Thailand: Opportunities in a declining apartment market

Such projects have three saving graces for expatriate families: large unit size, a desirable address and experienced staff whose responsibilities extend to maintenance of their unit, all at affordable rates.

The economic slowdown and brighter economic growth prospects in neighbouring countries are prompting multinational corporations to post expats to greener pastures than they see in Thailand.

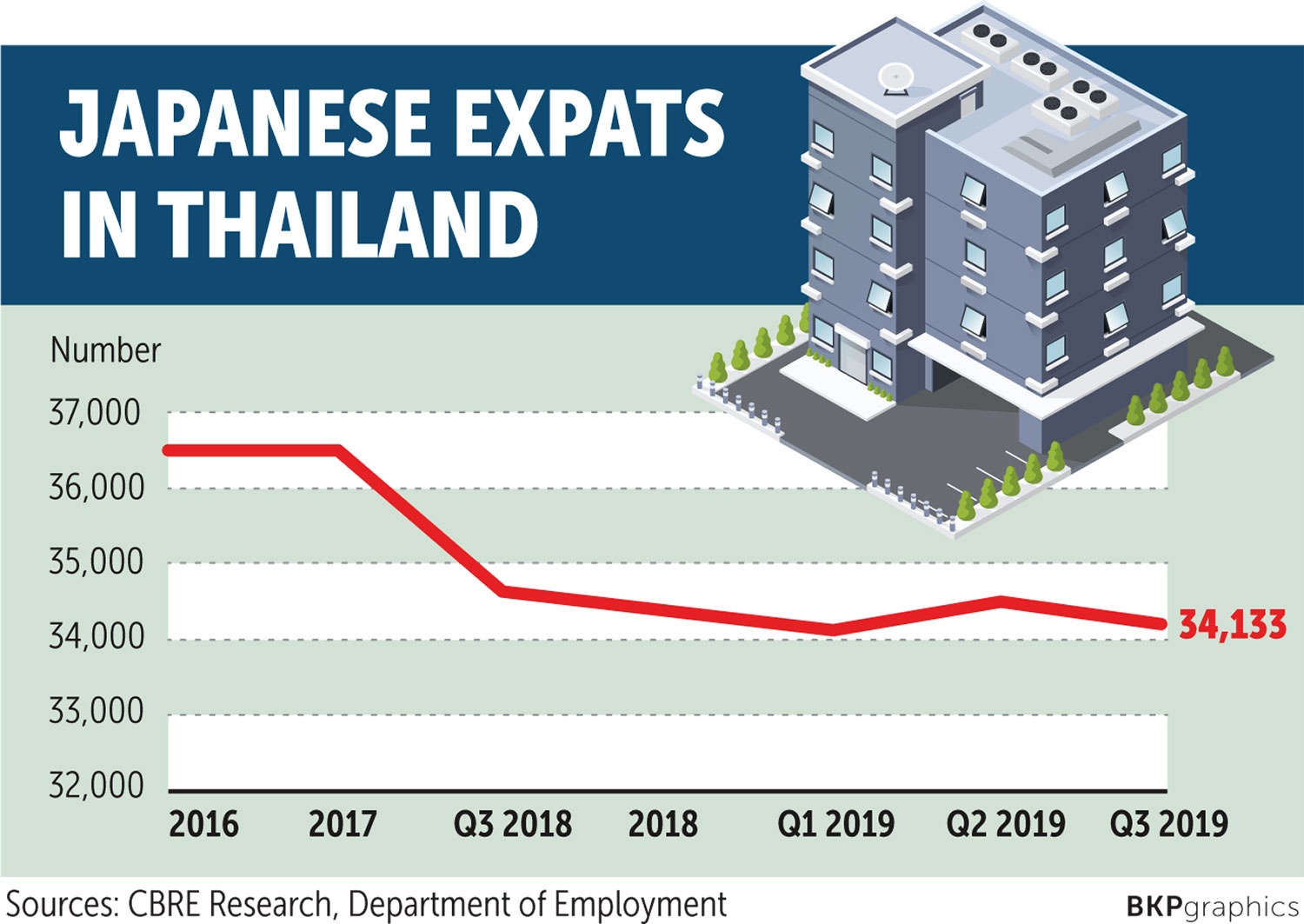

CBRE Research indicates that the number of Japanese expatriates was down by 2.8% year-on-year (equivalent to almost 1,000 Japanese work permit holders, excluding their dependents) in the third quarter of 2019. This has dragged the total number of the largest expatriate nationality in Thailand down to a six-year low.

As a result, Bangkok apartment occupancy was also at a six-year low at approximately 92%, as many Japanese multinationals are now sending their key expatriates to Thailand either without their families or on a project-by-project basis, or are replacing Japanese staff with Thais to save on cost.

However, a basket of Grade A apartments in the Sukhumvit and Central Lumpini areas are bucking that trend with an impressive 98% occupancy rate. These buildings are all under 9 years old or recently renovated older projects, featuring a variety of unit types including studio and one-bedroom units and offering a full suite of facilities.

This demonstrates that even in a declining market, it is still possible to maintain high occupancy with projects in fresh condition at the right location and with a variety of unit types.

CBRE expects to see the “survival of the fittest”, as some older projects in average condition with an unattractive unit mix are seeing very low occupancy rates. If owners do not adapt to new market conditions, their projects may join the list of apartments facing redevelopment.

Having said that, some projects are becoming “serviced residences” (similar to serviced apartments, but not available for daily rental) by presenting optional cleaning and laundry services and offering shorter rental terms (down from yearly to monthly leases) to tenants. This helps provide a competitive tool against serviced apartments and an edge over condominiums.

CBRE believes that a declining market does not always mean low occupancy if projects maintain competitive building condition, incorporate more family-friendly features to please traditional audiences that still exist, are at the right location, and offer a relevant unit mix for the new reality.

Source: https://www.bangkokpost.com/business/1803119/opportunities-in-a-declining-apartment-market

Thailand

Thailand