboration between the TBA and TCG to search for solutions, said central bank governor Veerathai Santiprabhob.

Regulation amendments could be needed to unlock the problem and open opportunities for SMEs to dissolve the liquidity crunch.

This would help SMEs to survive the difficult economic situation and grow in the long term, he said.

SME loan defaults under TCG’s credit guarantee scheme amount to 40 billion baht.

TBA chairman Predee Daochai said under current practices, banks need to file lawsuits against SME defaulters whose loans were guaranteed by TCG to claim debt collateral from TCG. Such practices appear to be a barrier for SME debt restructuring, he said.

With concerns over higher bad loans and credit-loss reserves, banks refuse to offer fresh credit lines to SME defaulters, so mutual solutions are needed.

Still unsatisfied

Even though the central bank forecast for 2020 growth of 2.8% is above the 2.7% predicted for this year, such growth is still lower than the economy’s potential of 3.5-4%, Mr Veerathai said.

“Despite the higher GDP growth forecast next year, we aren’t satisfied with it because such a rate is a slower pace than its potential and it could be higher if there are structural reforms,” he said.

“We should pay more attention to economic structural reform rather than growth rate to sustain economic expansion for in the long run.”

The structural reform should concentrate on supply rather than demand, which delivers short-term results, said Mr Veerathai.

Fiscal policy can address more specific problems than monetary policy and the economic transmission of the latter through financial institutions takes longer, he said.

The central bank stands ready to use additional tools to boost economic growth if needed, Mr Veerathai said.

The Monetary Policy Committee (MPC) left the policy rate unchanged at a record low of 1.25% at the Dec 18 meeting after two cuts earlier this year.

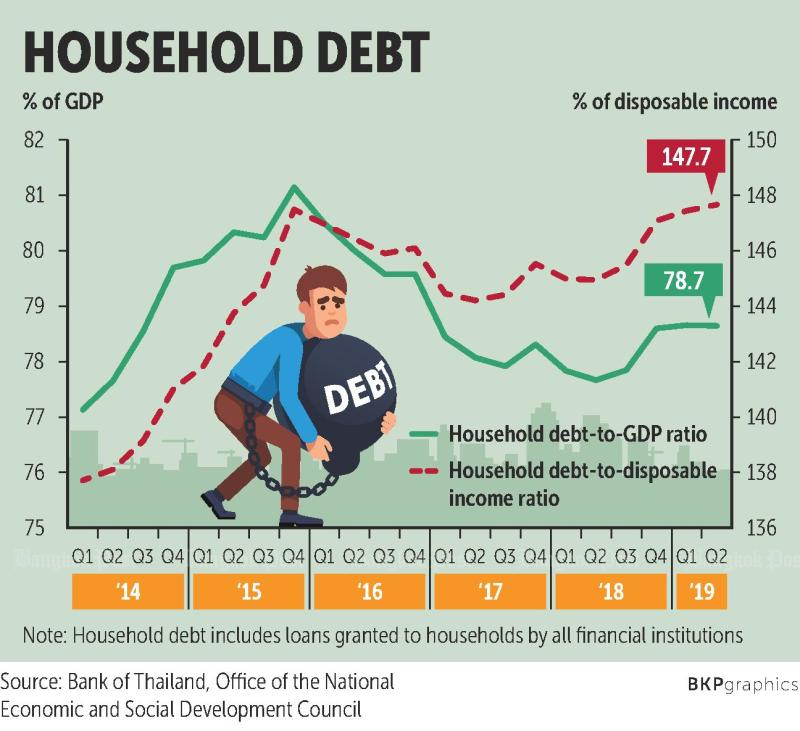

Household debt a concern

Mounting debt among households and SMEs continue to cause concern, according to a joint meeting of the MPC and the Financial Institutions Policy Committee.

The household debt-to-GDP ratio stayed at a high level and was poised to rise further amid the subdued growth outlook, partly driven by commercial banks and non-banks’ continued expansion in retail lending, notably credit cards and personal loans.

Special attention should be paid to households whose financial positions became more fragile, especially those sensitive to income shocks (those subjected to lay-offs or reduced working hours).

On the corporate front, the credit quality of SMEs continued to deteriorate.

There were also signs the credit quality issue began to spread from small enterprises, which had been in a vulnerable position for quite some time, to larger enterprises.

Source: https://www.bangkokpost.com/business/1822889/ministry-seeks-nod-for-sme-aid-deal

English

English